Are you a VAT-registered business that needs to start E-filing VAT returns with HMRC? Do you need some advice on how to choose a software to deal with the VAT return before the deadline? We at What A Figure Accounting use Xero and recommend it for VAT processing & filing for small and medium-sized businesses. Let us explain why.

Xero features

Xero is a flexible software that might be a good bookkeeping & accounting solution for small and medium-sized businesses.

It provides an automatic VAT calculation based on the uploaded invoices & transactions during the VAT period. It creates automated VAT returns as well, which then should be filed with HMRC before the VAT return deadline.

If your VAT return is due on a monthly or quarterly basis, then your VAT return deadline is one month and 7 days after the VAT period. Eg, if your VAT period ended on the 31st of October, then your VAT return deadline is the 7th of December. It works similarly for both submitting and payment itself.

Xero knows it so you can check your account’s relevant section at any time to ensure you’re up to date with VAT returns.

How to file the VAT return in Xero?

Xero works similarly to the rest of the accounting software solutions to directly file your VAT return with HMRC. It means you don’t have to manually upload your VAT figures in HMRC’s online services.

So using Xero might save a lot of time for you.

Your Xero account is ready to use after setting up your accounting system and putting the processes and procedures in place. The better your Xero account is set up, the easier is the process of VAT processing & filing.

It works almost totally automatically, so your only task is to thoroughly check the VAT return before filing (and make corrections if needed).

Types of VAT returns in Xero

It’s important to know that there are two types of VAT returns available in Xero:

- MTD for VAT (we’ll explain it below),

- non-MTD for VAT.

If you’re not registered for Making Tax Digital for VAT, you can use an older version of VAT return in Xero or the flat rate VAT return.

For more information on this see our blog post.

Submitting the VAT from Xero: how it works?

You can start submitting the VAT returns after setting up your Xero account and connecting it to HMRC.

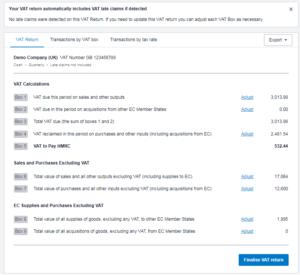

Technically it only requires logging into your Xero account and clicking on “Accounting > VAT return”. Then you’ll see all of the relevant info on your filed and pending VAT returns as well as the VAT return deadline.

So click on the needed return and see the amount of VAT payable to HMRC. Xero calculates this amount as the difference between lines 3 and 4 of your VAT return.

Your VAT return includes the info on the EC supplies and purchases as well. However, if you have these amounts filled in Xero (boxes 8 and 9), you’ll need to submit them separately in the form of an EC Sales List as well.

EC Sales List is a report that has to be sent to HMRC by the company that sells its goods or services to the EU customers.

Late claims in Xero

An excellent feature of Xero for VAT return submitting are the ‘late claims’. It lets you easily account for the changes made for the previous (already filed) VAT periods.

Eg, you’re on the accrual VAT scheme and your last VAT return for the October-December period is already submitted. However, soon after you receive a big VAT invoice from your supplier that has been issued in December. You have been missing it in Xero, so you upload it under with the correct December date. What you’ll see?

- If you have late claims included, this supplier’s invoice will be shown on the next VAT return (for January-March) in the late claims section. So this will reduce your VAT liability automatically in the next VAT period.

- If you have no late claims included, this supplier’s invoice won’t be shown on the next VAT return.

You’ll have to additionally upload a manual journal to move the VAT liability to the January-March period (if you want to reduce your VAT liability of course). Or just ask your bookkeeper to do it for you.

Another way to manually include any changes in VAT amounts is to make adjustments before filing the next VAT return. However, we highly recommend you to leave this to your bookkeeper unless you have a background in accounting.

We at What a Figure Accounting are ready to help you with this.

Please note: in case of MTD for VAT, Xero automatically includes the late claims in your VAT returns.

The dates your amounts are shown on the VAT return depend on the VAT scheme you choose. You can choose either cash or accrual VAT scheme (see more details on this here).

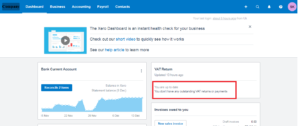

How to add VAT information on the Xero dashboard?

There is a suitable option to add the information on your pending VAT returns on the Xero dashboard. This will help you to stay on top of your VAT return deadline and payments.

It works as a good reminder, so you don’t need to always keep it in your mind.

If you want to see relevant VAT information on your Xero dashboard, just go to your VAT dashboard and click on “View summary on dashboard”.

Important: this option is only available for the companies who switched to MTD for VAT.

P.S. On the whole, it’s easy to customize a Xero dashboard. You can easily set it up the way you like it (and show or hide information based on what is important to you).

What should you check before filling the VAT return?

Before filing the VAT return please make sure you have all the necessary invoices uploaded (if you’re on the accrual scheme) and bank transactions reconciled (if you’re on the cash scheme).

This way you’ll be sure the information you have on your VAT return is up to date.

Also, Xero provides an interesting option of asking your adviser to review the VAT audit report before submitting it. For that, click on the VAT return (it should have a Draft status) and then click on “Ask your adviser to review this return”.

That’s also useful to pull a General Ledger report. If there are any transactions on the “Exceptions tab”, they should be checked.

VAT audit report

Xero creates the VAT return automatically based on the invoices, transactions, and manual journals uploaded during the VAT period. That’s true.

However, before filing the VAT return, a good bookkeeper would always check the amounts included in the VAT audit report. We highly recommend it to you as well.

There are a few reasons for it:

- You might make a mistake while uploading an invoice or transaction.

- There should be proper documentation attached in Xero.

Mistakes

Firstly, you and your bookkeeper are both humans who might make mistakes. Especially when Xero suggests you something automatically.

Some mistakes have smaller effects on the VAT return. Eg, if you put NO VAT instead of zero-rated VAT rate. So it doesn’t influence your VAT liability, but you still have to upload it under the correct tax rate.

However, some mistakes do affect your VAT payable to HMRC.

Eg, you can see an invoice in Xero’s VAT return and you’re totally sure there should be VAT on it. However, it is shown under the zero-rated section on the VAT audit report.

This would be a good reason to check this transaction.

On the other hand, sometimes you can put a purchase chart of account on the sales invoices.

This is totally wrong because it causes a purchase VAT rate as well. And this is a point for your bookkeeper to check it and make appropriate changes.

The conclusion is that it’s better for you to ask a good bookkeeper to see your VAT audit report before you submit it. It usually saves you both time and money.

Proper documentation

There are few alternative ways you can prove the VAT on your purchases, but the most common and important is a VAT invoice.

It should have the date of issue, the invoice number, the issuer’s VAT number, and some other details on it.

All of the VAT transactions on your VAT audit report must be accompanied by the proper documentation. Always double-check this for the 10 biggest bills. This is an unwritten rule for a bookkeeper. Doing it as a routine will help you a lot in the case of an audit.

How to move your Xero account to MTD for VAT?

Before you start

All VAT-registered businesses that reached the taxable turnover limit must sign up for “Making Tax Digital for VAT” and follow specific rules.

You can check this paper to see more info on VAT registration & MTD obligations.

Before moving to MTD, you need to choose a compatible software like Xero. Amazing if you already have it.

That’s not a super difficult procedure of signing up for MTD, you’ll just need to upload the relevant info about your business.

Here is the link to Sign up for MTD for VAT with HMRC.

Then you should receive a confirmation of signing up from HMRC in 72 hours.

Most likely it will go to the spam folder, so you just need to keep your eyes open on this.

What to do while you’re waiting?

Please notice that you shouldn’t submit any VAT returns before you receive the confirmation.

Also, it’s important not to sign up for MTD too close to the VAT return deadline if you pay by Direct Debit. Because in this case, Direct Debit might charge you twice. Do it at least 7 days before the deadline.

Once you received a confirmation, you can then connect Xero to HMRC and start using a new MTD system for VAT return submissions.

What about a VAT online account?

After moving to MTD, you will still be able to use your VAT online account.

However, you will be able to only view VAT return deadlines and completed VAT returns, manage payments, or print VAT certificates there. Instead, you won’t be able to submit the unfiled VAT return there.

What happens if a VAT return is not filed?

Usually, after you file the VAT return, it has a status “pending” for some time, and then it changes to “filed”. It means you’ve been successful in submitting the return.

However, it might happen that your return isn’t filed. Eg, someone else has already submitted it before you did.

In this case, Xero sends an email to you explaining if there is any problem with the VAT return.

Xero sends it to the Xero login email address of a user who tried to file the VAT return.

How to use Xero as bridging software to file MTD VAT returns?

If you have to move to MTD for VAT, but you also have some reasons not to use compatible software to submit the MTD VAT returns, then there is an option of using a bridging software for it. This is one of the basic MTD requirements/options.

Xero supports this option as well.

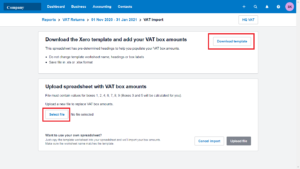

So using Xero as bridging software means importing a spreadsheet with VAT boxes amounts to Xero. (For that, you’ll need to download a VAT template file in your Xero account and fill it with your details).

And then you’ll be able to submit the VAT return via MTD from Xero*.

*For that, you’ll need a Xero pricing plan that includes VAT to submit MTD VAT returns.

We hope this paper answered your questions on filing VAT returns in Xero.

If you still have any questions on this, feel free to contact us at What A Figure Accounting.