Summary

Have you registered your business for VAT – and thought the difficult part was over? Let us at What a Figure! Accounting show you how and when to file a VAT return And explain when you need to register.

Which businesses should file a VAT return in the UK?

Business’ VAT registration obligation depends on an annual turnover.

Businesses’ annual turnover is calculated for the rolling 12-month period, but not just for a current tax year.

The businesses that have an annual turnover of more than the VAT threshold, must register for VAT. Please notice that the VAT threshold can change from year to year.

However, there are different thresholds for buying and selling from EU countries.

As for business’ annual turnover, it is calculated based on one’s taxable sales and supplies. So it doesn’t include VAT exempt sales & supplies.

Only VAT registered businesses should file VAT returns with HMRC in the UK.

From the effective VAT registration date, you have to charge VAT on your sales, keep VAT records and submit the VAT returns regularly showing VAT due to HMRC (which should be paid afterwards).

If you’re not a VAT registered business – then you don’t need to worry about any VAT returns and filings.

Who can file the VAT return?

You can choose whether you would like to file your VAT returns yourself or you would like your tax agent to do it on your behalf at your discretion.

There are some factors that can affect your decision like the size of business and annual turnover, knowledge of VAT requirements, variety of goods sold & services provided, availability of import/export operations, etc.

If your business has any complicated parts or there is something you’re not sure about, we highly recommend you to involve a professional VAT consultant.

You can authorise them to be your tax agent – you’ll need to authorise them via your HMRC online account and then he’ll be able to file VAT returns on your behalf.

If you file VAT returns via MTD for VAT – you’ll have to create a special agent services account for your tax agent.

Benefits Of Hiring A Tax Agent

You might see a higher amount of VAT reclaimed on purchases and other inputs after hiring a good tax agent (bookkeeper or accountant).

Experienced tax agents know which transactions might have VAT on, so they will request receiving related invoices and this will save your pounds on the next VAT return.

On the other hand, they will save your time on looking for the invoices that don’t have VAT on and on filing VAT return itself.

Also, it is necessary to keep up to date about VAT requirements and changes.

It makes it less effective for entrepreneurs to process the VAT themselves. The time they spend on the VAT ‘maze’ might be used much more efficiently if they spend it on business development.

We at What a Figure Accounting have a team of professional bookkeepers who can help you with VAT recording and filing. Furthermore, with professional reporting, allowing you to better understand how your business is performing.

Find out what a bookkeeper does and how to find a good one here.

How often should the VAT return be filed?

Most businesses should file their VAT returns on a quarterly basis, so every 3 months. The rolling period is individual for each business. This period of time is called the “accounting period”.

For the businesses that pay VAT on a quarterly basis, the deadline for VAT filing and paying is 1 calendar month and 7 days after the last day of a VAT quarter.

Eg, if your VAT quarter ended 31st October, you have to file your VAT return on or before 7th December. Then the VAT amount due should be paid to HMRC by the same deadline.

VAT Annual Accounting Scheme

If your business is on the VAT Annual Accounting Scheme, it means you have to submit your VAT returns and pay the VAT due on an annual basis.

In this case, you have to pay VAT to HMRC in advance based on the amounts on the previous VAT return. When you file the latest VAT return, the difference should be paid to HMRC or claimed back to you.

You can join the scheme if your annual taxable turnover falls within the specified limits.

However, this scheme won’t be the most suitable for you if you regularly have a VAT refund. In that case, you are better off on a quarterly basis for cash flow purposes.

What happens if you don’t file the VAT return on time?

If you don’t file the VAT return on time or HMRC doesn’t receive the full payment of your VAT due on time – then HMRC records a “default”. It means you’ll probably have to make an extra payment (a “surcharge”) on top of the VAT you owe.

So if you’re aware you haven’t filed your VAT return on time or you haven’t paid the VAT due on time in the past – you have to do it ASAP the way you would normally do it.

HMRC tends to forgive 1 default within a 12 months period.

HMRC’s Surcharges

Your surcharge is calculated based on the percentage of your VAT amount due (as for the deadline).

This percentage rate increases every time you default again during the surcharge period (12 months).

You won’t pay any surcharge for the first time you default. As for the next times, the percentage rate is applicable in accordance with the data.

If you filed a VAT return after the deadline, but it shows a VAT repayment or a nil VAT due, you won’t have to pay a surcharge. You also won’t need to pay a surcharge if you file the VAT return after the deadline, but the VAT itself was fully paid on time.

HMRC will inform you and explain if any surcharge is applied to you. HMRC will also let you know what happens if you default next time. So there shouldn’t be any surprises for you in that respect.

Where to file the VAT return?

Nowadays, most businesses have to file their VAT returns online.

HMRC can charge a penalty of £400 in case you violate this requirement by submitting a paper VAT return.

However, there are few exceptions from filing VAT returns online for:

- insolvent businesses,

- ones who can’t use computers because of religious beliefs,

- ones who can’t do it online because of personal reasons (like age or lack of internet connection etc.).

In the other cases, you’ll have to submit the VAT return online via HMRC’s free online service (business’ online account) or a MTD-compatible software.

From the 1st April 2019, if you exceed the VAT threshold you have to use MTD-compatible software for processing the VAT. This software will keep the VAT records for you as well as file the VAT return directly to HMRC. This will also help you stay on top of business record keeping.

However, once you’re registered for MTD for VAT, you won’t be able to file the VAT return via your online account on the HMRC site. You’ll have to do it via MTD-compatible software.

How to file the VAT return?

When you register for VAT, you receive a VAT number and a Government Gateway user ID and password. You’ll use these to log in to your account on the HMRC site.

Once you log in to your online account, you can submit the VAT return. You can do it by manually uploading the amounts under 9 boxes:

1. VAT due in the period on sales and other outputs.

2. The VAT due in the period on acquisitions from EU member states.

3. Total VAT due (sum of boxes 1 and 2).

4. VAT reclaimed in the period on purchases and other inputs (including acquisitions from the EU).

5. Net VAT to pay to HMRC or reclaim (the difference between boxes 3 and 4).

6. Total value of sales and all other outputs excluding any VAT.

7. The total value of purchases and all other inputs excluding any VAT.

8. Total value of all supplies of goods and related costs, excluding any VAT, to EU member states.

9. Total value of all acquisitions of goods and related costs, excluding any VAT, from EU member states.

Box 5 shows the amount you should pay to HMRC or claim back. You claim back the VAT if you had lots of expenses and few sales during the VAT period.

There is guidance on “How to fill in and submit your VAT Return (VAT Notice 700/12)”.

Making Tax Digital for VAT

Another way to file your VAT return online is Making Tax Digital for VAT, which can be implemented via 2 options:

– a compatible software that provides keeping digital accounting records so you can generate the VAT return from the software and file the return directly from the software. That works easily because if you keep your accounts in accurate order, the VAT return filing won’t cause any difficulty for you. It’s because the software will fill in the form to be sent to HMRC automatically. So there is no way to make an error when calculating anything manually and copying the amounts to the VAT return (like you can do when filling the return manually). You’ll just have to double check it before filing it, in case you see something strange or suspicious;

– bridging software to connect non-compatible software (in the form of spreadsheets) to HMRC systems.

HMRC provides you with the list of compatible softwares that is available here.

Our Recommendations For Using MTD-Compatible Software

We at What a Figure Accounting recommend Xero. It’s flexible and well-customized software that proved to be a good solution for small businesses. Also, it is suitable for both businesses and agents.

What is the difference between cash and accrual VAT schemes?

When you calculate your VAT, it’s important to understand the difference between cash and accrual VAT schemes and how it affects your VAT boxes.

The cash scheme means your transactions will be reflected on the VAT return based on the payment date.

The accrual scheme means your transactions will be reflected on the VAT return based on the invoice date.

Eg, if your VAT quarter ended 31st October, and you received a big VAT invoice dated 20th October, which was paid on the 10th November, you’ll see this invoice included in the VAT quarter ended 31st October – if you’re on the accrual scheme. And in the VAT quarter ended 31st January – if you’re on the cash scheme.

Here is a detailed explanation of this.

How To Change The VAT Scheme?

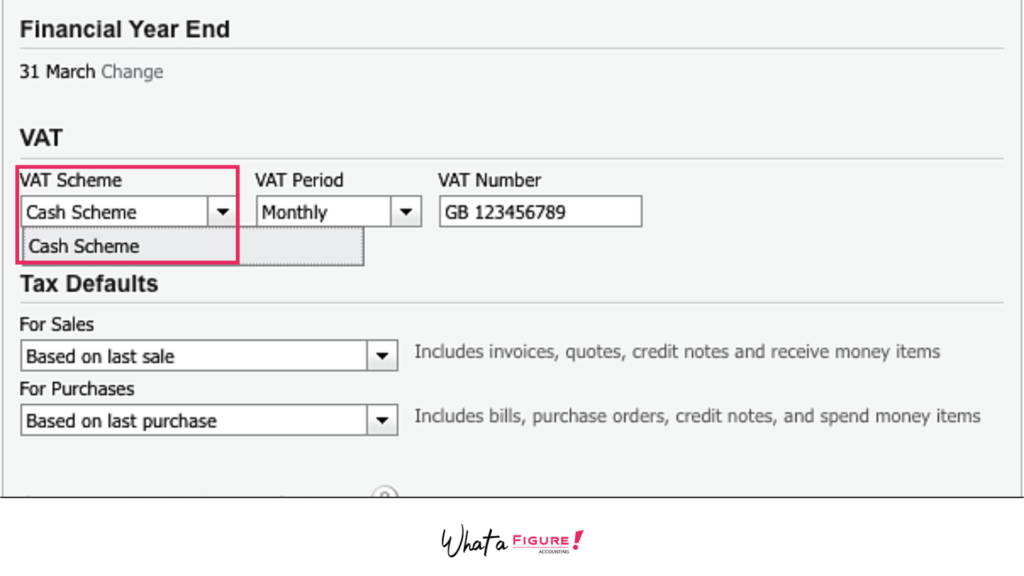

In Xero, you can change the VAT scheme in your financial settings. However, before doing it you have to file all of the VAT returns that fall in the periods before the date of changing the VAT scheme.

After changing the VAT scheme all the adjustments have to be done using VAT box adjustments. These adjustments should get away duplicates and missing transactions in the VAT returns.

If your VAT return is nil

If your VAT return is nil, you still have to file it as you would normally do showing zeros on your VAT form.

Sending VAT returns to HMRC is the only way for you to show you don’t owe anything.

Otherwise, HMRC records a default because you violate the requirements for VAT returns filing.

We hope that the above article on VAT return filing was useful for you. If you have any questions on this let us know in the comments below.