Clearing Account:

Top 4 Questions & Answers!

At What A Figure! Accounting we will review the core questions you may have about clearing accounts:

- What is a clearing account (CA)?

- How does it work?

- What is the difference between clearing and suspense accounts?

- Why does it matter in e-commerce?

Let’s go through them one by one.

Q1. What is a Clearing Account?

The clearing account by definition is meant to be cleared out at the end of the period. Sometimes it is also called a wash account.

The clearing is a buffer account where we record data temporarily until it’s time to move it to the permanent one.

Generally, it is used as a way to track and reconcile transactions that are in process.

For example, when you sell on Amazon (or any other marketplace) the flow of payments is indirect. This means that the marketplace collects payments from customers and makes payments to sellers according to their payout cycle. These amounts usually include different transactions (sales, fees, refunds, etc) which make recording and reconciling payments difficult. As a solution, we can set up a clearing account for each marketplace/payment processor to manage these deposits efficiently.

The ultimate goal of the clearing account is to keep track of transactions and then clear them off to where they belong and at the end of the period. They should balance to zero on your balance sheet.

Q2. How does it work?

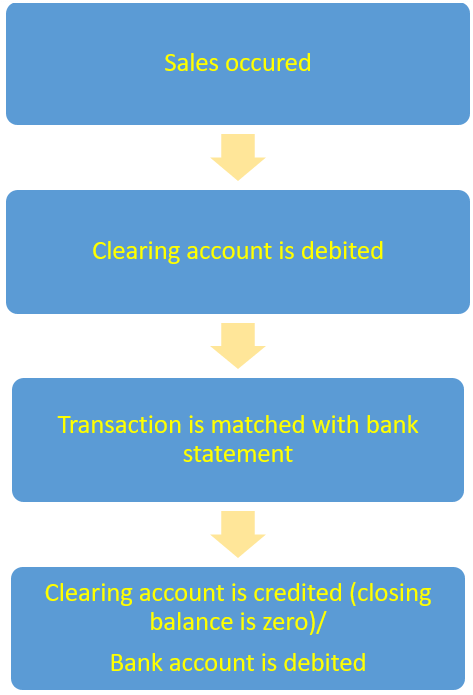

Here is an image of using the clearing account while reconciling e-commerce sales (more on that later):

At first, we allocate our undeposited funds to the clearing account. After that, once the payment hits our bank account the clearing account is cleared out, hence the balance goes down to zero.

There are several scenarios for using a CA to assist in tracking of each type of transaction:

- Liability CA – we could set aside the money for a payment that we have to make in the near future. This helps us have a better control over cash flow and avoid any payment problems in the long run. Suppose, we received a payment from a customer for work completed. However, we know in advance that 85% of that amount should be paid in 30 days to the contractor who completed the project. Therefore, to have a clear vision of how much we can spend now and how much we need to hold for future payments, we can use the CA.

- Asset CA – this usually refers to our accounts receivable. We’ve already showed this type of CA on the image above. They help to recognize payments to your organization when they occur rather than when they hit the bank. We will review this in more detail a bit later on through a practical example.

- Payroll Clearing Account – they behave similarly to liability clearing accounts. Using a clearing account allows you to ensure all payments to staff have been made. If the account does not balance to zero (after all payments were made) then there is either a miscalculation to a different account, or someone was underpaid or overpaid. It is a great way to ensure due diligence when processing payroll.

Q3. Clearing and Suspense Accounts: are they the same?

No, it’s not.

A suspense account is created to handle any uncertainties if we don’t know how to code a transaction. For example, you received a batch payment from a customer without a reference what this payment is for. As it is not clear how it should be allocated/reconciled you can temporarily put that transaction into a suspense account (until you find out all the required information). So, a suspense account is used when there is an accounting problem or discrepancy. Bookkeepers use it to ensure the Trial Balance is equal (on both sides) until this problem is resolved later.

Clearing accounts hold transactions for later use or transfer, ensuring that the accounting information is recorded accurately and to make the reconciliation easier.

However, we will not see the suspense or the clearing account on the Balance Sheet when the period is closed. So, the common feature of these accounts is that they are both temporary.

Q4. Why is the Clearing Account so important in E-Commerce Bookkeeping?

First of all, the clearing account is indispensable for the reconciliation of foreign currency transactions in Xero (you can read in detail about this side of the e-commerce bookkeeping here).

Secondly, if your online store directly integrates with Xero, the most common way to reconcile the bulk payments in your bank account is to use a clearing account. It is essential to accurately account for payments you receive for your e-commerce sales.

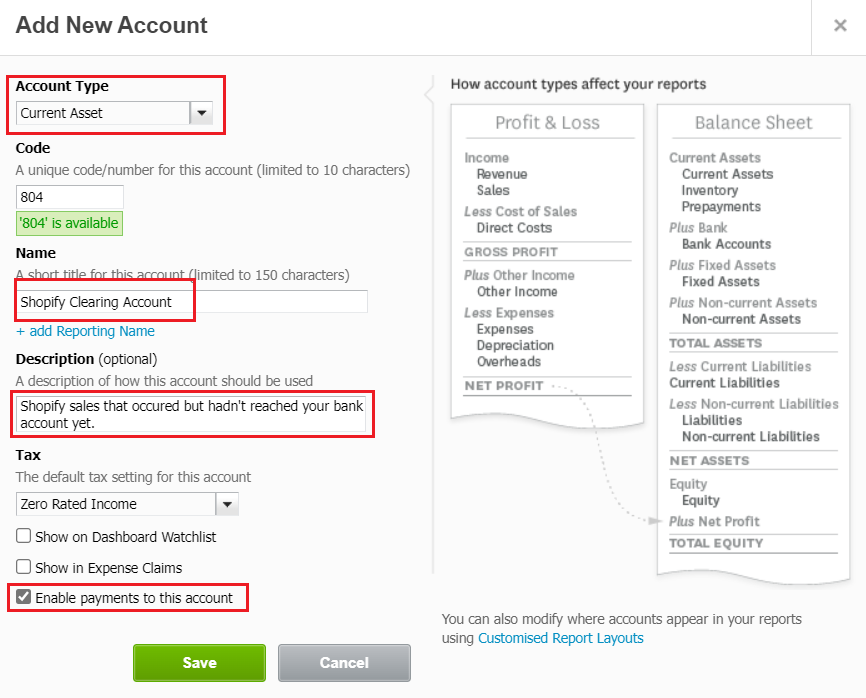

The first step is to create an asset account in Xero that will be used as a clearing account.

Afterwards, we need to set up our payment processor (or third-party tools like A2X or Weava) appropriately. If an online store directly connects to Xero, edit the settings so when it marks your Xero invoices as paid, the payment shows in the clearing account. In other words, we need to cutomize our accounts mapping correctly.

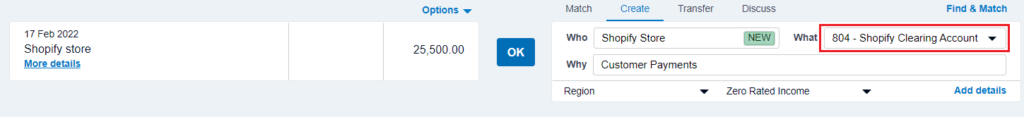

Once we receive a payment from the online store in Xero it could be allocated to the clearing account.

As a result, the balance of the Shopify CA equals zero while the bank balance increases by the deposited amount.

We can have several clearing accounts for different payment processors. There may be one for Shopify payments, another for PayPal or Stripe, etc.

Why do we need it? The separation of money flows facilitates the bookkeeping process by helping to identify issues and discrepancies.

Thanks for reading. We hope this article helped you get a better understanding. If you have any questions, please leave it in the comments below.