Budgeting and Forecasting: Start the Growth Journey

Many e-commerce business owners find themselves juggling many roles, and as a result, budgeting and forecasting get overlooked.

However, to do business we can’t only focus on the past. When you analyze the P&L or any other financial reports you always need to look back at how the business has performed during the analyzed period (or at a specified date if we talk about the Balance Sheet). But what happens when we try to predict the future?

At What a Figure! Accounting we will walk you through the following points:

- what is budgeting and forecasting and how do they differ?

- how to build a budget for a small business?

- what types of forecasts should you build for your company?

- how could you benefit from budgeting and forecasting?

Budgeting and forecasting: what is the difference?

Budgeting and forecasting are complementary but not interchangeable.

Forecasting is a set of techniques used to analyse historical data and based on it identify patterns to predict the future.

So, we use previous data to extract trends and make predictions about the future.

It can be dynamic and volatile in case of short-term monthly or quarterly forecasts. For example, cash flow forecasts should be updated at least on a weekly basis to get reliable data. In other words, it is a ‘live’ financial plan that requires real-time adjustments.

The longer period the forecast is, the higher the probability of inaccuracy. Just like the weather 😉

Budgeting on the other hand, is an estimation of revenue and expenses over a future period of time.

The budget is a target. Think of it as your future income statement. When you create a budget (or plan) you predict/assume that your P&L will be like that or close to it.

A forecast is a tool that determines whether this target could be achieved. It reveals business trends that help you determine if you need to adjust the course.

Imagine that you are planning a journey. You are only sure about the starting point and the destination you want to get to. However, there are several possible routes to get to your final point. You have chosen one, but during the journey, you encountered some unexpected obstacles (eg. the car broke down) which forced you to adjust your plan.

Similarly, the budget is only the projection of your destination point, the target you are keen to achieve. The business environment might change, but short-term forecasting will warn you about the approaching crisis, so you can change the direction and stay on track.

How to create a budget for a small business?

Before we start creating a budget it is important to ask ourselves the following questions:

- Are we going to expand the business? In other words, we must estimate the expected growth rate.

- What are the available sources of funding? What are our options of borrowing money?

- Last but not least, what are the industry trends? How are they going to impact the company?

In this step, we set realistic goals and priorities.

The next step is conducting the preliminary analysis. This means that we need to look at our historical financial reports. It will help us find out the correlation between our revenue and expenses. We will use this data as a basis for building the budget.

Know your ratios

When we talk about ratios, we mean crucial financial ratios as gross profit margin, operating ratio and net profit margin. Also, it’s important to know your breakeven point.

Why do we need it while creating a budget? These indicators reflect correlations that exist between revenue and expenses.

Suppose, we’ve looked through the last two months and determined the following:

| Month 1 | As % of sales | Month 2 | As % of sales | |

| Sales | 10000 | 100% | 11200 | 100% |

| COGS | 6000 | 60% | 7000 | 63% |

| Gross Profit | 4000 | 40% | 4200 | 38% |

| Rent | 500 | 5% | 550 | 5% |

| Advertising | 100 | 1% | 120 | 1% |

| Subscriptions | 200 | 2% | 200 | 2% |

| Payroll | 2000 | 20% | 2000 | 18% |

| General Expenses | 200 | 2% | 170 | 2% |

| Total Expenses | 3000 | 30% | 3040 | 27% |

| Net Profit | 1000 | 10% | 1160 | 10% |

Even though the numbers slightly changed the correlation was almost constant: the gross profit margin was 40% (or very close to it), the share of operating expenses was nearly 30% and lastly the net profit margin was 10 %. Looking at this table we can also say that 80% of all expenditures are COGS and salary.

So at this stage, we determined the key ratios we need to focus on while preparing a budget. Surely, it is great to improve them, but at the same time, we should set realistic goals.

As we already mentioned, the budget is the “future income statement”. Consequently, the structure is the same: we will have an income part, COGS and expenses part.

Examine sales to build an income budget

It is easier to have the same revenue breakdown we have on P&L. For example, it may be split by sales channels.

Besides the revenue structure, you need to take into account seasonal fluctuations. For instance, the analysis of the last 24 months shows that there is a significant sales decline over the summer months. Then we have a great revival in autumn up to Christmas and in January sales are weak again. With no doubt, these seasonal trends should be incorporated into our budget for the upcoming year.

As a rule of thumb, you need to know your average traffic to our online store, conversion rate and average checkout price.

Imagine that your Shopify store is visited approximately by 2500 people each month. The analysis of past periods showed that the conversion rate is 5%, which means that 125 visitors will make a purchase. Someone buys more, while others less but on average you get $150 from each buyer. So, this sales channel gives you $18,750 of revenue each month. Similarly, we analyse each channel and calculate the total sales we can expect. Surely, we adjust these figures depending on the expecting growth rate and seasonality and only then incorporate them into the budget.

Cost of Goods Sold Budget

In other words, we should specify the value of the products that we are going to sell.

Before starting we need to know how COGS and inventory are calculated (read here for more information).

The formula for calculating COGS:

Cost of Sales = Beginning Inventory + Purchases – Ending Inventory

If we are preparing the budget for the upcoming year, then the Beginning Inventory will be actuals as of 31 st December. Then we need to look at how much we are expected to sell in January. Once we know the required amount of products and the price we need to pay for ordering them we can calculate COGS.

We can plan the ending inventory to be equal to a certain percentage of the following month’s sales (so we have enough inventory on hand as at 1st February).

The Overhead Budget

Overhead expenses may include:

- Payroll

- Insurance

- Advertising

- Rent

- Utilities (electricity, phone, internet, etc)

- Subscriptions

These types of expenses stay almost always constant, therefore it is easier to plan them. The analysis gives a sense of how these expenses fluctuate with the business performance or during certain months, which can help to make more accurate financial projections. Overheads are mostly fixed (rent, insurance etc), however some might depend slightly on sales volume.

When your sales are higher, you are spending more to help your business scale faster. So, there is a direct proportion between sales volume and some overheads. For example, if we expect a 10% growth in sales then we should also plan in the budget with higher expenses ( maybe you will need to spend more on advertising, subscriptions or bonuses to your employees).

On top of adding planned spending to our budget, you should also add a cushion to cover any unplanned purchases or expenses (fixing a damaged computer etc). That way, when an unexpected expense occurs we are prepared!

Bringing it all together

The final step is combining sales, cost of goods sold and expenses anticipation into a single document – the budget.

Once all work is done we need to constantly keep an eye on the budget and don’t forget to use it. The next step is variance analysis. Let’s review it in short.

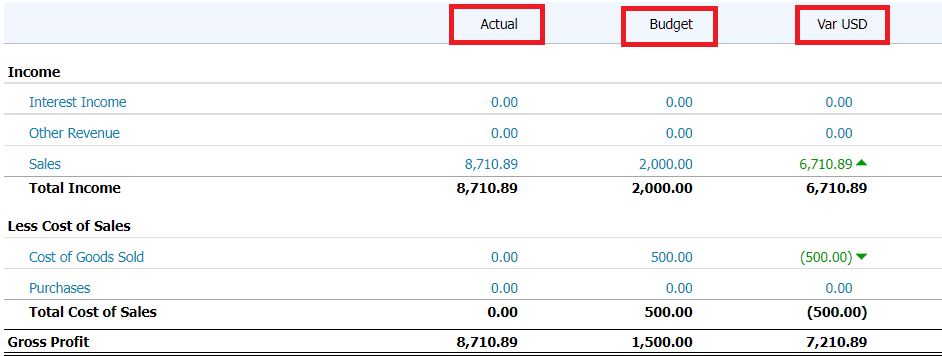

Variance Analysis

The most ideal situation is when our actuals match with our planned budget. However, in real-life things rarely go exactly as planned and we end up with a variance.

Xero has an option to upload a budget to the system. It is quite a nice feature as it gives more visibility. We can always compare our actuals to our budget.

If our factual expenses exceed the ones recorded on the budget, we need to control spending by reviewing expenses before they occur.

For example, one sales channel may be doing well but another may require more attention. It will help you identify areas of low productivity and fix the issues before they grow.

Types of Forecasts

As many dimensions/aspects of business activity exist as many types of forecasts can be built for each of them. We can predict cash flow, capital (assets vs liabilities), the volume of demand, expected sales and stock level.

Let’s walk through the most important ones for e-commerce companies:

Demand Forecasting

This type of forecasting helps to determine the consumer interest for a specific product/service across the entire market. It differs from the sales forecast as it gives an assessment of the external environment. So, don’t confuse it with sales forecast while the last is internally oriented (more about it a little bit further).

It is especially crucial if we want to expand our listings and sell a new product. We might also use information from this forecast and decide to hire more staff or extend your hours during certain times of the year. It will make your business even more profitable in the months that demand is highest.

Without demand forecasting, we take the risk of operating in a market that potentially doesn’t have a need for our product.

Sales Forecasting

For each type of business, the planning process starts with projecting sales for the upcoming year – since sales capture the major activity of the firm and the level of sales will tend to drive so many of the other expenses, assets and liabilities. It always goes hand in hand with demand forecast as both of them are interrelated.

Once we built a prediction for the demand on the market we need to determine the share of it that we can capture.

We should examine previous sales, the number of customers, and repeat purchases. Combining historic data helps to find trends. As a result, we can map what possibly will occur in the near future.

For B2B companies there are some useful tools that help to monitor future sales (eg. Pipedrive).

Cash Flow Forecasting

It gives you a picture of how much money will come in and go out in the near future. This is a key forecast. The more accurate it is the smoother the business will run. You can download a free template here to run it with the spreadsheet or find out more about how to set it up with the Float app.

Inventory Forecasting

It is a prediction of required inventory levels for a future period. It is vital for e-commerce businesses as it assures that you have enough products on hand to fulfill orders. At the same time, we should be keen to avoid overstocking.

Here are some tools that might help to automate the process:

- ForecastRx – has Amazon and QuickBooks integrations, 30-days free trial

- Inventory Planner – automates the reordering process; create/sync purchase orders and warehouse transfers between systems. Amazon, Shopify, Etsy, Ebay integrations; 14-days trial.

- Katana – suitable for manufacturers. It has a wide range of integrations across different marketplaces, 14-days free trial.

Benefits you get from budgeting and forecasting

After learning the essentials of budgeting and forecasting, let’s wrap it all up with their advantages:

- Financial Control – you can easily track what areas are under performing or overspending.

- Identify risks at the earliest stage possible – different types of forecasts may give you a deep insight into what is expected in the near future: raising inventory prices, demand shortage or great cash outflow.

- Spot business opportunities – maybe it is time to review your listings and launch a new product? Market research and demand forecasting will help you make smarter decisions.

- Setting goals and monitoring the progress – sticking to the budget helps you stay organised and achieve your goals easier.

Thanks for reading! We hope that the above article helped to understand the core aspects of budgeting and forecasting. Let us know your thoughts in the comments below.