Once you have decided to use Xero for your small business accounting, you will need to set up the conversion balances. So what are Xero conversion balances and what do you need to pay attention to?

What is Xero Conversion Balances for?

Conversion Balances are also called opening balances. If you are not a new company and have some trading history, you will need to pay close attention to setting this up correctly. Conversion balances will include all your historical totals from your previous accounting software (or Excel – if you happened to use that).

To give you an easy example:

If your bank balance when moving to Xero was 10,000, if you don’t set up Xero conversion balances correctly, going forward your bank balance will start from 0. So if you have earned 1,000, your total bank balance in Xero will show as 1,000 instead of the correct 11,000.

When should you move to Xero?

If you are a new company and this is your first year doing your finances, you can start any time. Usually the sooner the better – to make sure you are on top of your finances.

If you are an established small business with trading history, you have two options:

-Set it up at the end of your financial year-end

This option is highly recommended. The reason why, is because at the end of your financial year-end your accounts have been fully closed and all your year-end figures are (hopefully) spot on. It will give you a lot of headaches if you set it up and the figures are actually wrong. So make sure you tidy up your accounts and finalize them before moving.

What if you want to start at the end of your financial year-end, but your accountant hasn’t closed the accounts as yet?

You can set up Xero conversion balances just with the bank balances (so at least you can rely on that). Start your accounts on the 1st January for example and once your accountant has closed the year-end, you can then go back and enter the opening balances.

Please note, that bank feeds sometimes take a few days – weeks to work, so if you want to make sure you can do your accounts in Xero on the 1st Jan, start setting it up a bit sooner. Bank feeds don’t import historical data, so if it starts working later than you planned, you will have to import transactions manually. If the bank feed starts working sooner, you can easily delete the unwanted transactions.

-Set it up half way through your financial year

If you have the choice, I highly advise against this one. The reason is that most companies, bookkeepers don’t close the accounts properly half way through the year. So the opening balances you have in your old accounting software might not be correct and hence Xero won’t be correct either. This is usually because things weren’t accrued for or depreciation wasn’t done, and so on. So unless you have no other choice, go for it, but this shouldn’t be your #1 choice.

How to set up Xero conversion balances if you are a new company?

If you haven’t traded yet, it will be very easy. All your balances will be zero as below.

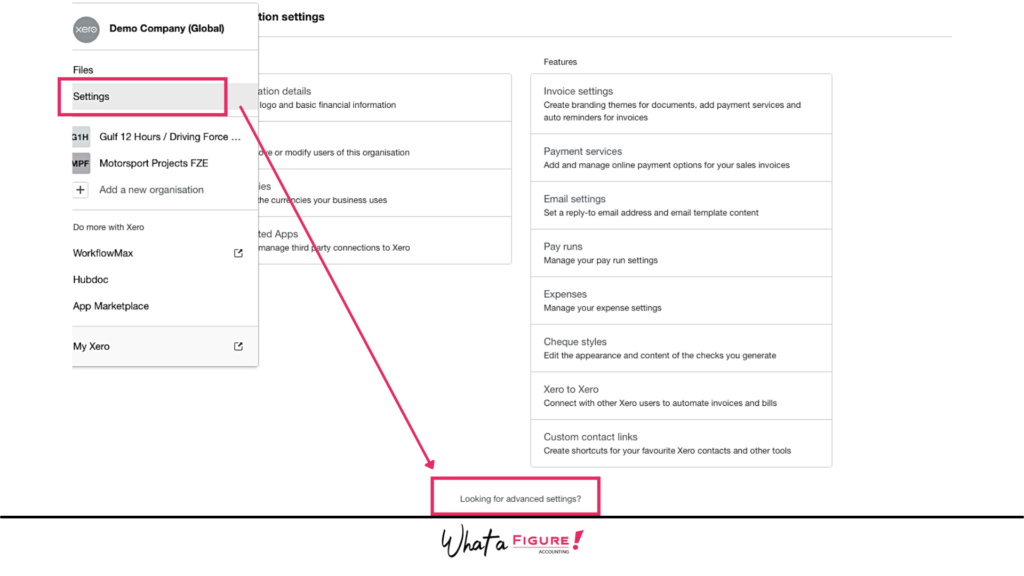

Go to Settings > Advanced Settings > Conversion Balances

How to set up Xero conversion balances if you have a trading history?

If you have a trading history already (and this is not your first financial year), then you have two options:

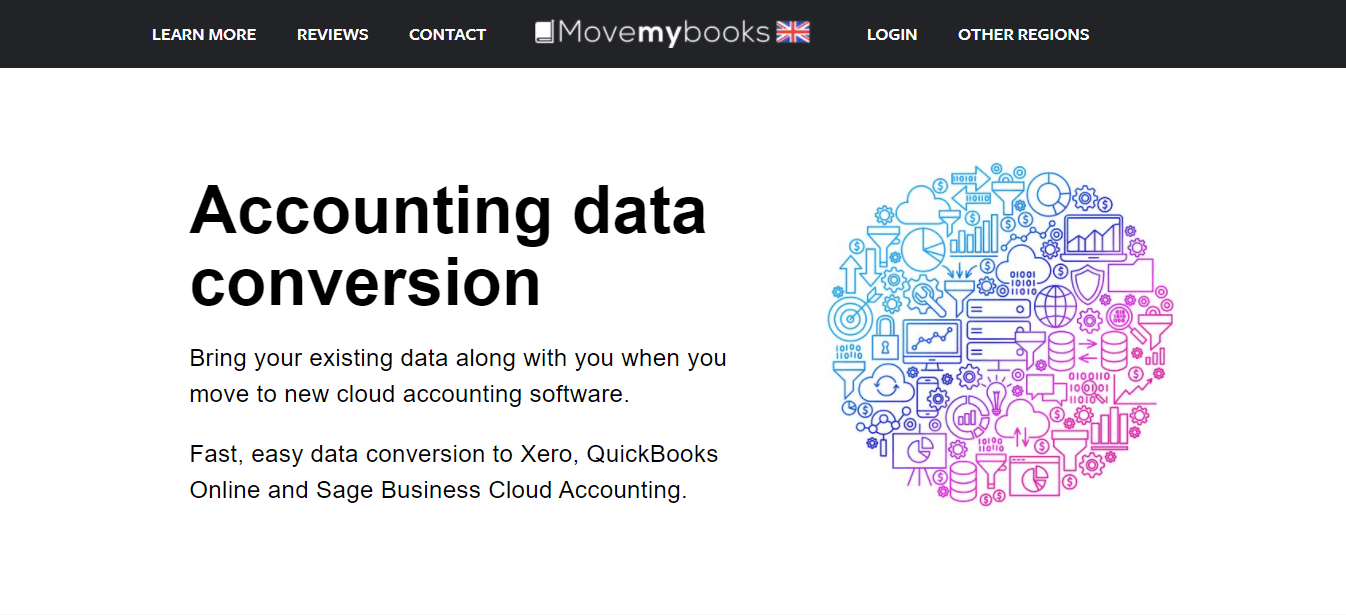

-Use a software

MoveMyBooks is a software that moves your data from your old accounting software. If you are moving to Xero, it’s usually free – as it is paid by Xero. MoveMyBooks will take all your totals from your old accounting software and enter them in Xero. If you don’t mind just seeing totals and ‘total outstanding invoices’ instead of them showing one by one so you know which clients to chase, then MoveMyBooks is a great, fast and definitely cheap option. However, if you want to see more detailed information, it doesn’t compare to manual entry.

-Manually

The other option is to enter all the information manually. I personally prefer this a lot more. It will give you all the historical outstanding invoices, potentially historical Profit & Loss for reporting comparison purposes and a lot more. It’s definitely slower and comes at a price, but you need to decide what is more important for you.

What do you need for setting up Xero Conversion Balances?

Checklist:

Please see the full list of items we recommend you have / know before you start setting up Xero:

- When would you like your Xero account to start from? (We highly recommend your financial year end).

- When is the company’s financial year end?

- Is the company VAT registered?

- If yes, is it on cash or accruals basis? Usually, it is accruals.

- When is the company’s VAT quarter?

- What is the company’s VAT registration number?

- Do you want to use the pre-set Chart of Accounts already available in Xero (recommended) or will you use the one from your old software?

- List of your bank accounts, their currency, sort code and account number. Sort code and account number is required for setting up bank feeds.

If your company had transactions prior to your Xero account start date:

You will need the following closing balances for the date prior:

- Trial Balance (TB)

- Bank Statements reflecting your bank balances (these should agree to the bank balances on the TB)

- Foreign currency exchange rates – that were used to convert your bank balances – if any

- Aged Receivables Report – List of all your outstanding sales invoices (this should agree to the Aged Receivables figure – also called Trade Debtors – on your TB)

- Aged Payables Report – List of all your outstanding purchase bills (this should agree to the Aged Payables figure – also called Trade Creditors – on your TB)

- Fixed Assets Register – List of all your fixed assets and their value after depreciation.

What to pay attention for?

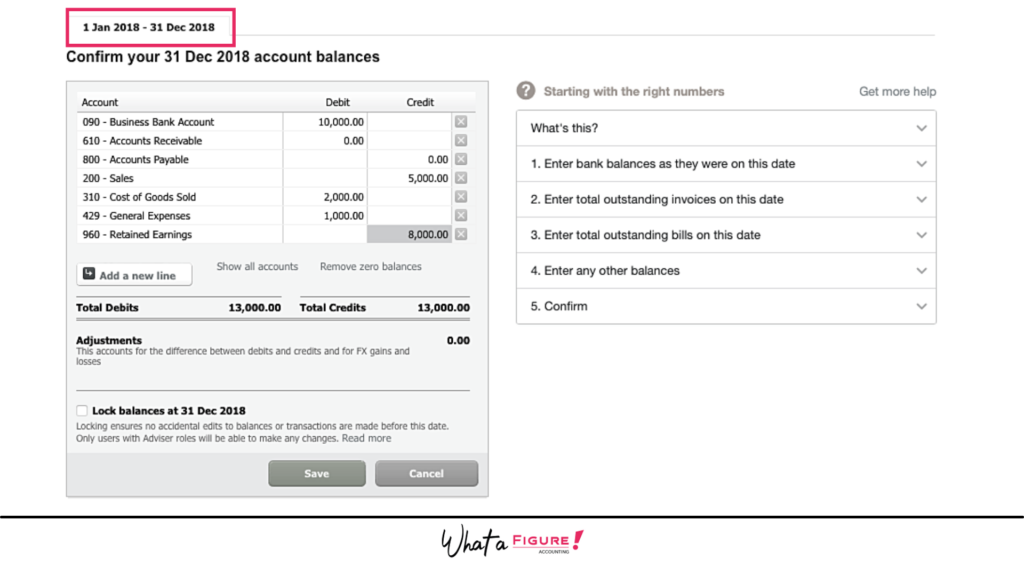

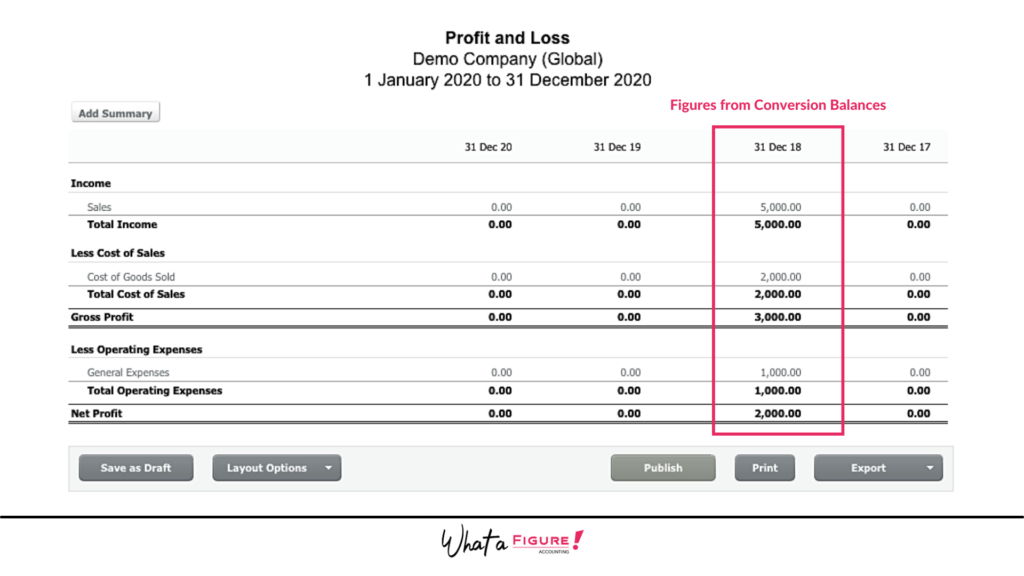

If you want to see historical balances in Xero (not just your Balance Sheet – which is common) then we recommend you ask your accountant to enter both the Balance Sheet as well as the Profit & Loss figures into your Xero Conversion Balances.

What does it mean?

So, if your last year end was 31st Dec 2019, then you will have all the Balance Sheet figures for 31st December. Balance Sheet includes your profit for the year (1st Jan – 31st Dec). So instead of entering this total figure, you can enter the full Profit & Loss for the year: 1st Jan – 31st Dec. What this means is that you will also have 1 year of Profit & Loss report in Xero for historical results. Please note, you can only enter 1 year’s Profit & Loss in Xero conversion balances like this.

Here you can see the conversion balances showing for the Profit & Loss accounts:

Things to keep in mind if someone is setting it up for you

As you can see, Xero conversion balances can be set up very quick with little minimal information or very detailed. This is also the case when accountants set it up manually.

What do you get when Xero is very well set up – not just the basic information?

-Company branding: Invoice templates for you with your own company branding and bank details.

-Xero Conversion Balances: These include Balance Sheets and Detailed Profit & Loss balances (or income statement)

-Bank Accounts: Bank accounts, credit cards or even PayPal or Stripe, all set up for you (ready for you to connect the bank feed – which usually needs your bank’s login)

-Contact List: Your customers and suppliers imported with their contact information.

-Outstanding Invoices: Each invoice is added one-by-one – this makes it much easier for you to know what’s outstanding and who you need to chase to get paid.

-Fixed Assets: A list of all your fixed assets (eg. Computer & Office Equipment) added and their value after depreciation.

Summary

What is Xero Conversion Balances for?

When should you move to Xero?

-Set it up at the end of your financial year-end

-Set it up half way through your financial year

How to set up Xero conversion balances if you are a new company?

How to set up Xero conversion balances if you have a trading history?

-Use a software

-Manually

What do you need for setting up Xero Conversion Balances? – Checklist

What to pay attention for?

Things to keep in mind if someone is setting it up for you

Read next: Conversion Balance: Fixing it can fix your Bank Balance