What is an Accounts Receivable Aging Report?

If you want to efficiently manage your cash flow it is necessary to thoroughly keep track of your receivables.

At What a Figure! Accounting we will review the following questions:

- What is an accounts receivable aging report and how does it work?

- How could you benefit from it?

- How to manage your receivables efficiently?

Forget about uncertainty in these financial times!

The Definition of Accounts Receivable Aging Report

If we want to assess the total volume of cash that we expect to receive from our customers we can simply look at the accounts receivable line on the Balance Sheet.

However, in this case, we can’t take into account the time factor: some invoices may be well overdue while others will fall due only in a month or so. Therefore, the Balance Sheet is not helpful if you want to get a deeper insight into your receivables.

If we categorise our outstanding invoices by the date they fall due then we can get an idea of how much will possibly hit our bank account in the nearest future.

The accounts receivable aging report is a list of unpaid invoices that are grouped based on the time they are due.

This report is used by the company or organization to see where the financial health of their business is and to see where the project stands against the overall financial health of the company.

The importance of AR aging report (+example)

And now let’s review the main points of how your business can benefit from using this report:

- It gives a snapshot of money owed to you. By examining it we can get an idea of the receivables structure. Which invoices will be possibly paid soon? What percentage of a customer’s debt is uncollectible? This report can help you to get answers to these questions. Alongside cashflow forecast tools it could give you valuable information about expected cash inflow.

- Detect unreliable customers. Sometimes it is better to stop doing business with those who don’t pay constantly. This report ensures you don’t lose money providing goods or services that will never be paid. Remember that accumulating bad debt may be destroying your business.

- Identify internal issues. AR report may help you to detect negative tendencies. Probably it is time to review your sales politics: use a stricter process for issuing credit. Or maybe you just failed to follow up with the client on time.

- Learn client and other industry payment behaviour. If you generate the AR aging report on a regular basis you can also notice which segments are problematic and which are thriving.

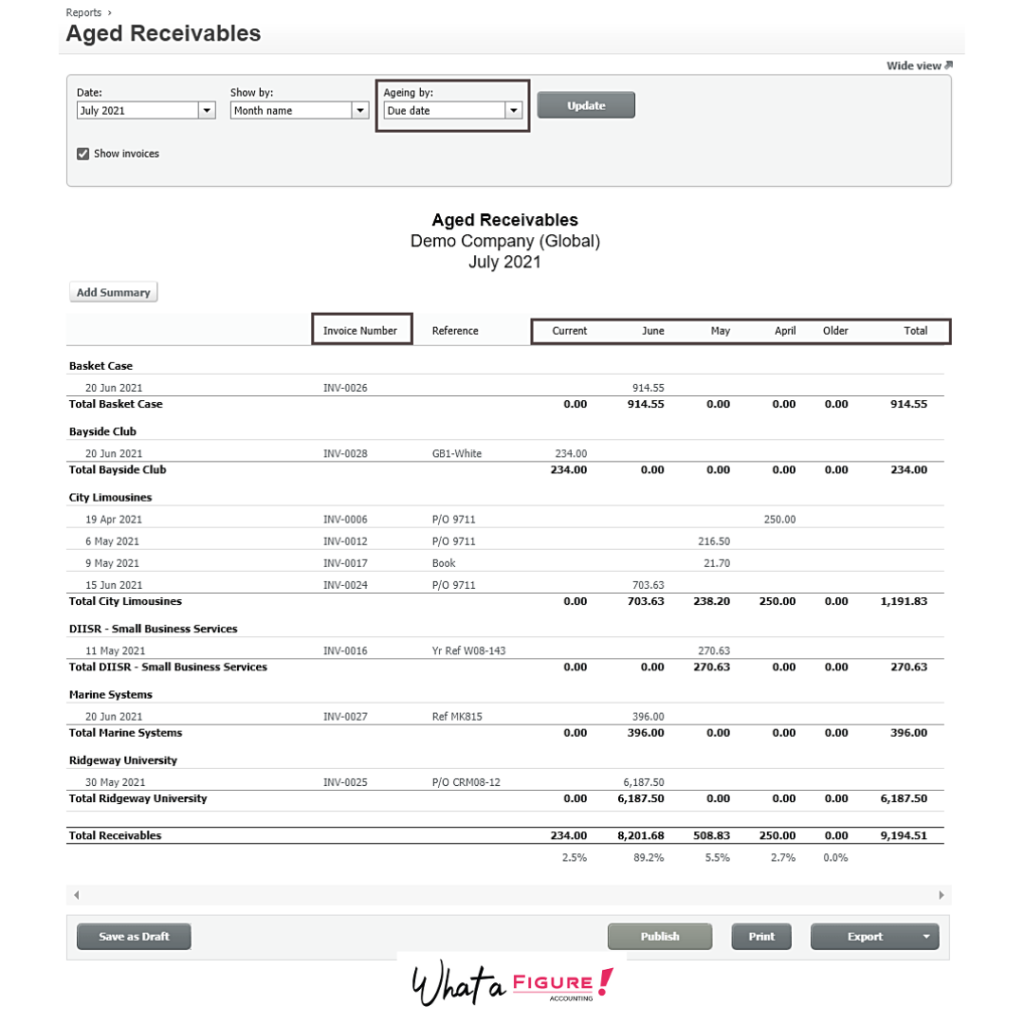

Almost all cloud accounting software can generate this report.

You will be able to generate a Aged Receivables report from Xero in a few different formats. This the most common one.

Besides categorising sales invoices it also shows a percentage of receivables for each period in proportion to the total volume. A small but nice feature that makes the analysis even easier.

In our example shown in the picture, 89.2% of receivables have fallen due in June.

Depending on your needs Xero can create it based either on the due date or the date of invoice.

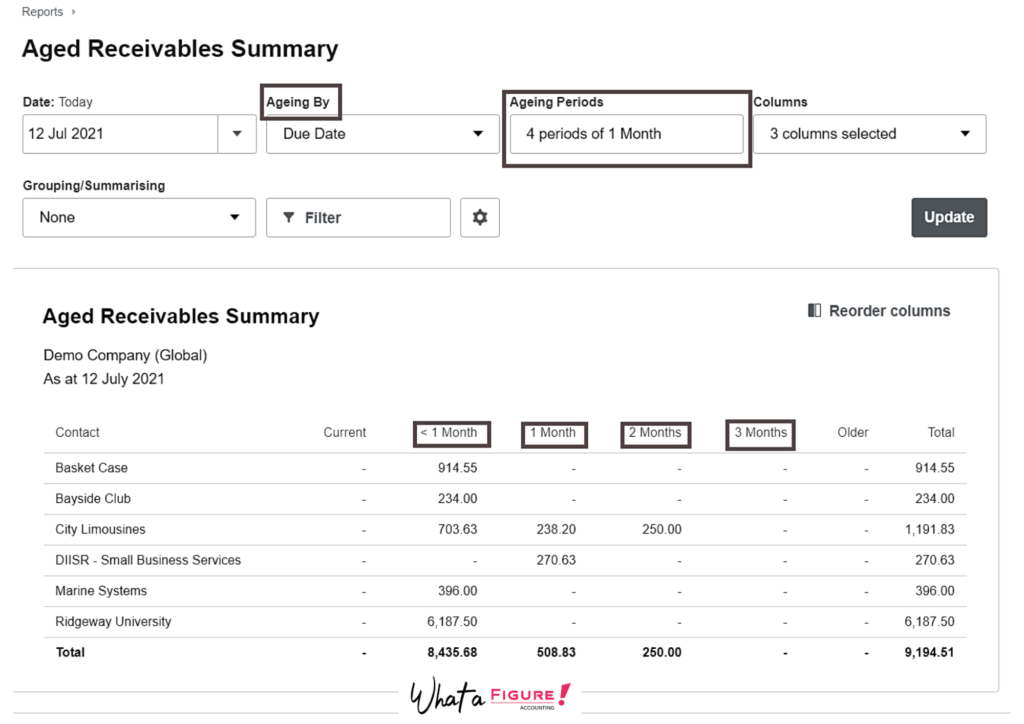

We can also generate an Accounts Receivables aging report in the following format:

This kind of report gives more space for customizing it depending on your preferences and needs. You can choose the aging period, invoice details you want to include in the report (invoice number, contact details, tax amount, etc) or even group it by tracking categories.

Accounts Receivable Management: Useful Tips

Accounts Receivable management (often called as credit control) is a process in which an organisation tracks the progress of customer payments against invoiced amounts.

It is a critical process in an organisation due to the fact that it involves the movement of funds between the customer and the business. The system is used to ensure that customers pay on time, collecting payment from the customer is managed effectively and that the correct invoices are issued.

We listed here some useful tips to make your accounts receivable management more efficient.

Use credit limits

You can agree with a client upfront on the number of goods/services that might be provided in credit. Potentially it could save you from the risk of accumulating debts owed to you.

Set up a payment plan

Making calls and sending follow up emails might not be the most pleasant work to do. However, sometimes we can’t avoid it. Some clients just need a reminder to put a payment through.

For someone, a payment plan may be a good solution. Even your most loyal customers may face some temporary financial issues. In this case, the schedule of payments meets the financial needs of both parties.

Suggest the most convenient payment method

If you send recurring invoices to the client then you can use the benefits of direct debit. It will free out tons of the time that you used to spend on chasing customers.

Furthermore, it is always better to be flexible in questions of processing payments. You can allow the client to use different methods: ACH, checks, credit/debit cards or any of the online gateways (Stripe, PayPal, etc).

Last but not least is propose a discount for early payment. This type of encouragement may work well also.

Use a factoring service for you receivables

It is possible to sell your outstanding invoices (the receivables). A factoring service can help you to overcome temporary cash flow crisis and improve the financial position of the company.

In a nutshell, you sell outstanding invoices to the factoring company which takes responsibility to collect the debt. For this service, the factoring company will charge a fee (usually 2-10% of the outstanding invoice amount).

What is a Bad Debt Expense?

As we have discussed it earlier, the Accounts Receivables aging report could be used as a tool for detecting bad debts.

Bad debt is a business expense which occurs when the receivable amount can not be collected (eg. due to a client’s bankruptcy).

Having bad debt results in lower profitability and could seriously impact the business in a negative way. It is hurting the bottom line.

Nevertheless, the business owner can’t ignore the well overdue invoices and let them sit on the Balance Sheet for years. It overstates assets as well as net revenue. Consequently, the financial statements are not reliable.

Direct write off method

The easiest way to report bad debts is a direct write-off method. In this case, we credit (decrease) receivables on the Balance Sheet by the amount of uncollected debt and debit (increase) the bad debt expense on the Profit & Loss account. As a result, we deduct money owed to us from our assets in the Balance Sheet and convert it into expenses on the P&L. This method is used only for small unmaterial amounts. This is because the related sales transaction and the bed debt journal entry take place in different reporting periods. It contradicts accounting principles.

Allowance method

However, in order to get the most precise information in our financial statements, we can post an estimated amount of uncollectible debt (as an expense) to our P&L each month. At the same time, we must create an allowance for bad debt in the Balance Sheet (also known as bad debt reserve). The allowance for bad debt is an opposite account to accounts receivables.

If you made $2000 of sales during the month you can assign some part of it to bad debt, let’s say $100. The amount you assign to the bad debt reserve depends on the calculating method you may use.

This is the snippet of the Balance Sheet for our example:

| Cash | 5 000,00 |

| Accounts Receivable | 2 000,00 |

| Allowance for Doubtful Accounts | -100,00 |

| Prepayments | 550,00 |

| Total Current Assets | 7 450,00 |

The journal entry will look like this:

| Debit | Credit | |

| Bad Debt Expense | 100 | |

| Allowance for Doubtful Accounts | 100 |

In other words, we make an assumption of how much we will not be able to collect from the current month’s sales.

So you can gradually recognise this type of expense in your income statement and accumulate the allowance for bad debt on the Balance Sheet.

Once you decide to write off an uncollectible amount from your books you need to post the following journal:

Allowance of Doubtful Accounts – Debit

Accounts Receivable – Credit

This entry will clear off the allowance account and exclude the bad debts from receivables.

We hope that this article answered all questions you had about accounts receivable and aging report. We would love to see your suggestions and questions in the comments below!