The 6 Key Questions About Business Assets

Financial literacy starts with understanding the business assets as it is a cornerstone for determining the company’s value. It’s hard to say where you stand if you have no idea what you own.

In this article, we will cover the 6 most important questions you may have in this area.

What are Business Assets?

So, what exactly is an asset?

It’s an item that has some value to the business.

Assets in business are much more than just the money in your checking account and the products on your shelf. Mistakenly we usually think of business assets like physical items we can touch or withdraw from a bank account. However, they can be not only tangible, such as raw materials and inventories, but intangible also, such as trademarks, patents and franchises. It is important not to miss any of them and show them properly on your reports.

Business assets are listed on the Balance Sheet and are categorized by type. The most common classification is dividing it into current and non-current assets.

As the name suggests current assets are those that are used in day-to-day activities. These are:

- Cash in the bank and on hand

- Aged receivables – even if you made a sale but haven’t got paid yet it is an asset. You are entitled to it and will benefit in the future.

- Inventory – one of the most important assets to estimate in e-commerce. For more information go here.

- Prepayments

The following assets are usually considered as non-current:

- Fixed Assets – office equipment, buildings, vehicles, everything that can be used for more than a year.

- Intangibles (we will review it later in this post)

Every business, whether a start-up or in a mature company, needs to identify and manage its business assets.

These are the main features of each asset:

- monetary value

- generate revenue: it means that you use it in your operation or as other investments for financial returns.

Which of my assets are intangible?

Often intangible assets are overlooked. Expecialy if you run a small business. At a first glance, you do not have any.

But have you ever thought about the value of the traffic to your online store as an asset? And what about your brand awareness? You probably highly value your frequent buyers who often come back to make a new order.

Intangible means something that is not physical in nature but can nevertheless be considered an asset.

These include:

Knowledge – your and your employees’ skills can also be classified as an asset.

Value of Brand – it is what would be paid on top of the market value of the company if you decided to sell it.

Intellectual Property – you don’t necessarily need to invent anything to call it an intellectual property. However, if you are creating content for your website that is also an asset and has value.

Loyal Customers – as we’ve already mentioned this is one of the core assets for each e-commerce seller. Collecting a long email list of loyal buyers is a hard and time consuming task and it has significant value for the business.

We should admit it, that identifying an intangible asset is easier than valuing it. We will talk about it in more detail later on.

How to record assets?

Keeping track of your assets in business is crucial. Therefore, correct and thorough record keeping is a must.

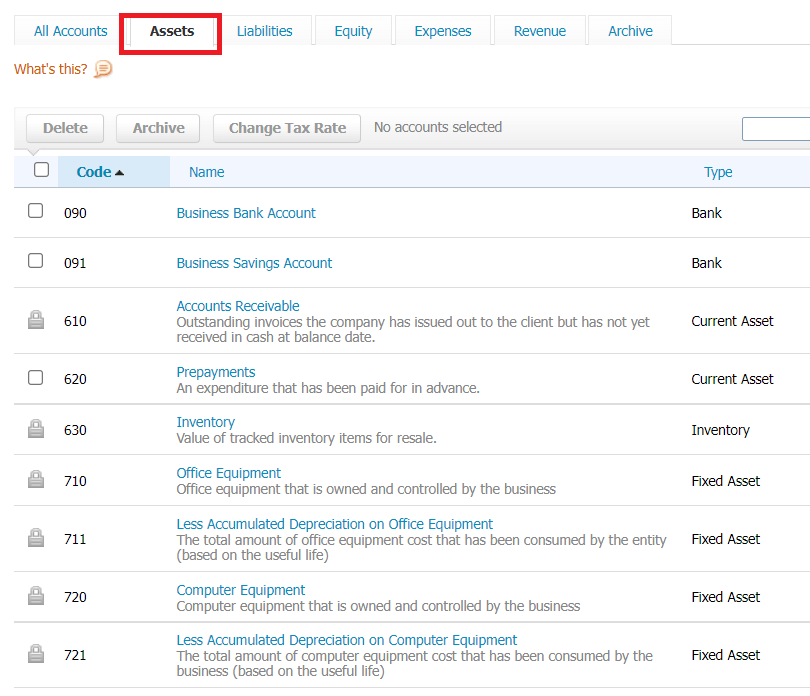

In the chart of accounts, you can find a separate category of accounts for this purpose.

If we acquire a new asset then we need to debit an asset account and credit the cash or loan account (depending on the source of financing). For example, the purchase of a new computer requires the following entries:

| Debit | Credit | |

| Bank Account | $1, 000.00 | |

| Fixed Assets | $1, 000.00 |

Later we need to reduce the value of this computer to reflect the asset’s depreciation over time, but it is a separate story to tell: Fixed asset register and depreciation – What is it and how to do it?.

We don’t buy new fixed asset items often. The transaction you probably come across on a daily basis is making sales:

| Debit | Credit | |

| Sales | $5, 000.00 | |

| Accounts Receivables | $5, 000.00 |

As you can see, every time you raise an invoice your assets rise by the value of the sale even though you haven’t received the cash yet (it’s only true for accrual accounting; otherwise, if you do cash accounting, we will debit the cash account (asset) and credit sales once the money is received).

If you don’t feel comfortable with journal entries you can check our Debits and Credits Cheat Sheet or ask for help from a professional e-commerce bookkeeper.

What are net assets?

As a business owner, having a good understanding of your business’s net worth is extremely important. You need this number so that you can track your profit and loss, and also for tax purposes.

Net assets are the value of a company’s assets minus its liabilities.

Eventually, net assets are what you actually own after paying off all debts and settling all liabilities. This is the most important figure to look at while analyzing financial reports. A hefty assets section on the Balance Sheet doesn’t necessarily mean a thriving business. Especially if your liabilities are also high.

Companies with positive net assets may be financially healthy. Conversely, if a company’s net assets are negative, it could be having difficulties, especially if it is growing.

How to value my assets?

The most important thing to keep in mind is that numbers in your Balance Sheet don’t represent the market value of your assets. These numbers are books values (or carrying values) and usually don’t represent the fair price of what your business owns.

The fair value of an asset is usually determined by the market and agreed upon by a buyer and seller, and it can vary. In other words, the carrying value generally could be outdated, while the fair value reflects the current market price.

Often there are no tangible assets except office equipment. In this case, we need to deal with hard-to-value things like goodwill, intellectual property and the well-recognized brand’s value.

The most common method to value intangible assets is cost-based value. This means if you want to determine the value of your brand (or any other intellectual property) you need to calculate all spendings required to develop it. This figure should include the cost of hiring specialists (etc. marketing agency or artist to create your logo), the advertising costs, etc. Think of it like creating a new brand from scratch to the same level as your current brand is.

How much is my business worth: assets-based approach

Let’s look first at the factors that determine the value of an e-commerce business:

- Financials – first of all, we need to analyze such figures as gross sales, COGS, net profit and net assets over the last few periods. It helps to determine the overall state of the company as well as the potential for growth. However, there are some important financial indicators that are relevant specifically for e-commerce.

- Traffic – basically it is the core indicator of the online seller success. No traffic for an online store means no sales.

- Brand – determines the monetary value of the brand you own if you were to sell it.

There are quite a few methods to determine the worth of the company like the seller’s discretionary earnings method (SDE), discounted cash flow analysis, EBITDA method, etc. They are quite complicated and take into account a wide range of factors.

We will cover only the assets-based approach which is more straightforward and will help you to track your company’s progress and growth.

The net assets figure gives a rather rough vision of a company’s worth. Hence some corrections and additional calculations are needed.

Most assets of small businesses won’t need any adjustments. However, you may need to correct aged receivables and write off bad debts.

As fixed assets, e-commerce businesses usually don’t own any expensive tangible assets like land, equipment, etc. However, sometimes even office equipment is worth another look. Some fixed asset items might be fully depreciated while still being in good working order and producing value for the firm. Therefore, the fair value should be determined and the asset revaluated based on its market price.

After adjusting and re-valuating those assets that are already listed on the Balance Sheet we need to identify what is missing. As we mentioned earlier in this post, often intangibles are not fully shown in reports (or not shown at all).

For example, if the business has a social media account with 2k followers this also should be taken into account. Or you have collected the same amount of emails of the newsletter subscribers. All this is a valuable tool for reaching the audience and should be added to the value of the company.

Suppose, your Balance Sheet stated net assets of $50k. You may value each subscriber contact of $5 and add $10k to your intangibles. The business has been operating for 5 years and developed a well-recognised brand. You’ve been spending $5k each year for marketing and advertising. So, we are adding another $25k to intangible assets as brand value or goodwill. Our assets-based value of the business will be $50k+$10k+$25k=$85k.

So, some business assets you create by yourself. It also could considerably increase the value of a company.

We hope this article helped you to understand what are business assets and how to analyze them. We would love to see your comments below!