What is a Chart of Accounts?

Business owners usually overlook the importance of their chart of accounts. However, it’s a great misconception. Read on to understand the benefits of a good COA and how to build one for your e-commerce business.

At What a figure! Accounting, we will walk you through the following points:

- What is a Chart of Accounts and why it matters.

- How to set up it for your e-commerce business

- Common mistakes to avoid while structuring COA

Chart of accounts definition. Why is it important?

Chart of Accounts is a list of all accounts used by the company in order to organize its transactions.

Let’s clarify what is an account first.

Once the transaction occurs (sales or purchases are made, taxes paid, etc) it has to be ‘tagged’. It’s like using a hastag on social media, with the exception that you can only use one. The one tag that best describes what that payment is for.

This ‘tag’ is called an account and often identifies a small group (eg. sales or advertising). Therefore, learning the COA is an initial step in understanding finance.

Business owners often can’t read their reports because it’s not clear what is included in their numbers.

”What is the structure of my revenue?”

”What was included in travel/utilities/subcontractor expenses?”

These questions arise not because of weak financial knowledge, but because of poor COA.

A well-organized Chart of Accounts can not only make the process of doing your books faster, but it can also determine how clear and readable your financial statements are.

Chart of accounts structure

Let’s start with the smallest part of it: the account.

The main components of an account are:

- Code – most commonly it’s 3 or 4 digits, Xero (a cloud accounting software) allows you to use up to 10 characters. It helps to group similar accounts, so it is easier to differentiate them. As a result, we can build a neat logical structure. For example, you can assign 2** codes to your revenue items (201, 202…etc), 6** to liabilities and so on and so forth. All up to your needs and preferences. The only requirement is that the code must be unique. Therefore you can’t use the same code for two different accounts!

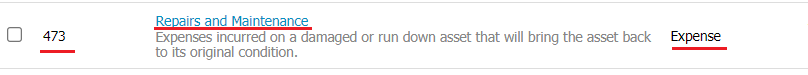

- Name/Description – we can’t solely use codes and numbers in our books. The name gives an idea of what purpose the account was created for. Alongside the name, you can also add a short description. See below:

Titles should be descriptive but not too lengthy.

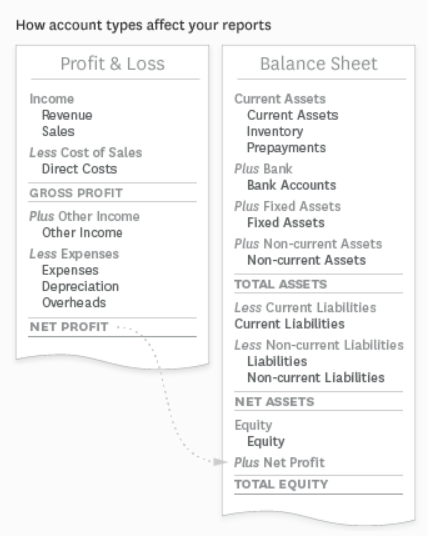

- Type. This is the most important part. The type you choose will determine the place of the account in your reports.

There are 5 basic groups of accounts: assets, liabilities, equity, revenue and expenses. Within each group we can distinguish smaller sub-categories. We will review them further on.

You might have heard the expression ‘balance sheet accounts’ or ‘profit & loss accounts’. It is because the ‘type’ you set for your accounts will determine whether they will be shown on your P&L or Balance Sheet.

Balance Sheet accounts:

- Assets. Could be divided into Current Assets, Fixed Assets, Inventory, Non-Current Assets, Prepayments. Examples: Bank accounts, Account Receivables, Prepaid Insurance.

- Liabilities. Usually, break out into Current and Non-Current Liabilities. Examples: Bank Loan, Accounts Payable, Sales Tax, etc.

- Equity – examples are Owner a Drawings, Retained Earnings.

Profit and Loss accounts are:

- Revenue – usually includes Sales, Income Revenue, Other Revenue (revenue not related to day-to-day activity).

- Cost of Goods Sold – besides COGS itself to this category usually belong Shipping, Delivery and Fees associated with sold products.

- Expenses – this category might include Subscriptions, Internet & Telephone costs, Bank fees, Salaries, Rent etc.

Is there a standard chart of accounts?

Well, yes and no.

If you set up an account in any accounting software it will suggest you a perliminary Chart of Accounts.

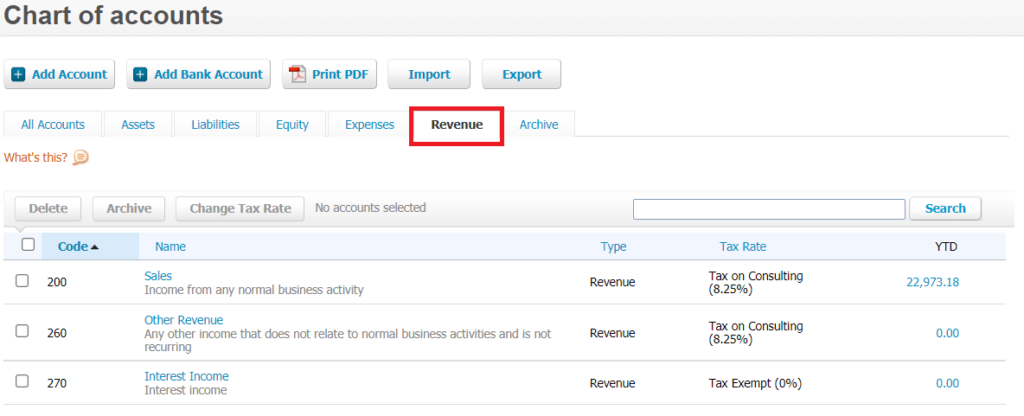

Let’s take look at what Xero suggests.

We will get only three revenue accounts:

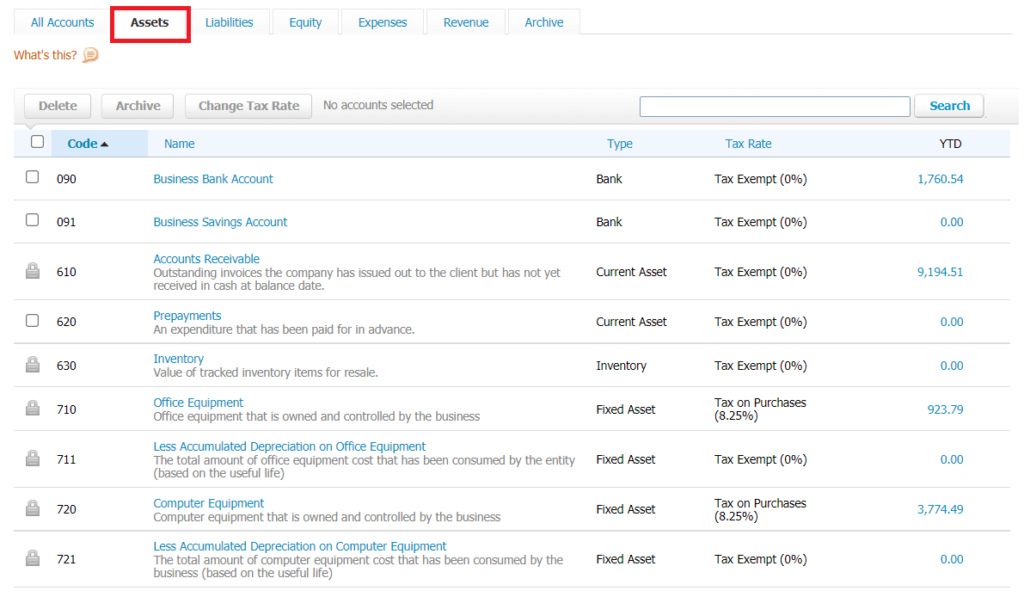

This is a list of a default assets accounts:

As you can see, you will get a basic set of accounts which include one account for sales, COGS, and several accounts for operating expenses, etc. However, it doesn’t mean that these are fixed and you can’t change them.

You can either import your own or you can follow the pre-set structure, and still create any subcategory within each group if you need to.

As you already know, the standard groups are assets, liabilities, equity, revenue and expenses. It is a fundamental rule that can’t be changed. However, inside each group, we can create accounts tailored to our needs.

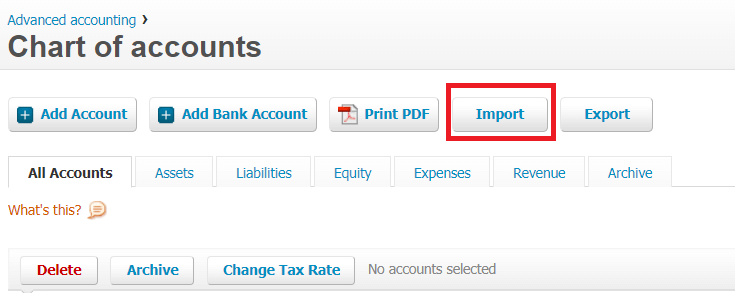

So it can be extended and adjusted. Furthermore, if you need to create many, you can import them in csv format to make your life easier.

How to set up the Chart of Accounts for an e-commerce business?

The Chart of Accounts for e-commerce has some specific features. Every Shopify or Amazon seller deals with fees, shipping charges, returns and refunds as well as Cost of Goods Sold (COGS). All these transactions should be duly reflected in your books.

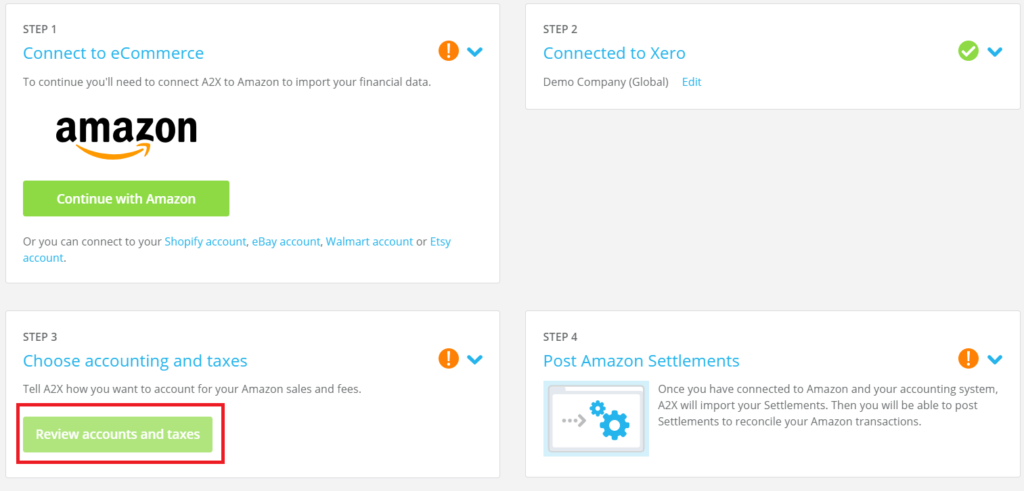

If you are using a 3rd party app to sync your sales with accounting software (like A2X or Weava), then you are in luck. During the integration process, it will help you create accounts needed to post your settlements (a report of all your income and fees for a particular period).

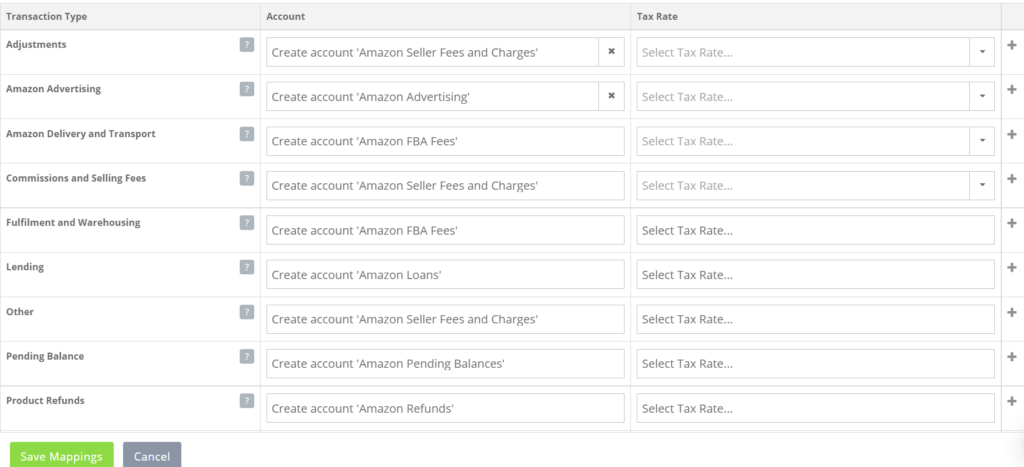

So, it is possible to tell A2X how you want to account for your fees, refunds, shipping, adjustments, etc – under which chart of account. Also, it’s important to choose a tax rate for each transaction type. You can do this during the mapping process. This is how a transaction mapping table looks like:

Following A2X’s prompts, we can add missing accounts to our system. For example, you can see an option “Create account ‘Amazon Advertising'”. If you select it, then A2X will create an expense account called “Amazon Advertising” in Xero. As a result, advertising expenses from Amazon settlements will be assigned to that account.

However, you can also choose an existing account if it matches with a transaction type:

Creating accounts with A2X or Weava can also prevent from making mistakes one may make while doing it manually. A2X-generated accounts are assigned to the correct types (revenue, expenses, liabilities or assets) so you don’t have to worry about it.

If you are not using any automation yet we prepared a template of a chart of accounts for a small e-commerce business. Read on!

Example of chart of accounts for an Amazon seller

There are quite a few specific items that will effect your bottom line. The following accounts might be relevant for your e-commerce business:

- Amazon Fees – expense, fees and charges you pay for selling on Amazon.

- Amazon FBA fees – expense, applied to FBA sellers

- Advertising fees – expense, fees paid for advertising on Amazon.

- Amazon Unavailable Balance or Reserve Balance – current asset. It refers to money you are entitled to but can’t withdraw or use as Amazon holds it for some period of time.

- Shipping Income – revenue; took place if a buyer pays for shipping.

- Refunded Sales – contra revenue account, refers to money you paid back to customers.

- Discounts – contra revenue account, which represents the number of discounts given to your customers.

- Promo rebates (Amazon Promotions) – contra revenue account; eg., the buyer has paid shipping and then has been reimbursed for it.

3 Mistakes to avoid

While setting up your Chart of Accounts you should avoid the following mistakes:

1.) Using Accounts Incorrectly

The first and most crucial thing is following the structure we were talking about earlier. So we need to assign accounts to the correct categories/types while setting up the COA.

If we are creating an “Office equipment” account in order to account for things like computers, printers etc., then we have to keep in mind that it should be an asset account. It is easy to get confused and assign it to expenses.

Another tricky thing is distinguishing between accounts that may have a similar name but absolutely different nature. The best example is ‘Accumulated Depreciation’ vs ‘Depreciation Costs’. The first is an asset account that goes on the Balance Sheet and represents the total decrease in value of the fixed assets. Whereas ”Depreciation Costs” is an expense and consequently will show up on the P&L.

2.) Different methodology

Another important point is using the same methodology in creating different groups of accounts. This mostly refers to revenue and costs of goods sold. If we are dividing revenue accounts based on the product type (eg. Sales – Yoga Mats) then we have to follow the same approach while structuring the COGS part (COGS – Yoga Mats). Otherwise, we will not get an informative P&L.

3.) Too granular as well as too general structuring

Suppose, company’s revenue is aggregated under a single sales account. What product categories are best sellers? Which of the sales channels are the most profitable? It will be hard to get answers to these questions without a well-structured COA.

For example, we can break down our sales based on the product type: ‘Sales – Product A’, ‘Sales – Product B’, ‘Sales – Product C’… Another option is to separate the revenue by sales channels: Amazon Australia, Amazon US, Amazon UK, etc. All depends on our needs and the nature of the business.

Too little detail is bad but too much is not good either. Dozens of accounts may result in confusion and disorder in the company’s books. You won’t see the forest for the trees. Furthermore, reconciliation will become more difficult and prone to errors.

The process of setting up the chart of accounts might not be easy. It is worth to admit that sometimes it’s better to rely on a professional bookkeeper.

Thank you for reading and hope you found this article helpful. If you have any questions or remarks please let us know in the comments below. Would love to know your thoughts!