If you came to the final conclusion that it’s time to move on from Excel spreadsheets (or skip that step all together), you came to the right place. Preparing your cash flow forecast statement with Float app is an excellent, time saving solution. At What a Figure! Accounting, we will show you how to set it up.

What are the advantages of using Float app?

Preparing your cash flow forecast statement in a spreadsheet can be very time consuming. If you have very low transaction volume, it can be manageable. However, the more income and expenses go through your bank account(s) the longer it will take to cross-check them. At the end of the day, spreadsheets are very manual. You will have to ensure all transactions are in your spreadsheet, otherwise, your bank balance will be out. This then causes your cash flow forecast statement to be wrong.

On the other hand, a software like Float app, will sync with your accounting software. It will import all your outstanding sales and purchase invoices, so you can forecast their payment date. Furthermore, it will also sync your bank balances. Therefore Float app eliminates 80% of the work and you can concentrate on actually preparing the cash flow forecast statement itself.

What accounting software does Float app work with?

Float app can sync with Xero, Quickbooks and FreeAgent – the most popular cloud accounting software. At What a Figure! Accounting, we specialize in Xero, therefore we will show you the set up with that. However, setting it up with Quickbooks or FreeAgent, should be fairly similar.

Setting up your cash flow forecast statement

Go to the website of Float App and create a free trial or log into your account.

Once you have logged in, they will ask you a few questions about your company. Don’t worry, the settings you choose won’t make a difference when it comes to your cash flow forecast statement. They are just for the internal statistics of Float App!

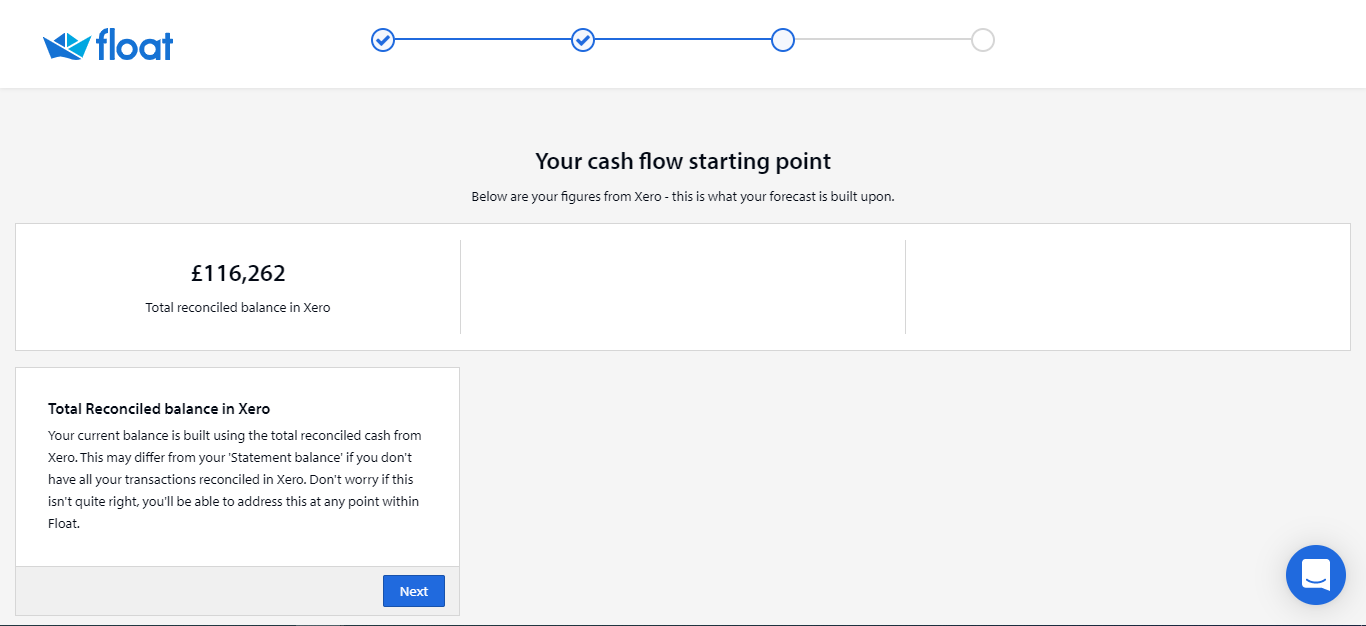

You will then start connecting it with your cloud accounting software (in our case, Xero):

Just hit ‘Next’ until you get to the 3rd part, which is IMPORTANT:

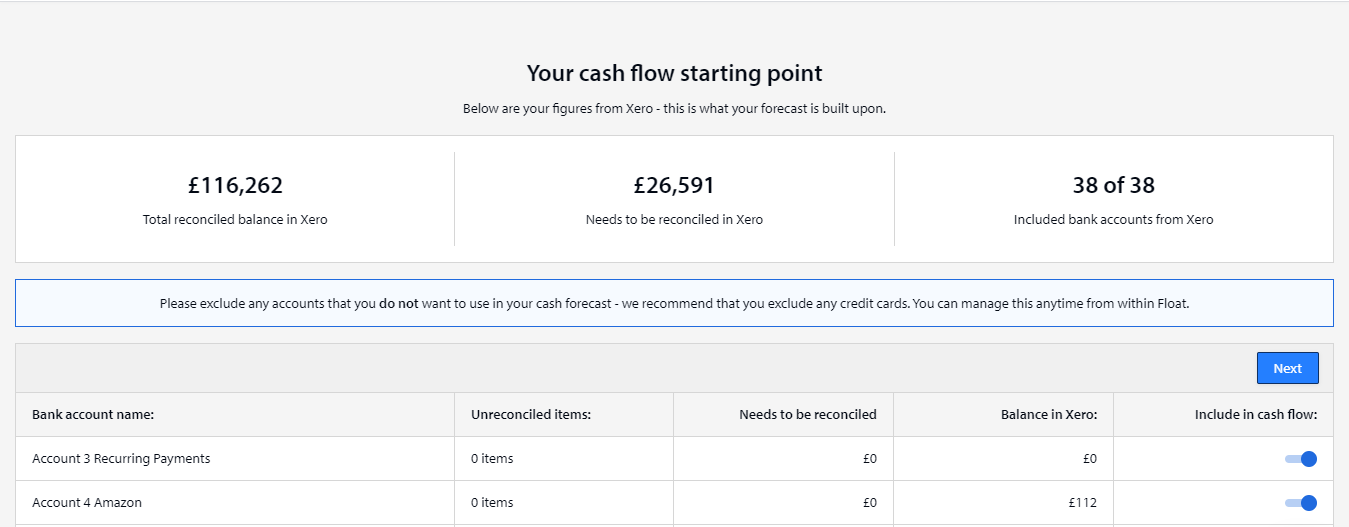

Bank Accounts

Here you have to select the bank accounts you want to use for cash flow forecast statement purposes.

Which bank accounts to include:

-Bank accounts you use for income and expenses – YES

-Bank accounts that has money in it (even if you don’t use it) – YES

-Bank accounts you use for administrative purposes or as clearing accounts (basically bank accounts that don’t have actual money in them) – NO

If you get this step wrong, don’t worry, you can always modify it in the future!

Outstanding sales invoices and purchase bills

Once you have finished selecting the bank accounts, repeat the same step with outstanding sales and purchase invoices. Remove the ones that have been paid.

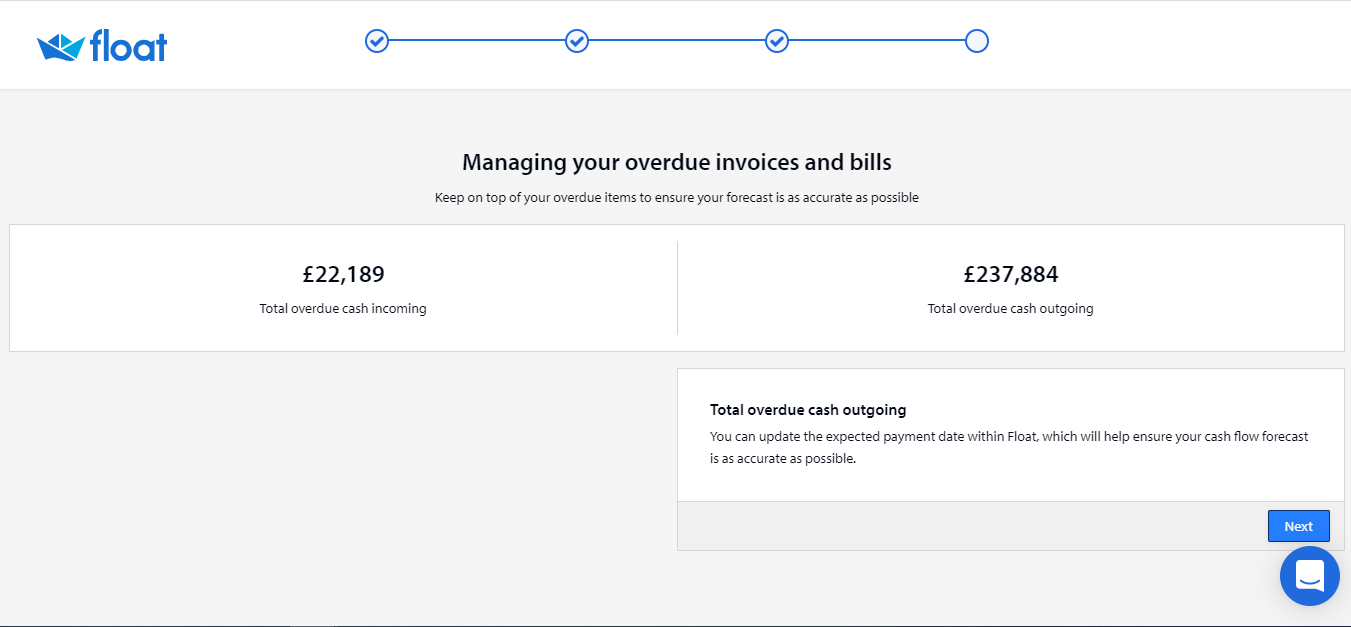

Any invoice that is marked as outstanding AND overdue, won’t be included in your cash flow forecast statement in the future. So if you have a £10,000 invoice overdue and you have £6,000 in cash, Float app will disregard this £10,000 until you move it into the future. Otherwise it thinks it was already paid and that is why your cash balance is £6,000.

Therefore to ensure your cash flow forecast is correct, go to the ‘invoices due’ and ‘bills due’ tabs. If there is anything overdue, they will have a red exclamation mark next to them and you have to change the expected payment date into the future.

You can also change the expected payment date in Xero (under: Invoices > Awaiting Payment) and when you sync Float app with Xero (in the top right corner) and refresh the page, those dates will also show in Float app. It just depends on your preference or staff access.

Updating the budget

Once you have updated the outstanding invoice dates, go to the ‘Cash Flow’ tab and scroll down. You will see a budget table. Here you need to enter the expected future income and expenses. This section works in the way that you enter your future planned income (eg. in Sales in November) and this will be used for the forecasting. Float app will fill up this ‘budget figure’ with the actuals and modify the cash flow forecast statement if you go over your budget.

This is great to use for order acknowledgements for example. Many e-commerce sellers place orders to their suppliers but don’t receive the bill for them for several months until the order is delivered. Enter your order acknowledgements as expected future payments in here to help you plan your cash flow.

Additional payments

After updating the budget, there is one more thing you want to do.

There are some payments that don’t necessarily show as bills or happen every month. A typical one is the VAT payment. The amount due shows up on the balance sheet and therefore, might not automatically show up in your Float app budget. Create a budget for these and enter them quarterly.

Corporation Tax – as this is due yearly, you want to make sure you forecast for this as well, if you haven’t already. Better to be safe then sorry.

Once you have finished

When you finished, we highly recommend you to change the cash flow forecast statement to ‘Weekly’ on the cash flow tab, instead of ‘Monthly’. This will help you see if there are any weeks in the near future when your cash balance goes below zero. If this is the case, you will need to either push out payments further into the future or chase payments to come in earlier.

For detailed help on managing your cash flow, read our other blog post:

How to Do a Cash Flow Forecast (free template!)

Float App – Cash Flow Forecast Statement video

For detailed information on how to use Float app, watch their short introduction video:

Read next: Proforma invoice: What is it and how it affects your VAT?