What is the Purpose of the Trial Balance?

If you are unsure what is the purpose of the trial balance, or wandering how it differs from the balance sheet, read on.

At What a Figure! Accounting we will walk you through the following questions:

- What is a Trial Balance?

- How does it work?

- What is the purpose of the Trial balance?

In this article, we will explore all of the above based on practical examples.

What is the Trial Balance?

Trial Balance is an internal report which lists all business accounts and their closing balances.Now let’s dig a bit deeper into the essence of this definition.

Just like everything in the universe, accounting strives for harmony. Nothing comes from nowhere: each action has a source and a consequence.

Similarly, each business transaction affects two accounts: one on the debit side and the other on the credit side. No matter whether you buy inventory, get a loan or pay salary and taxes. It is a fundamental rule.

Let’s say you transfer $100 to buy an inventory item. It will decrease your bank account by $100 (credit it) and increase the inventory account by the same amount (debit it). Your $100 didn’t disappear, you obtained some products instead. This value just flowed from one account to another. The harmony was saved! 🙂 In accounting, it is called a double-entry system.

If we list all transactions over the analyzed period we can see that the sum of the debit transactions are equal to the credits (if we have done everything correctly).

This report is your trial balance.

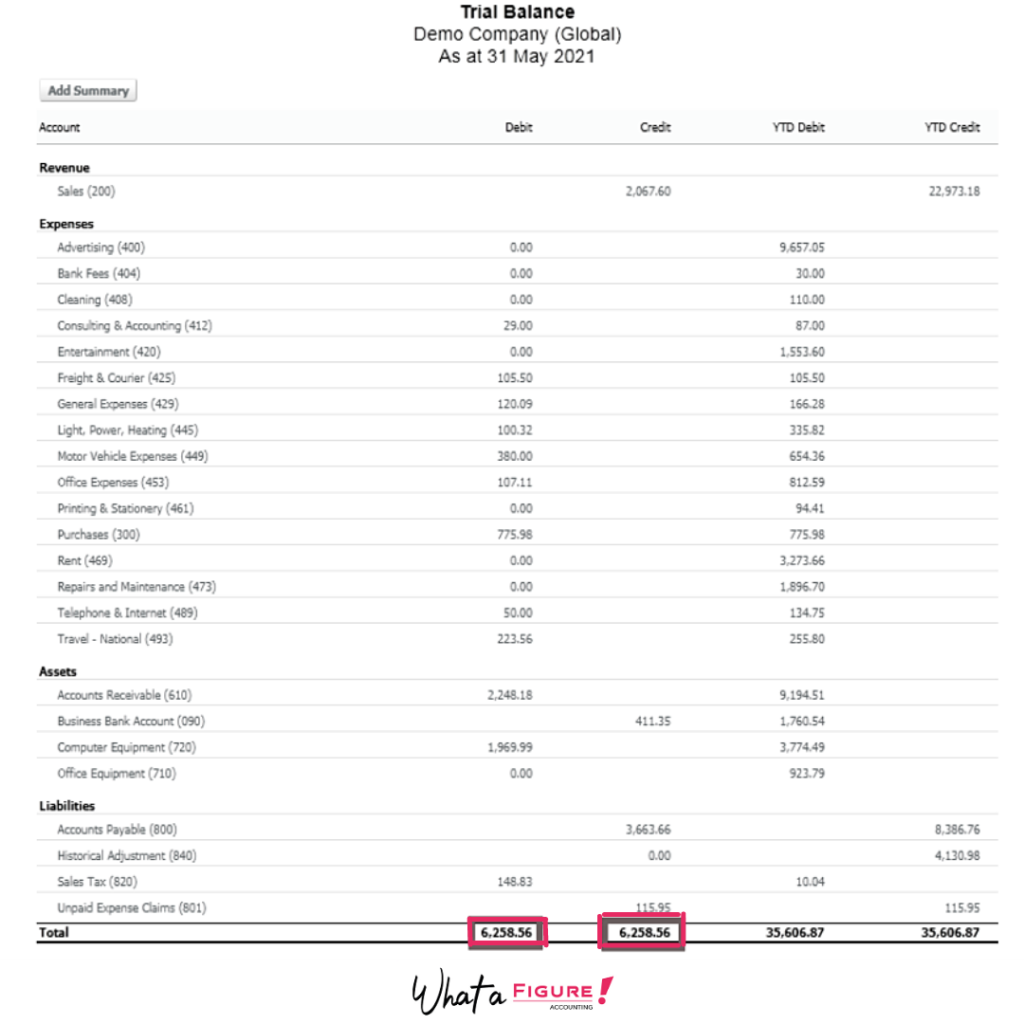

Fortunately, the time when it had to be prepared manually has long passed. This is the example of a Trial Balance in Xero.

With Xero (or any other accounting software you prefer) this task could be completed in a few clicks.

However, it gives only a bird-eye view of your transactions. If we need to get more detailed information of each account it is also worth looking at the General Ledger report.

Trial Balance vs Balance Sheet: what is the difference?

As they sound very similar, they could be confusing.

Trial Balance is an internal company report used to aid the preparation of other financial statements. It is not a part of mandatory statutory accounts (that needs to be submitted to the tax office).

Usually the trial balance is used only within the accounting department of the company.

All data is grouped under the debit or credit columns which should be equal. You can’t determine the financial position of the company solely by using the trial balance.

Whereas the Balance Sheet is a more complex report. The accounts are grouped in a specific way (assets, liabilities, equity), so it gives an insight into the company’s position. The trial balance is a source of information for the balance sheet. The Balance Sheet is a part of final accounts and unlike the trial balance, the balance sheet is used by external users (tax authority, investors, etc).

Purpose of the Trial Balance

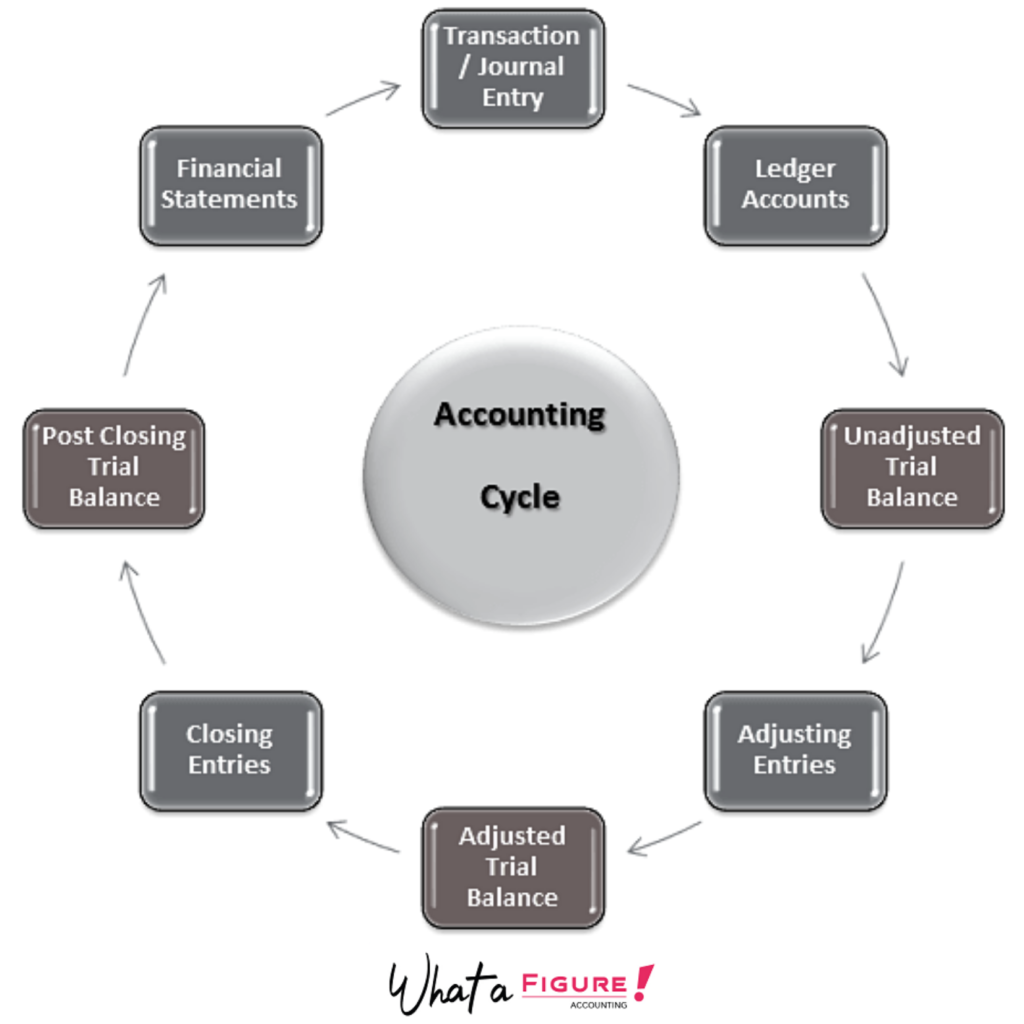

First of all, the preparation of the Trial Balance is an essential step in the accounting cycle. In a nutshell, the accounting cycle is all those steps required to identify, record, and summarize all transactions in order to prepare financial statements and close the period.

The purpose of trial balance is to reveal any possible inaccuracies at any step of the accounting cycle before drafting the financial reports.

On the image below you can see the structure of the accounting cycle and the place of different stages of the trial balance in it.

We can also describe the Trial Balance as a transitional step before generating the core financial statements (P&L, Balance Sheet). .

Trial Balance is an important tool to determine the accuracy of all entries. It is prepared three times during the cycle. So, it could help to find mathematical errors if there were any. Luckily with many popular cloud accounting software now, the chances of mathematical errors are minimal.

Therefore, the trial balance is just the raw data that should be thoroughly reviewed and processed before it could be used further.

Undetectable errors in a trial balance

We listed here the most common types of errors that couldn’t be dedected by reviewing the trial balance:

- Errors of Principle. The wrong account type was used. For example, the laptop purchase was coded as a general expense instead of fixed asset.

- Errors of Omission. The transaction was not recorded at all. As it was not posted in the ledger, it didn’t affect the trial balance. Hence can’t be detected as it is not there.

- Compensating Errors. One error offsets another: it can happen when we have two transactions of the same amount. The accounts could be different though.

- Duplication. If we post the same transaction twice, the credit and the debit side of the trial balance will be still equal.

Debits and Credits Cheat Sheet

To avoid errors in your books you can use this table.

Account | Debit | Credit |

Assets | + | – |

Liabilities | – | + |

Equity | – | + |

Expenses | + | – |

Revenue | – | + |

As you can see, if we debit the assets and expenses accounts, it will increase the value of those accounts. For example, if you acquire a new fixed assets item this transaction must be shown on the debit side of the related asset account.

The entry on the credit side of assets and expenses accounts means decreasing them.

For liabilities, equity, and revenue accounts this is the polar opposite: debit means it decreases, whereas credit means it increases.

It is always a good idea to double-check the accuracy of the entry before posting it to the ledger.

As we have already mentioned it, a bookkeeper usually prepares a trial balance three times during the accounting cycle (before the period is closed).

Let’s take a closer look at the different stages of a trial balance.

Unadjusted Trial Balance

The term speaks for itself: this is a trial balance before any adjustments are made.Here is an example of an unadjusted trial balance:

Account | Debit | Credit |

Cash | 22,000 | |

Accounts receivable | 5,000 | |

Inventory | 9,500 | |

Accounts Payable | 20,000 | |

Accruals | 5,500 | |

Equity | 6,000 | |

Revenue | 17,000 | |

Prepaid insurance | 1,200 | |

COGS | 3,500 | |

Rent | 3,300 | |

Other expenses | 4,000 | |

Total | 48,500 | 48,500 |

The purpose of the unadjusted trial balance is to test the whether debits equal the credits after the recording phase.

Now let’s move to the next step.

Adjusted Trial Balance

There are various adjustments that we have to make after the Trial Balance is prepared for the first time. All depends on the nature of the business.

For example, e-commerce sellers need to make appropriate adjustments to get an accurate balance of inventory and cost of sales.

Besides, quite often bookkeepers post adjusting entries to accurately account for expenses or defer the revenue.

Let’s assume that the company has prepaid $1200 for insurance on 1st January ($100 for each month). Also, they paid salaries on 5th each month (so the January salary will be paid on 5th February).

Here is an example of the trial balance before and after the adjustments have been made.

Account | Unadjusted Trial Balance | Adjusting Entries | Adjusted Trial Balance | |||

Debit | Credit | Debit | Credit | Debit | Credit | |

Cash | 22,000 | 22,000 | ||||

Accounts receivable | 5,000 | 5,000 | ||||

Inventory | 9,500 | 9,500 | ||||

Accounts Payable | 20,000 | 20,000 | ||||

Accruals | 5,500 | 5,000 | 10,500 | |||

Equity | 6,000 | 6,000 | ||||

Revenue | 17,000 | 17,000 | ||||

Prepaid insurance | 1,200 | 100 | 1,100 | |||

COGS | 3,500 | 3,500 | ||||

Rent | 3,300 | 3,300 | ||||

Insurance | – | – | 100 | 100 | ||

Payroll | – | – | 5,000 | 5,000 | ||

Other expenses | 4,000 | 4,000 | ||||

Total | 48,500 | 48,500 | 5,100 | 5,100 | 53,500 | 53,500 |

As we can see it is not enough just accurately record all transactions which occurred during the period.

It’s also important to recognise revenue accurately and allocate costs to the period they refer to. Only then will we be able to generate really informative reports we can rely on while making decisions.

So the purpose of the adjusted trial balance is to ensure the debits and credits are equal once the adjusting entries were entered. It is also the basis for preparing financial statements.

Post Closing Trial Balance

A post closing trial balance is the final trial balance before the period is closed. As you already know, the adjusting entries are reflected in the adjusted trial balance. However, we still need to do a few closing entries before running the post closing trial balance.

The post closing balance doesn’t include revenue and expense (Profit & Loss) accounts. In accounting, they are called temporary and must be closed at the end of the period.

Profit & Loss accounts are temporary, while Balance Sheet’s accounts are permanent.

Here is the post closing trial balance created based on our previous example.

Account | Debit | Credit |

Cash | 22,000 | |

Accounts receivable | 5,000 | |

Inventory | 9,500 | |

Accounts Payable | 20,000 | |

Accruals | 10,500 | |

Equity | 7,100 | |

Prepaid insurance | 1,100 | |

Total | 37,600 | 37,600 |

As you can see there are no revenue nor expenses accounts in our example. They were closed. We calculated the net income and transferred the result to the equity account.

If you want to get more information on closing entries go here.

A post closing trial balance is a report that is created to verify that all temporary accounts have been closed and their balance reset to zero.

If you’re using accounting software almost all of this work is completed automatically. However, if you record accounting transactions manually to the spreadsheet, you’ll need to make sure that your temporary account balances are reset to zero to begin the new accounting period.

We hope that this article helped you to get a better understanding of the essence and purpose of trial balance. Let us know about your questions in the comments below.