Whether you just became an E-commerce Seller recently or you are a veteran, understanding financial statements are essential for every business. What are the most important ones and what are the benefits of the others? How to read and understand them? Finally, why financial reporting is crucial for a successful business? At What a Figure! Accounting we will give you all the answers!

The most important Financial Statements

When we talk about financial statements, most people think of the 3 most important ones. The Profit & Loss Statement, Balance Sheet and Cash Flow Statement. These are essential for every business and you should know how to read and understand them.

We will touch on these quickly here and will separately discuss them in great detail in individual articles of each.

1. Profit & Loss (P&L) statement

Profit and Loss (or also called Income Statement) includes a detailed breakdown of your income and expenses and shows profit (or losses) over the specified period of time. In simple words, the purpose of this report is to show profitability by reflecting how much sales (or loss) you made.

To understand its structure and what E-commerce sellers need to pay attention to when reviewing their Profit & Loss statement, read this article: How to Prepare an Income Statement? The 8 basic steps (+free template!)

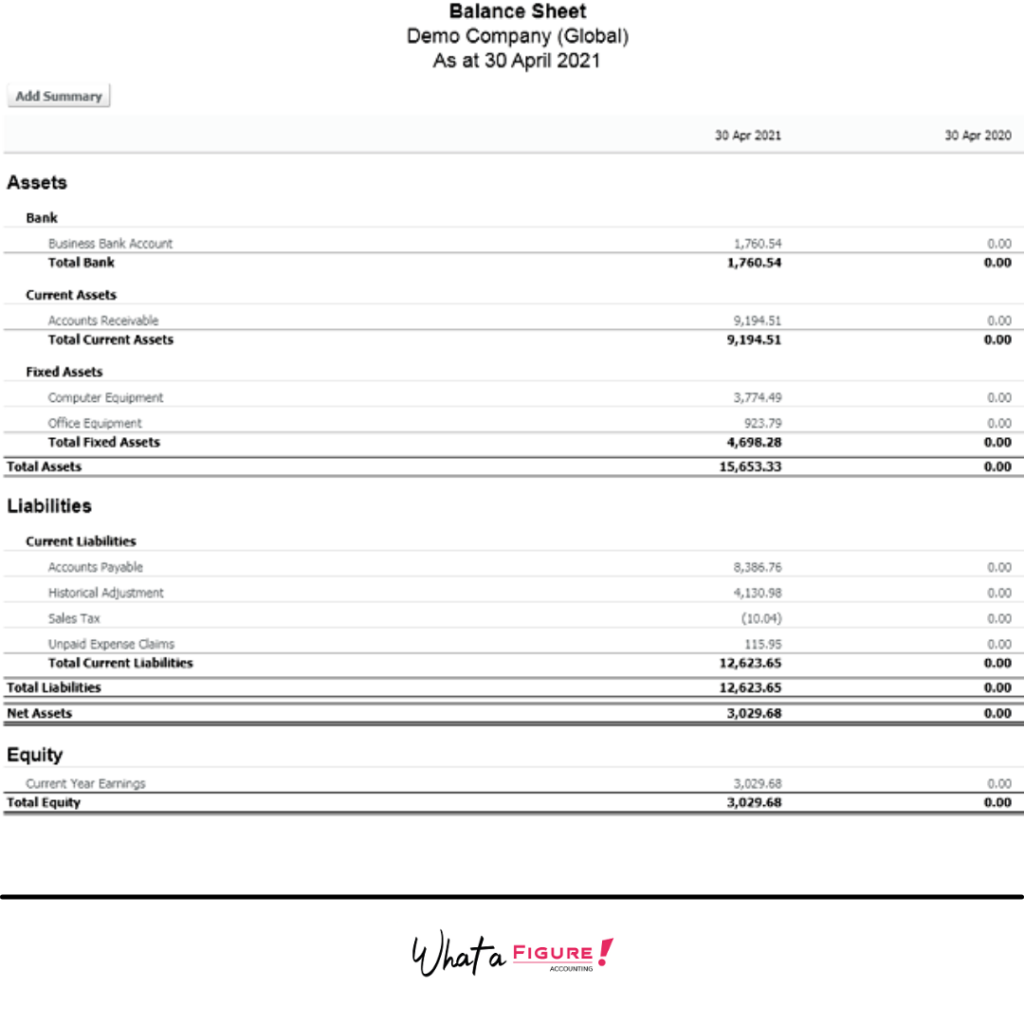

2. Balance Sheet

Unlike the P&L which shows how a company performed over a period of time, a balance sheet shows a business’s financial health at a single point in time (since you started the company), focusing on assets and liabilities.

In simple words, the balance sheet shows what your business owns and what it owes at a particular point in time.

To understand it in detail, read the following article: How To Read A Balance Sheet? The 6 Most Important Steps.

3. Cash Flow Forecast

The cashflow forecast helps to predict how much money your company will have at a certain point in time (in the near future) by analyzing/planning with expected income and expenses. In the nutshell, it shows inflows and outflows of cash over a specified period of time. It can help to determine whether a company has enough money to pay its expenses.

Your P&L may show high profits while in reality, the business could have cash flow problems. On how to identify these and to learn more about cash flow, read our article: How to Do a Cash Flow Forecast (free template!).

Additional Financial Statements

Other than the three most important ones (discussed above), there are several other financial statements that will give you very detailed information on certain areas of the Profit & Loss or Balance Sheet.

Typically, these are supporting documents and you won’t necessarily use them every month, unless the ‘bird-eye’ view you get from the Core Financial Statements are not enough. These could be any (or all) of the below:

1. Statement of Owner’s Equity

Statement of Owner’s Equity (also known as Statement of Retained Earnings) is a financial report which reflects all changes in a company’s equity. These changes may include earned profit (or net loss), dividends, additional owners contributions, withdrawal of equity, etc.

The final figure (the equity at the end of the period) is reflected on the Balance Sheet. However, the detailed overview on the company’s equity is only available on the Statement of Owner’s Equity.

To learn more about it, read this article: What is the Statement of Owner’s Equity?

2. Aged Payables & Aged Receivables Reports

Aged Payables report displays the amounts you owe to your suppliers categorized by the time that has passed since the invoice date.

Aged Receivables Report is a financial report that categorizes amounts due to the company over the specified period of time.

Both of these financial statements are usually on a weekly or even on a daily basis, unlike the P&L and the Balance Sheet that are generated on a monthly or quarterly basis.

To understand how to read them and how to prioritize which is urgent and which is not, go to: Aged Receivables Detail report and Aged Payables Summary report.

3. General Ledger Report

As the Profit & Loss and the Balance Sheet only provides top level (summary information), the General Ledger report is your go to for deep transaction level information. It is very useful if you are looking for mistakes and it is fairly easy to scan through.

To find more information on the General Ledger Report, go to: What is the General Ledger Report?

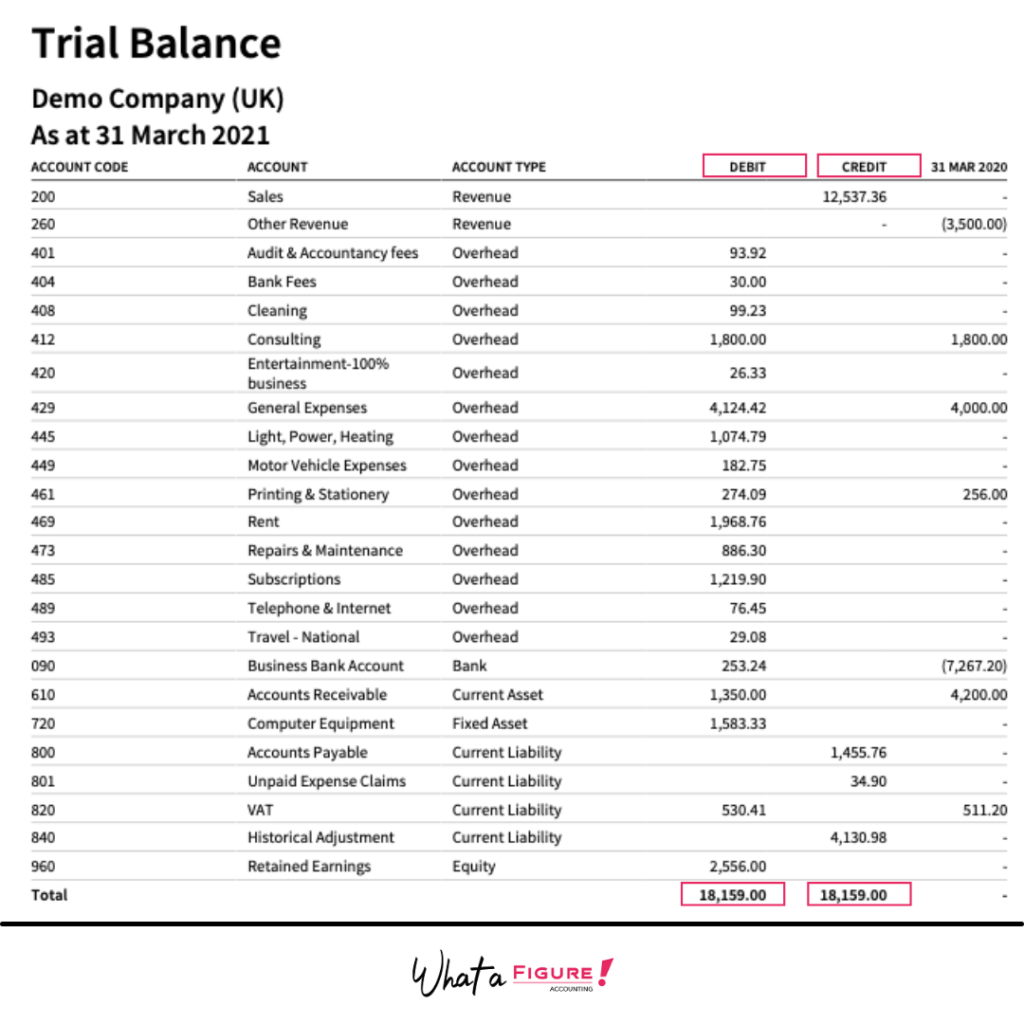

4. Trial Balance

Trial Balance is a report that lists the balances of all accounts of your company’s General Ledger. All accounts are categorized by their types: assets, liabilities, equity, revenue, expenses.

Each account includes its description, code and final debit or credit balance.

As a rule of thumb, the credit and the debit side of this financial statement should agree.

This is an example of a trial balance in Xero:

The main purpose of the Trial Balance is also to detect any possible mistakes. Above all, it is a basis for preparing P&L, Balance Sheet and other financial statements.

5. Fixed Assets Register

Fixed assets register is simply a list of the fixed assets that belong to the company.

This report usually includes the following information about each asset:

A fixed asset register shall be reviewed at a regular interval to make sure that it represents an accurate picture of the company’s assets. You should know the correct value of your fixed assets. Furthermore, this information is valuable for potential investors and creditors (banks).

To learn more about the Fixed Asset Register and how it is used, go to: Fixed asset register and depreciation – What is it and how to do it?

Why you need accurate financial statements for your business

1) For financial forecasting and planning: It’s almost impossible to create a business strategy without understanding financial statements. Analyze your financial reports to be prepared and avoid a possible crisis.

2) To access solvency and liquidity of the enterprise – both for a business owner and potential investors and lenders (banks)

3) To get an accurate picture of your tax liabilities – not only for corporation tax but also for VAT (sales tax).

4) To determine the strong and weak sides of the business. Whether your operating expenses are too high or short-term liabilities are falling due soon: all these you can understand from your financial statements. Forget about uncertainty!

We hope the above article helped you get a better understanding of financial statements and reporting. If you have any questions or suggestions let us know in the comments below!