How to use the Accounts Payable Aging Report? Get the most out of it.

Dealing with overdue bills might seem like a nightmare. However, accounts payable aging report (or simply AP report) can save you from lots of issues associated with managing your payables.

At What a Figure Accounting! we will walk you through the following points:

- What is an AP report and how to create it?

- How the business can benefit from it?

- How to manage your payables efficiently?

Let’s have a closer look at all of these questions.

Accounts Payable Aging Report Definition

First of all, we must understand what accounts payable is.

Accounts payable represents the amounts owned on any given date to suppliers for goods or services that have been delivered but not yet paid.

It is an important source of short-term financing for any company. Basically, it is interest-free. Furthermore, many suppliers offer a discount on the early settlement of an invoice (we will review the discount policy a bit later in this post).

The Accounts Payable aging report is a list of outstanding bills that are categorised based on the time they fall due.

It will show which suppliers you owe to, their current balances, and how long you’ve been owing for each of them.

Accounts payable aging report is critical in a business sense and considered by many to be an essential part of running a business. The report provides a set of valuable information that can help an organisation to adjust to its changing circumstances.

We will review all details in this post. Let’s get through the structure of the report first.

Example of an accounts payable aging report

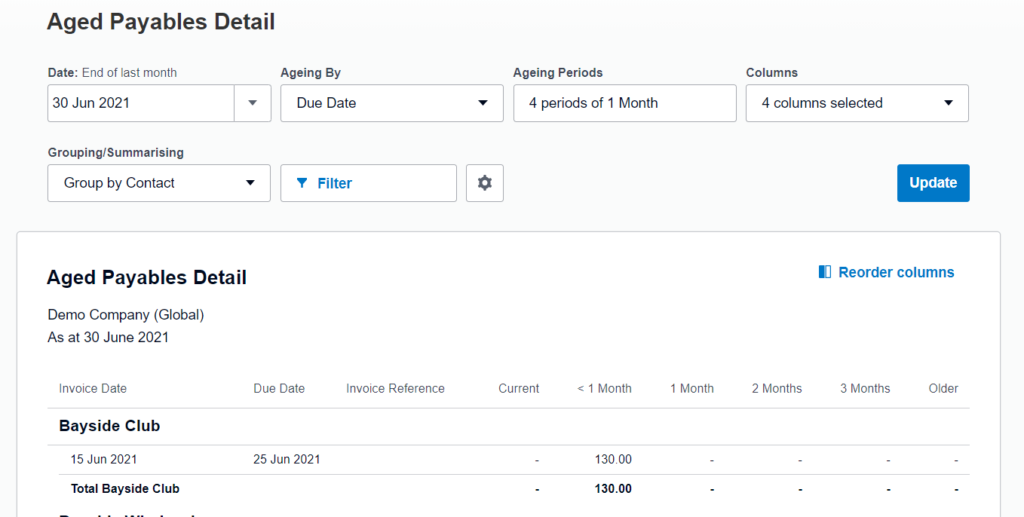

This is a snippet of the Aged Payables report pulled from Xero:

As you can see the layout of the report is pretty simple. The first column indicates the supplier name. In the next columns, you can find the breakdown of the amounts due depending on aging. In our example, the 30-days period was used. However, you can track the information by weeks or any other preferred period.

Xero gives lots of options for customising the report. You can choose aging by invoice date or due date, change aging periods, add any other additional information like invoice numbers, tax information etc. All up to you!

Usually, the Accounts Payable aging report shows totals for each supplier separately and a grand total of all supplier’s balances. So it’s very easy to review your obligations.

Why does the AP aging report matter?

1.) Gives you at-a-glance visibility into your liabilities.

Helps quickly determine the status of the overall accounts payable. As a result, you will get an idea of your upcoming debts and plan your activity more efficiently.

It is important for the purpose of tracking and monitoring funds (whether budgeted or not) and keeping financial records in order.

Secondly, it will help you to maintain a good relationship with suppliers. Agree that forgetting about outstanding bill doesn’t seem professional.

2.) Accounts Payable Reconciliation.

Accounts payable (AP) reconciliation is the process of checking your AP account for any errors or incorrect amounts so that you can amend them. The total amount shown in the AP report should tally up with the Accounts Payable line on the Balance Sheet.

Reviewing the AP report is one of the steps in the accounting cycle. Hence it is an important tool while preparing the core financial statements.

3.) Assists in cashflow forecasting and payables management.

The Accounts Payable aging report helps you to prioritize payments. You can decide which bills should be paid immediately and which can wait a bit longer. This approach helps the company keep enough cash on hand to stay afloat without acquiring more debt. Therefore it is one of the instruments for planning and managing the business cashflow.

In pair with the Aged Receivables report, it is an indispensable source of information for decision making.

Accounts payable management is quite a complex concept and it deserves closer attention. So keep reading 🙂

Payables Management: Useful Strategies

When it comes to paying your suppliers essentially there are two scenarios. You can either pay on the day of the invoice (and possibly get a discount) or delay payment. Choosing the right course of action might not be an easy task. We gathered all useful info on that below.

Delay payments

We are not encouraging you to deceive your suppliers and don’t pay for purchases. Acquiring a bad reputation is definitely not what you are looking for. It can also give your company a bad credit score, which could discourage future suppliers from working with you!

However, negotiating with your vendors may be winning for both of you. The buyer receives goods and allowance to pay later while the seller can attract more customers and expand its market. As an e-сommerce seller, your trade terms with suppliers play a crucial role in your profit margins.

The supplier can allow you to delay the payment which is good for your cash flow. Also, you can agree about to have a trade credit.

Trade credit is a business-to-business agreement in which the buyer can pay in instalments or in extended terms (30, 60, 120 days).

Average Aging Days

Besides others, we need to ensure that our average aged receivables days are lower than our average aged payables days. In short, the AR days is the estimated number of days your customers’ invoices are outstanding, while AP days are the average period you are required to pay suppliers.

So basically it is always better to pay later than receiving your income. You hold cash a bit longer to use it for interest-free short term financing.

Cash Conversion Cycle

The time (in days) that it takes for a company to convert its spending (inventory, other resources) into cash flows from sales is called a cash conversion cycle (CCC). It’s worth mentioning that this ratio is the most efficient for retail companies, including e-commerce sellers. CCC takes into account such factors as inventory, aged receivables and aged payables.

If the cycle is short, that is a good indication that the firm’s cash position is in good shape. If the cycle is longer, the firm is likely losing money because its customers are delaying payment and consequently you can’t meet your obligations.

Take advantage of discount policies

There are lots of companies who offer discounts that are so tempting, but are they worth it? Usually, yes.

Suppose the terms of a supplier invoice are 1/10, net 30. That means the invoice must be paid within 30 days. However, if it is paid within 10 days the vendor gives a 1% discount.

Now, suppose that you don’t have cash available to pay within 10 days. In this case, you will have to use borrowed funds (bank overdraft).

You need to make a choice: use the bank credit and get the discount, or ignore it and save the interest cost you would pay for using the credit. So, we need to decide which option is cheaper.

The cost of not taking the discount is:

(Percentage Discount Allowed / 100% – Percentage discount allowed) x (365 days / Total pay period – Discount period)

So for a 1/10, net 30 invoice, the cost of not taking the discount would be:

= (1% / (100% – 1%)) x (365 / (30 – 10))

= (1 / 99) x (365 / 20)

= 18.43%

Once we calculate this figure, we can compare it with the bank’s interest rate charged.

The lower rate is better for business from a costs point of view.

Let’s say the cost of using overdraft is 10%. That means that in our scenario using bank credit to get a discount is a better option than paying in a 30 days and losing it (because the bank rate of 10% is lower than the calculated cost of not taking the discount of 18.43%).

As an e-commerce seller you can negotiate for other non-price benefits for early payments. For example, some suppliers may provide support for your customers. It may include maintenance, customer care services and after-sales services etc. Or you possibly can get free shipping for early payment.

Here are other important tools to consider for most efficient payables management:

Automatize the process. Even if you are a newcomer it is better to use automation from the early start. First of all, you don’t need to store paper invoices and receipts. Such tools like Dext (formerly Receipt Bank) will help you to keep bills in good order in digital format.

The next step is processing bills. You can rely on online accounting software (eg. Xero, Quickbooks, Sage). It will prevent you from errors and streamline the workflow. Furthermore, most of them suggest a free trial (eg. a 30-days trial in Xero), so you can try it first.

Follow the same routine. The process of managing payables usually includes three main steps:

- preparing the purchase order and sending it to the vendor.

- receiving the goods with shipping slips;

- getting an invoice from the supplier.

This process is called the three-way match process. If we follow it we will prevent ourselves from possible mistakes. As a rule, compare the order with what was actually received and make sure that the receipt documents match with the invoice. Don’t let the payables process get chaotic.

Create budgets and cash reserves. Without a budget to guide your spending and funds on a saving account, you’re likely to be in the red. The cash reserve must be enough to cover at least one month of operating expenses, such as utilities or any possible unexpected costs.

We hope that the above article gave the answers to your questions regarding the accounts payable aging report. If you have some more please let us know in the comments below. Would love to know your thoughts and suggestions!