Time to Compare: Director’s Loan Account, Salaries and Dividends

As a director of a company, you should be rewarded accordingly for the work you do. There are various ways to receive money from your company. As a business owner, you might be asking yourself what these ways are, how they differ and which one to choose.

At a What a Figure Accounting! we will review the differences between:

- director’s remuneration (or simply salary);

- dividends;

- director’s loan account (DLA);

Director’s Remuneration

Getting Dividends: how does it work?

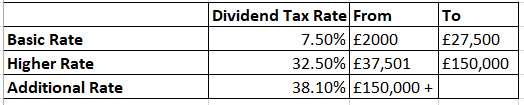

Most company directors take a small salary that does not exceed their personal income allowance of £12,579. Above that figure, directors usually take dividends as it has some tax advantages, as long as the company is profitable.

Also, there’s a certain procedure you need to follow to pay yourself dividends (even if you are a sole director):

- hold a board meeting;

- issue a dividend voucher which includes company’s and shareholder’s details, and the amount of dividends;

Let’s look at an example:

EXAMPLE 1. You get £4000 of dividends and £30,000 in wages for the last fiscal year.

The total yearly income is £34,000.

The personal allowance in 2022 is £12,579. So, we need to deduct this amount from our total income: £34,000 – £12,579 = £21,421

Now let’s calculate taxes:

- 20% on wages/PAYE: (£21,421 – £4000)*0.2 = £17,421*0.2 = £3,484.2;

- National Insurance: £2,665.90

- Total Deductions: £3,484.2 + £2,665.90 = £6,150.1. As a result, your net wages for the whole year: £30,000 – £6,151.90 = £23,848.1

- Employer National Insurance (company pays this): £3,145.45

- no tax on £2000 dividends allowance. So we need to deduct this amount from £4000 and apply a 7.5% tax rate on the difference: (£4000-£2000)*0.075 = £150;

- total taxes: £3,484.2 + £2,665.90 + £3,145.45 + £150 = £9,445.55

EXAMPLE 2. Now, let’s imagine the situation that your total income of £34,000 include £12,000 of salary and £24,000 of dividends. As the total salary amount is under the taxable threshold you don’t need to pay PAYE.

- National Insurance: £280.90. Net wages: £12,000 – £280.90 = £11,719.1;

- Employer National Insurance: £436.45

- Tax on dividends: £24,000*0.075 = £1,800

- Total taxes = £280.90 + £436.45 + £1,800 = £2,517.35;

As we can see, the amount of taxes due in the second example is considerably less. However, relying entirely on dividends is not always the best approach. First of all, we can’t always be sure if the company will be profitable in the foreseeable future. Secondly, we withdraw money that could be reinvested to fuel further growth.

What is a Director’s Loan Account?

The director’s loan account (DLA) is used for keeping track of all money that you either borrow from the company or lend to it.

The personal and company tax responsibilities depend on whether the director’s loan account is:

- in credit – the company owes director;

- overdrawn – director owes the company;

Director’s loan: money lent to the company

Director withdraws money

You may wish to borrow money from the company in order to help you with a personal cash-flow problem or cover any unpredictable expenses which are not business-related.

So, the director often chooses a mixture of different options to take money out of their limited company in order to reduce taxes (both for the business and the personal tax bill). Your accountant can always guide you on what is best for you and your company.

We hope this article helped you to understand the essence of a director’s loan, director’s remuneration and dividends. Let us know your thoughts and questions in the comments below.