Summary: Sometimes your accounting looks like it doesn’t agree, but in fact, you might just need to change from accruals to cash basis. In other times using cash vs. accrual accounting could have an impact on the taxes you pay – and could tremendously help your cash flow. At What a Figure! Accounting, will explain the differences and which one to use, when.

What is cash basis accounting?

The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid.

On the other hand, accrual basis accounting recognizes revenues when they are earned.

Example:

For easier understanding, let us explain it with an example:

Companies usually issue invoices to their clients that need to be paid within 30 days – sometimes even longer.

For example:

Invoice issue date: 31st January to be paid in 30 days

Client paid: 1st April (very late).

In the above example, if the company accounts for it on an:

Accrual basis: will recognize the revenue in January (invoice date: 31st Jan)

Cash basis: will recognize the revenue in April (payment date: 1st April)

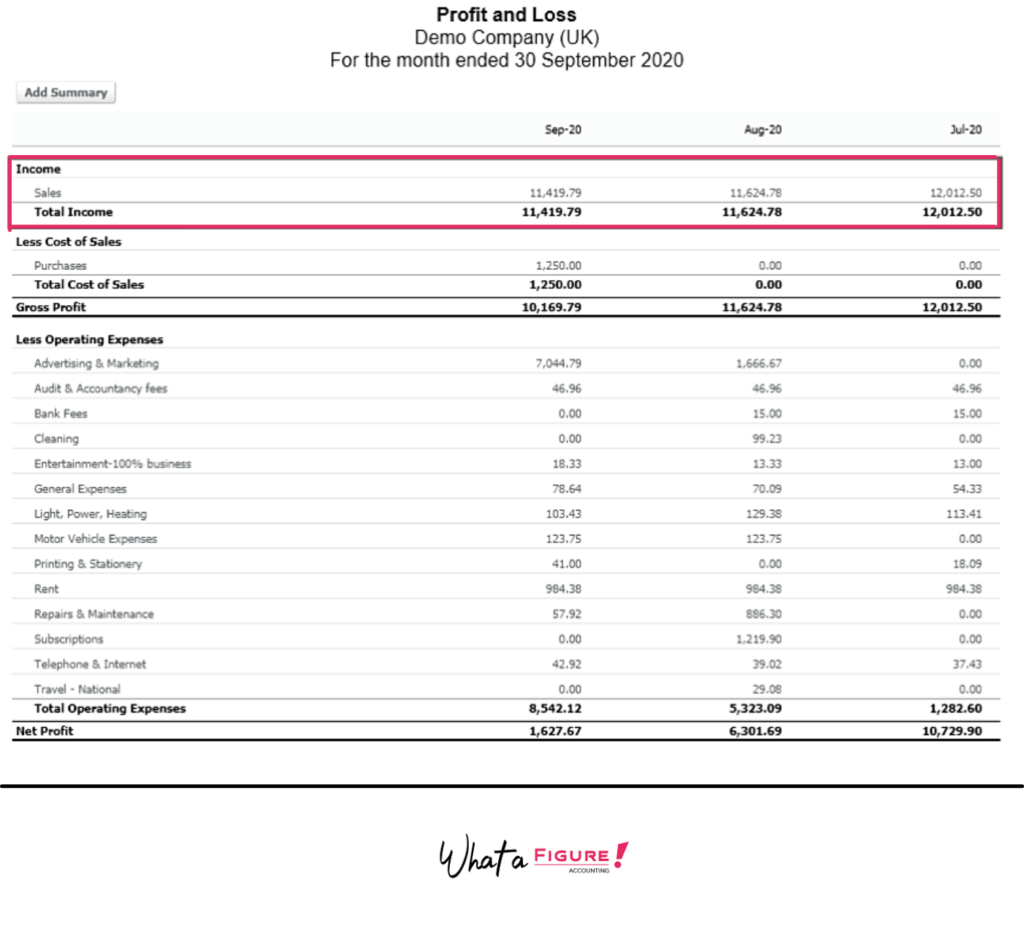

How does cash vs. accrual accounting affect your P&L?

Based on our example above, you can tell that on the Profit & Loss statement, if the company accounted for the invoice on an accruals basis, it would have shown in January vs. on a cash-basis, it would have shown in March.

Why is this important?

Every company should review their P&L (or also called Income Statement) to keep an eye on their performance. To be able to see progress, it should always be compared to a previous period. Either to a previous month, quarter, or year.

If the accounting is done on an accrual basis, the P&L statement will be more ‘stable’ every month as it depends on your company’s efforts (and dates you issue your invoices). Hopefully, you will even see an improvement.

See image below:

All July, August and September show a similar amount in sales on an accrual basis, BUT most of July’s and August’s invoices haven’t been paid yet! They were paid in September.

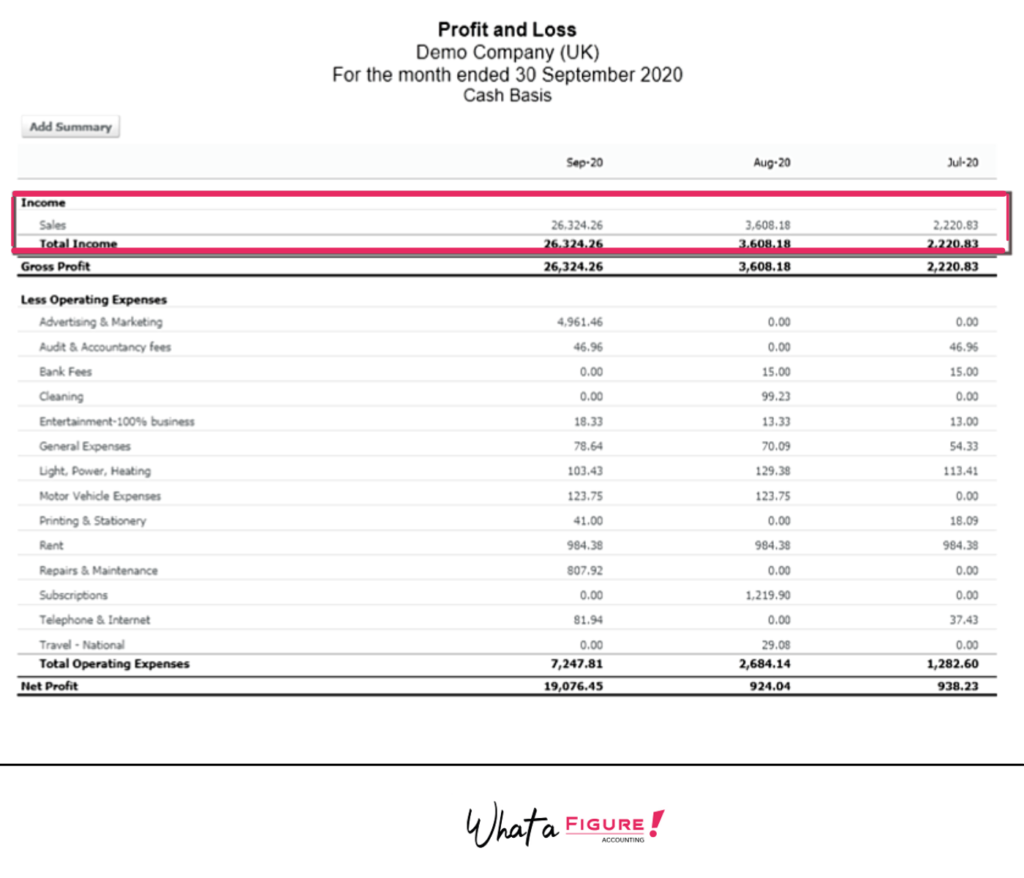

However, if you look at the SAME P&L on a cash-basis, you will instantly see a huge difference in Sales. This is because (as mentioned above) July’s and August invoices were paid in September. This is reflected on the below report.

Is your P&L mixed on cash vs. accrual accounting basis?

Most of the time yes – and we will explain why this is.

Sales invoices: most companies raise sales invoices in their accounting software, so this will be (as a standard) on an accrual basis. You will then have the option to view them on a cash basis.

Purchase bills / expenses: this is where the ‘mix’ can happen. It is because you will receive bills from most of your suppliers (where the invoice date and the payment date will differ). However, you might not receive bills from some. The majority of these will have an invoice date that is very close to its payment date. For example, bank fees. They will be deducted from your bank account, but you might not receive bills for them. In this case, they will be reconciled on a cash-basis (when the payment came out of your bank account).

Therefore, when it comes to purchases, you will have some payments which are reconciled on a cash-basis. However as their invoice date is so close to their payment date, most often, you would end up with a very similar P&L report as if they were accounted for on an accrual basis. Therefore pulling your report on an accrual basis, will be very accurate (even with the occasional transactions that were reconciled on a cash-basis).

The big difference when it comes to cash vs. accrual accounting reports, it is usually shown on the sales side – if your clients pay very late (assuming you pay your bills on time).

Cash vs. accrual accounting’s implication on your taxes

Year-end accounts and VAT returns should be done and submitted on an accrual basis (as standard). However, for small sole-traders or small businesses, there is some allowance to do it on a cash basis. To look at the eligibility requirements in the UK, please refer to the links below:

Year-end accounts: eligibility

VAT return: eligibility

Most accountancy firms will do your accounts on an accrual basis as that is the long term requirement if your business grows. Also switching between the two can come with a lot of admin work if your accounting software doesn’t handle it well. However, for cash flow purposes cash basis accounting can be much better and we often recommend it.

What are the tax and cash flow implications?

If you are a small business with clients paying late (sometimes even months late), then you will have to pay the VAT / tax on these invoices, even if you haven’t received the payment for them yourself! For small companies, this can be a real financial burden. On the other hand, you will be able to claim the VAT on your purchases, even if you haven’t paid those bills yourself.

So let’s look at our above example with the Profit & Loss statement. If your VAT quarter ended in August, you would have to pay the VAT on your July’s and August’s sales (total: £23K) based on accrual accounting. 20% VAT on that is £4,600. Whereas, if you submitted your VAT return on a cash basis, you would only have to pay the VAT on invoices totaling £5.8K. The invoices you actually received payment for in that quarter. The VAT on these is only £1160. Therefore you would keep £3440 until those invoices are paid in the future. This will help your cash flow!

What can you do if you are on an accrual basis with no option for cash-basis?

If your turnover exceeds the eligibility criteria for cash-basis, you won’t have an option, but to submit your taxes on an accrual basis.

The good news is, you still have options!

A solution for this is to issue ‘Pro-forma’ invoices to your clients, instead of actual invoices. The difference between the two is, that a Pro-forma invoice is a request for payment. This invoices does not count as a VAT invoice. It works more like a quote to be paid for. Therefore, it won’t be included in your VAT return. Once you receive a payment for your Pro-forma invoice, you will then issue the actual invoice.

We hope the above article on cash vs. accrual accounting helped you understand the differences and its tax implications. If you have any questions on this let us know in the comments below!