What is a General Ledger?

Reading and understanding the General Ledger report is an essential skill for each business owner. If you run a company, you need to know what the financial transactions are and how they are reflected in the books.

At What a Figure! Accounting we will review the following questions:

- What is a General Ledger?

- What is the structure and the purpose of it?

- What is a General Ledger reconciliation?

Let’s get started!

What is a General Ledger in Accounting?

This report is used by a company to maintain its accounts by tracking all the operations that have taken the place during the period.

The general ledger is a daily record of the financial transactions that shows balances of assets, liabilities, equity, and expenses for the firm.

It includes what is owed to whom and how much, what expenses occurred and how much was earned during the analysed interval. Essentially, it lists all entries related to accounts receivable, inventory, payroll, revenue, cash, and others.

The Structure of General Ledger

General Ledger may be a hundred pages long. All depend on the size of the firm and the volume of operations.

However, the structure of this report is always constant. It consists of these core elements:

- Chart of Accounts. It lists all accounts: both that are included in P&L (revenue and expenses) and the Balance Sheet (assets, liabilities, equity). We will see the code for each account and their name (eg. ‘600 – Accounts Receivables’).

- Under each account, we can see the description for each transaction. So, following our example, under the Accounts Receivables account will show up all invoices that we raised during the period and payment received.

- A debit and credit column. Each journal entry posts a debit or credit to the general ledger. If we raise an invoice for $100 it will be shown on the debit column of Accounts Receivable and on the credit column of Sales/Revenue account (check a free debit and credit cheat sheet here).

- A balance. The totals of the debit and credit columns are compared to calculate the final balance of each account.

It is also worth to mention, that some companies may use sub-ledgers. It is used when we need to get a more detailed breakdown for a particular account.

For example, someone may need to track purchases by each supplier. Instead of storing all purchases under one account we can split them by creating sub-accounts. As a result, we can get a more informative report.

How does the General Ledger report work?

Let’s look at it a bit closer based on practical examples.

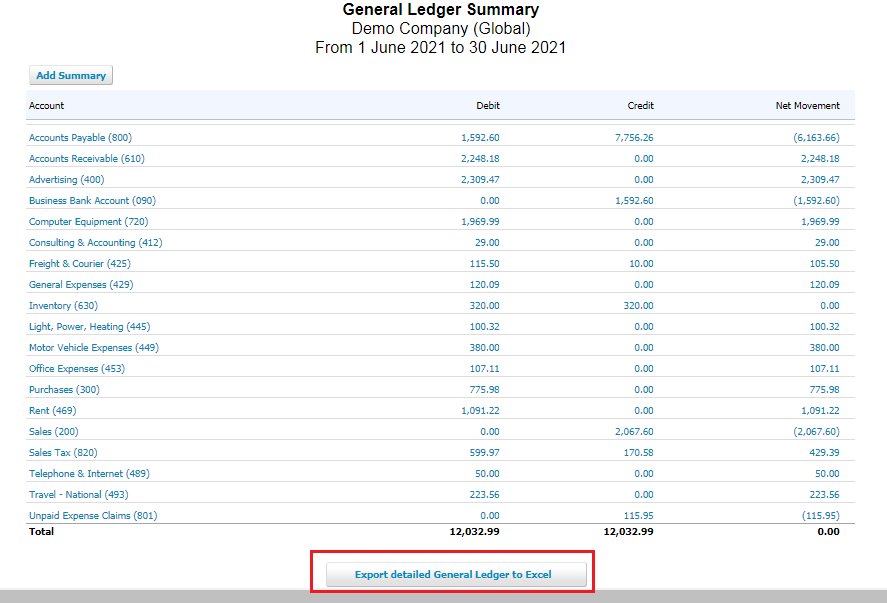

This is an example of General Ledger summary in Xero (a popular cloud accounting software):

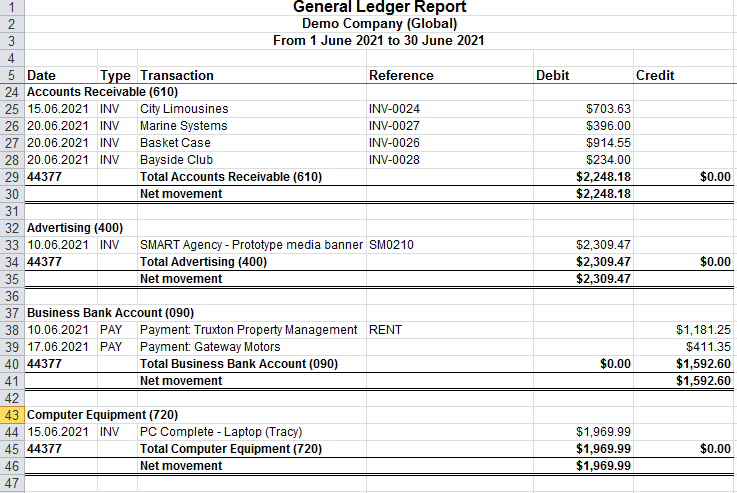

If we click on the “Export detailed General Ledger” button (see on the picture highlighted with the frame) we will get a full list of transactions that occurred.

This is just a snippet of the company’s General Ledger. As we mentioned it before in practice it may be quite a long list. It is not a surprise as we need to include each transaction in it. With this report, nothing can escape the attention of a good bookkeeper!

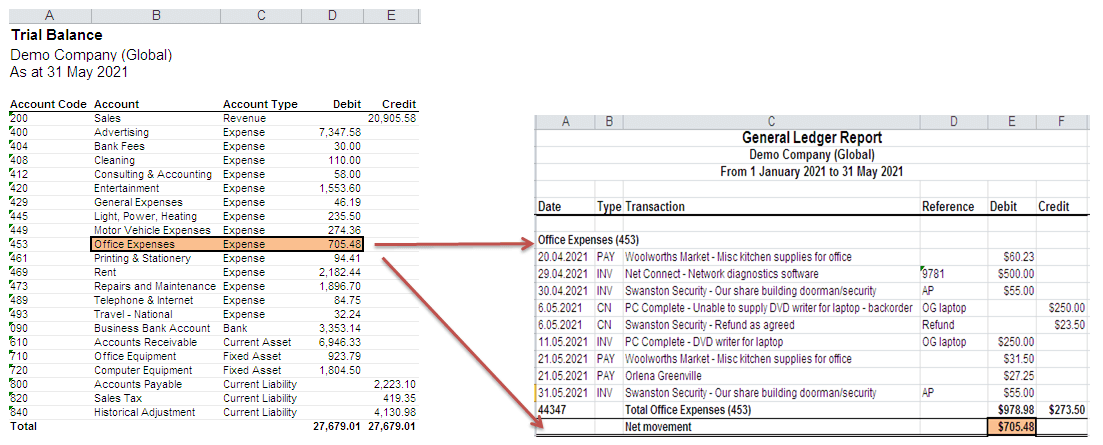

Unlike in the Trial Balance, here we can also see each transaction that is included in the closing balance. The “Net Movement” is the closing balance at the end of the analyzed period. This is the only figure we can see in our Trial Balance.

So, this report may give us more information, as we can find out how ending balances have been formed.

What is a General Ledger reconciliation?

In the nutshell, the general ledger reconciliation is a comparison of entries with actual data.

Ideally all should tally up.

Even though nowadays automated systems can do a good job in this task, the manual preparation and reconciliation of the general ledger is still necessary.

Technology cannot always prevent you from making mistakes.

Let’s take a closer look at this process.

1) Compare beginning and closing accounts balances.

This step is more relevant for those who do their own bookkeeping manually by using spreadsheets.

At this stage, we need to compare the ending balances of the prior period and the opening balances of the current period for each account.

As a rule of thumb, revenue and expense accounts should start with a zero balance. These accounts are temporary and are reset to zero each period.

2) Review the source documents and reconcile it with closing balances.

Bank statements, bills, receipts, invoices – these are those initial data we rely on when making entries to the ledger.

Suppose that the balance of the “Motor vehicle expenses” account seems too high compared with the previous month. What should we do? The first thing is to return to the original documents. We need to review all related bills, receipts that were assigned to this account.

3) Detect and investigate discrepancies.

Once we reviewed physical documents we can detect possible errors. The same transaction might be posted twice, or a wrong amount was entered. Or maybe all data was correct but it was coded to the wrong account.

We are all humans. However, we need regularly review our books and detect errors at the earliest stage possible. Don’t allow mistakes to accumulate as they could ruin your business.

4) Post correcting entries if needed.

After detecting errors we can make required adjustments. As long as the period is not closed and we are on the way to preparing financial statements we can make amendments. Also, we can post correcting entries and reverse journals that have been posted with mistakes.

So, the general ledger reconciliation is an essential step in detecting errors. It helps to make sure that your bookkeeping is in good order.

Example of the General Ledger Entries

The core of general ledger accounting is the double-entry bookkeeping. This means that each transaction affects at least two accounts.

To get a better understanding of how it works let’s review a practical example with a few business operations involved.

Example

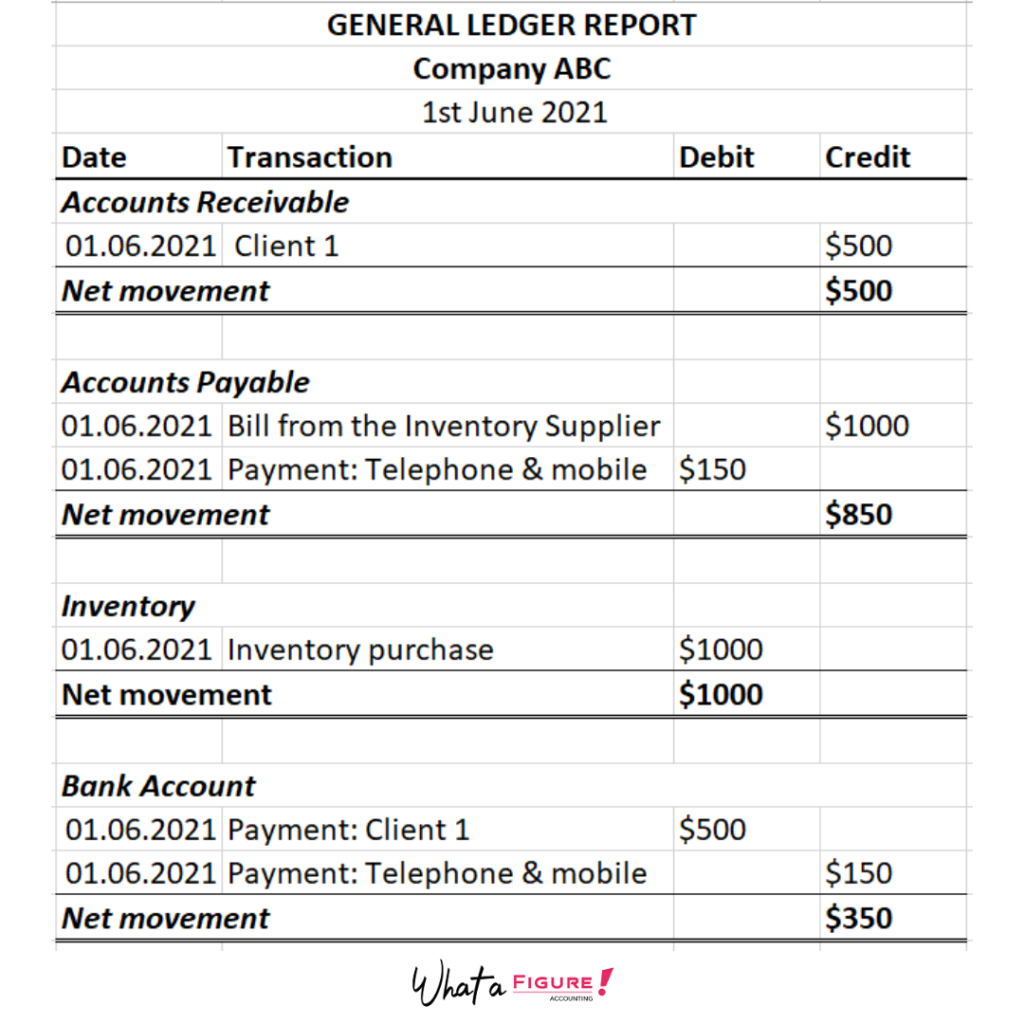

On 1st June the company ABC purchased some inventory items for $1000. The bill from the Inventory Supplier is due in 30 days. Also, they received $500 from their debtor (customer). On the same day, this firm paid a $150 phone bill.

In this case, the report for the company ABC that covers the period of only one day will be as follows:

This example shows how business activities are recorded and how they affect different accounts.

As you can see the outflow of cash from the bank account results in decreasing of liabilities (payment of the phone bill). The incoming payment from the client means that we not only debit our bank account (receive cash) but also decrease accounts receivable (credit it – the client has settled the debt).

Lastly, we have shown that our Inventory balance increased by $1000. At the same time, the liabilities have been also increased by the same amount. That bill for inventory items is outstanding and should be paid in a 30 days term.

In a conclusion, General Ledger is not only a detailed breakdown of transactions. It is also the basis for preparing a trial balance and consequently other financial statements.

We hope that in this article helped you understand the main principles of the general ledger accounting. Please let us know about your thoughts and suggestions in the comments below!