What is the Statement of Owner’s Equity? The Full Guide with Examples!

Statement of Owner’s Equity is one of the most important financial reports alongside the Balance Sheet and Profit and Loss.

At What a Figure! Accounting we will cover all you need to know about this financial statement:

- What is the owner’s equity?

- How to prepare and analyze the Statement of Owner’s Equity?

- How is it connected with other financial reports?

Let’s dive into these questions!

What is Owner’s Equity?

You may come across with the following statement: “Owner’s equity is assets that can be claimed by the owners”. This is the most common definition. What does it mean?Imagine the situation when the company has settled ALL liabilities and nothing is left outstanding to anyone. In this situation, your remaining assets (or net assets) are equal to your equity.

(If you are not familiar with these, check out our article explaining: ‘How to read a Balance Sheet‘).

If you liquidate the company the value of those assets will be what is left in your pocket. This is your owner’s equity.

Owner’s equity can be either negative or positive. Negative shareholders’ equity can occur when a company’s liabilities exceed its assets. For example, if a company has $100 in assets and $100 in liabilities, its shareholders’ equity is zero. Positive shareholders’ equity can occur when a company acquires more assets than it has liabilities. For example, if a company has $100 in liabilities and $200 in assets, its shareholders’ equity equals $100.

However, it’s quite a simple example. If you are not the only owner and have partners and investors the picture becomes more complicated.

For example, two people join to form a limited company. Each puts in $50,000, so the opening balance for each owner’s equity account is $50k. They are 50% owners (as their contributions are equal) and they will distribute profits and losses using this percentage.

So, the share in the capital is determined by the contributions of each partner (owner). If the company issues shares, the equity is structured depending on how many shares each owner has.

The Owner’s Equity is one of the elements of the Balance Sheet. However, only the Statement of Owner’s equity gives a detailed breakdown of how (and from what sources) your capital is made of over the analyzed period.

That’s why this report may also refer to as a statement of changes in equity. It helps to identify the factors that caused these changes in the owners’ equity over the particular period. Furthermore, it gives detailed information that is not presented separately elsewhere in the financial statements.

You need to understand the elements of this statement first. Only then you will be able to efficiently analyze it to get the most out of it.

The Components of the Statement of Owner’s Equity

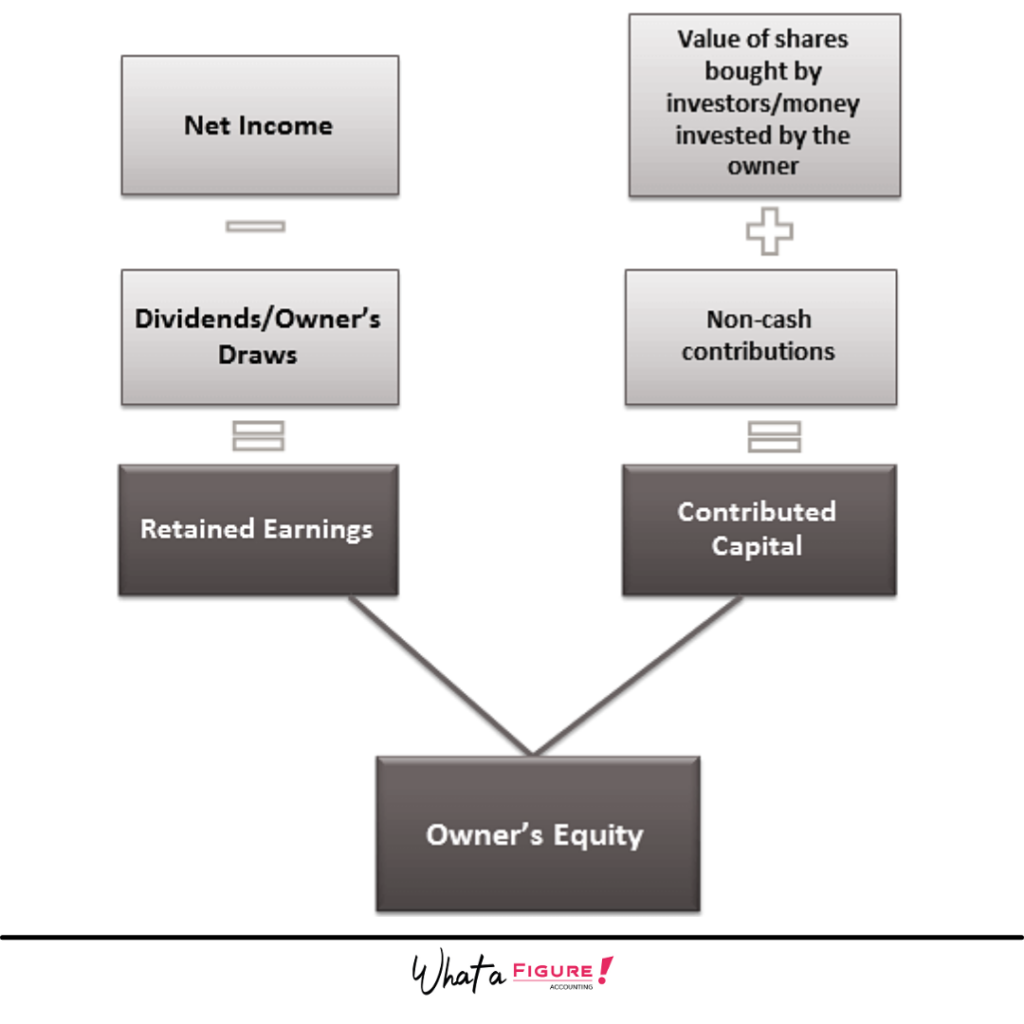

The structure of the Owner’s Equity is shown below:

Contributed Capital (also known as Paid in Capital). When you start a business, you will almost certainly have to put in money to get it started. This money is your initial capital contribution.

You can also fuel up your business with additional funds whenever you think it is necessary. All these fundings will be shown in your statement of owner’s equity.

For limited companies and corporations the contributed capital is associated with the value paid by investors for shares issued by the company. It is not relevant for small e-commerce businesses (who are usually sole traders) so we won’t be reviewing it closely. However, if you are interested in, read this section on Investopedia: Contributed capital.

It’s important to understand that capital contributions can come in other forms besides the sale of equity shares and direct cash injections. Businesses can also receive capital contributions in the form of non-cash assets. You can contribute other assets, like a computer, some equipment, or a vehicle that will be owned by the business.

Net income is a company’s earnings after deducting COGS, operating expenses, and taxes. Net income is a popular way to measure a company’s financial performance. However, it only tells a small piece of the story. Bear in mind that not the full amount of the net income would be reinvested in the business. We need to take into account the owner’s withdrawals.

Owner’s Withdrawals is an amount of money taken out from a business by the owner (in sole proprietorship or partnership). It is the same thing as dividends (which is the common term for companies).

The transfer of cash to an investor in a corporation would require a dividend payment. However, the essence remains the same: both dividends and withdrawals are financed from the net income.

If we deduct the owner’s withdrawals from the net income we get retained earnings.

Retained earnings, sometimes called accumulated earnings or undistributed profits, are the amount of profit a company has earned but not distributed to its shareholders. These are earnings that have been reinvested in the business. These are considered owned by the shareholders and are a valuable source of future growth.

Retained earnings could be also called reinvested income.

As you’ve seen in the picture in the beginning, the sum of retained earnings and contributed capital equal owner’s equity.

Examples of the Statement of Owner’s Equity

Example A

Let’s assume that the company has an opening balance of owner’s equity of $4k as of 1st January. Now the company raised money from shares issued worth $2k. Also, during the year, the company recorded a net loss of -$1k. The company’s Statement of Owner’s Equity should look as follows as of 31st December :

Opening Balance of Owner’s Equity | $4,000 |

Contributed Capital | $2,000 |

Net Loss | -$1,000 |

Ending Balance of Owner’s Equity | $5,000 |

As you can see the capital has increased at the end of the year, despite the business not operating well. It didn’t make any profit.

In fact it lost money.

Example B

In our second scenario the company had the same opening balance of equity, but there were no additional contributions. The net income totaled $2k, owner’s withdrawals – $1k. As a result, the Statement of Owner’s Equity was as follows:

Opening Balance of Owner’s Equity | $4,000 |

Contributed Capital | – |

Net Income | $2,000 |

Owner’s Withdrawals | -$1000 |

Ending Balance of Owner’s Equity | $5,000 |

In both examples, the ending balance of the company’s equity is the same. However, in example B the company was profitable and was able to reinvest the part of its earnings.

Shareholder equity alone is not an exact indicator of a company’s financial health. It is always better to analyze its structure.

The situation when the company has a higher portion of paid-in capital means that its funding comes mainly from investment. Whereas the company with a higher portion of retained earnings means it is making a profit and operates on these earnings.

The Connection Between Financial Statements

We can also describe the Statement of Owner’s Equity as a connecting link between the Income Statement and the Balance Sheet.

This connection is illustrated in the picture below:

As you can see we can’t prepare the Statement of Owner’s Equity without P&L. It is impossible to do it without knowing the net income figure.

Only when P&L and Statement of Owner’s Equity are both ready we can start our work on the Balance Sheet. The ending balance on the Statement of Owner’s equity will be used to report the owner’s equity on the Balance Sheet.

The Statement of Owner’s Equity is crucial because it provides owners with financial information to make important business decisions. It can also give the opening balance of the owner’s equity, explanations for increases and decreases during the accounting period, and the closing balance.

Essentially, this report shows how much capital the business owner accumulated at a particular point in time.

We hope that the above article helped you understand the statement of the owner’s equity and how to analyze it. Let us know your questions and suggestions in the comments below.