Summary: Learn everything about credit note: what it is, how to create one and how it can even help you claim taxes back. At What a Figure! Accounting, we will cover it all.

Credit Note

A credit note is a letter sent by the supplier to the customer notifying the customer that he or she has been credited a certain amount due to an error in the original invoice or other reasons. A credit note is also known as a credit memo, which is short for “credit memorandum.” (Invoiceberry)

Why is a credit note issued?

They could be issued for several reasons:

- A customer was charged the wrong amount previously

- A customer is due a refund (eg. returned goods)

- A customer overpaid their original invoice

If the customer still has an outstanding unpaid invoice, this credit note will be allocated to it, to reduce the outstanding balance.

If the customer has paid everything, then they will receive a refund.

Therefore a credit note could mean just a reduction in the amount due (on the original sales invoice) or actual money paid back to the customer.

How to issue a credit note?

Please see the screenshots below on how to issue a credit note in Xero (our favourite accounting software). If you are using another one, usually the steps should be fairly similar.

Before we start, we want to highlight, that you could have two types of credit notes on your system:

Sales credit note, is issed by you (the seller to your customers)

Whereas purchase credit notes, are issued by your supplier to you, to reduce the amount you need to pay them.

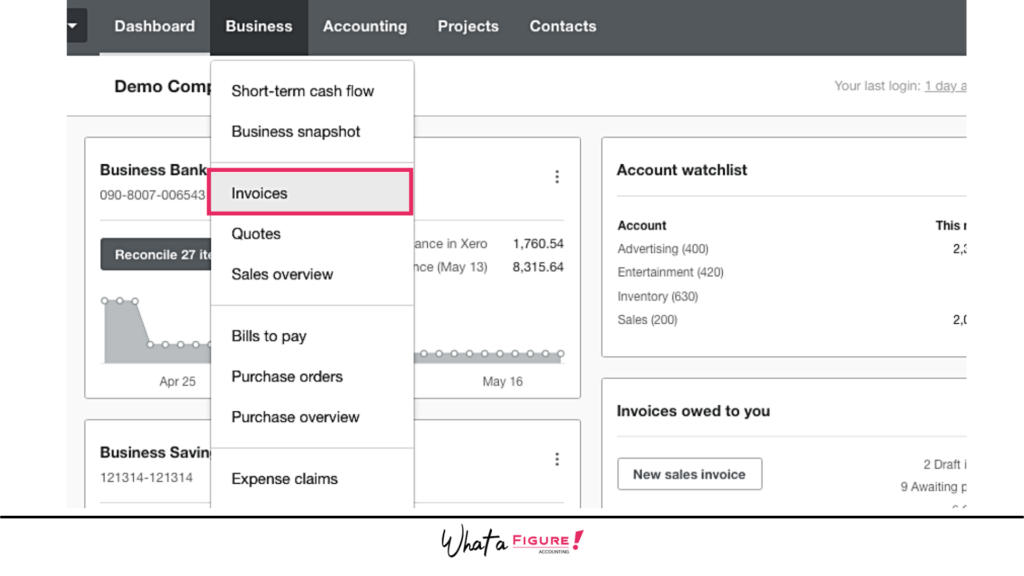

To issue a sales credit note in Xero, go Business > Invoices

(if you are looking to upload a purchase credit note, go to: Business > Purchase Bills)

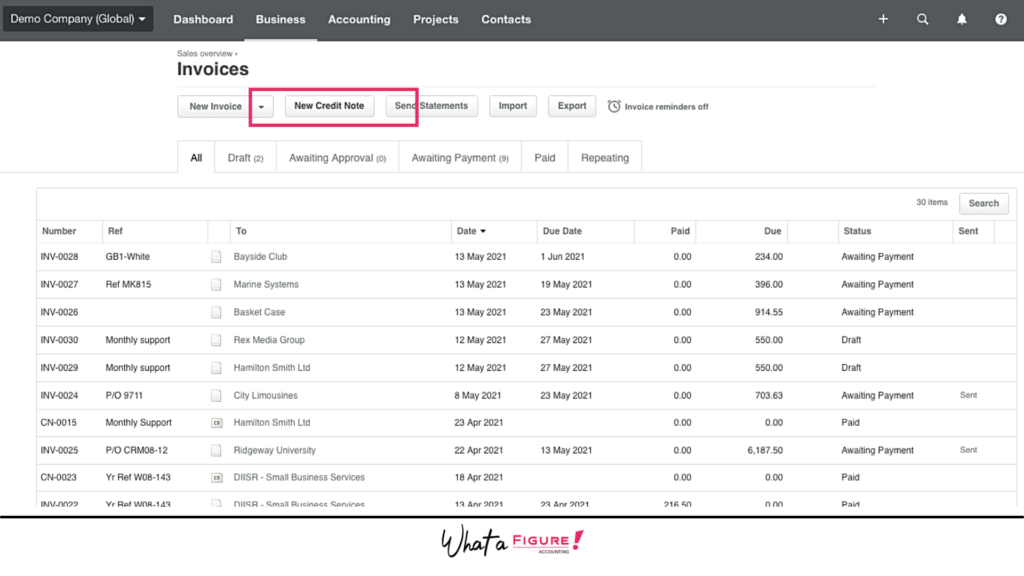

Then go to: New Credit Note

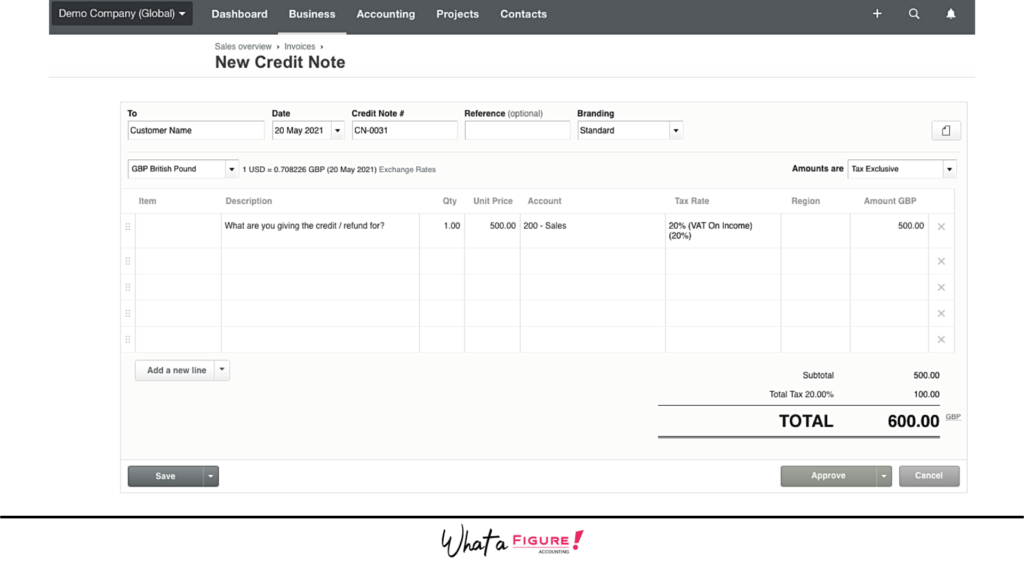

Then as a last step, enter the details, just like you would by issuing a sales invoice to your customer.

One thing to pay attention to is to use the same chart of account (eg. Sales) as you did when you issued the original invoice. This will ensure that your Profit & Loss is correct and your sales will be reduced.

Make sure to also use the same tax rate (eg. 20% VAT).

Once you are ready, you can approve it and send it to your customer.

Credit notes can reduce your tax bill

Many companies have outstanding sales invoices sometimes dating back to even years.

If your company is one of them, and you are registered for VAT (and submit your VAT on an accrual basis):

Then you paid VAT to HMRC on your sales invoices, but you have never received it from your customers.

If these sales invoices have been outstanding for more than 6 months, then you can write them off as bad debt.

It means that on your next VAT return, you will claim back the VAT you paid to HMRC, but never received it from your customer.

How it can help your cash flow

In extreme cases, they could even save the day.

This happened to a customer we were consulting years ago.

He had a few big clients with big sales invoices and one of them hasn’t paid them for over 6 months. The company had to submit and pay their VAT and they didn’t know how they can even pay their staff salary for the month.

We noticed that they had these big outstanding sales invoices with 20% VAT on them. Their total was £50k + £10k in VAT.

As he confirmed they are bad debt, we issued a credit note and wrote them off. This meant that now, he not only didn’t have to pay any VAT, but instead, he received close to £10,000 back from HMRC. As it was very close to the VAT deadline date, he received this money in days and could pay his staff salary.

We hope this article helped and highlighted the importance of issuing credit notes. If you have any questions, please let us know in the comments below.

Read next: