How to Reconcile Foreign Currency Transactions in Xero?

Earlier or later every successful business goes global and consequently faces the need to reconcile foreign currency transactions.

At What a Figure! Accounting we will walk through the following questions:

- How to reconcile multi-currency transactions in Xero?

- What are foreign currency gains and losses?

- The impact of currency fluctuations on your business and how to estimate it?

Reconcile Foreign Currency Transactions in Xero. Examples.

To start with Xero can process transactions in over 150 currencies. It even allows running financial reports in different currencies. If you enable multi-currency in Xero your bank reconciliation will be slightly more complicated.

We’ve already covered the question of Xero bank reconciliation in one of our previous posts. If you are familiar with the basics we can now dive into such particulars as foreign currency transactions reconciliation.

There are several possible situations you may come across while reconciling your bank. We will look at these today.

Receiving payments and paying bills

Paying bills in foreign currency

Xero will do all work for you. Let’s say, your bank account is in GBP (base currency) and you are paying a bill in EUR.

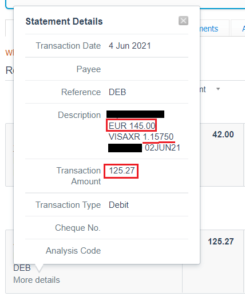

In this case, you will see the amount converted to the base currency (GBP). However, banks usually provide details of the transactions. If you click on “More Details” you will see the amount in the original currency and the exchange rate on the payment date.

Receiving Payments for Invoices Raised in Foreign Currency

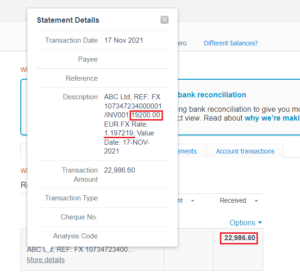

This scenario is very similar to the previous one. In this case, we have an invoice raised in a currency other than our base currency.

As you can see the process is quite simple and straightforward. In the description, you will usually find the exchange rate used. It helps to find the matching invoice easier.

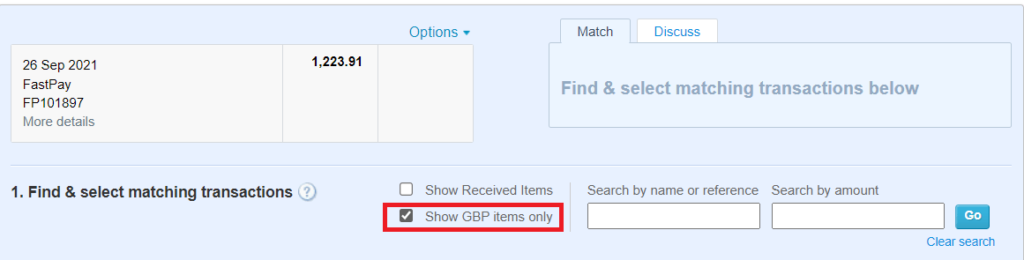

Important tip: while reconciling foreign currency transactions, don’t forget to untick the “Show GBP items only” box (there might be any other currency that you use as your main).

Otherwise, Xero will not show items in other currencies and we won’t find the matching invoice.

What if the base currency is not involved?

Suppose we issued an invoice in Euro while our main currency in Xero is in British pounds. We don’t have a Euro bank account, only USD and GBP. If our customer pays this invoice to our USD bank account, it might be difficult for you to reconcile it if you are not familiar with Xero bookkeeping.

The difficulty is that in Xero either the statement line or transaction recorded must be in your base currency (GBP in our case). However, in our example, we received USD for our EUR invoice.

In these rare cases, we need to use a clearing account. It is not a real bank account, the closing balance should always be zero. Let’s look at it through a practical example.

We have an invoice for 19,200 EUR which has been paid to our USD account. We can’t reconcile it in the normal way – if we go to the “Find & Match” tab our invoice will not be displayed there among other unpaid invoices (we will only see USD and GBP invoices).

As mentioned earlier we need to create a clearing account. To do that we need to follow these steps:

- go to Bank accounts in Xero, press “Add New”;

- It will request to choose a bank and enter an account number – we can choose any suggested bank and enter random numbers, it doesn’t matter (but we highly recommend entering zeros);

- Give it a name (eg. “Clearing account”);

- Choose the currency – GBP.

- Press Save. Voila! We have a clearing account!

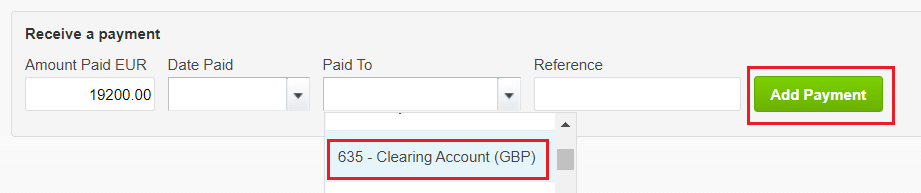

Now we need to return to our EUR invoice. At the bottom of the invoice page in Xero, we can add the payment manually.

We enter the date of the payment, the amount (19,200 EUR), exchange rate and choose our clearing account from the dropdown menu (“Paid to”).

Our invoice is now paid in Xero. As a result, the balance of our clearing account is £16,361.31 (19,200 EUR/1.1735). Half of the work is done!

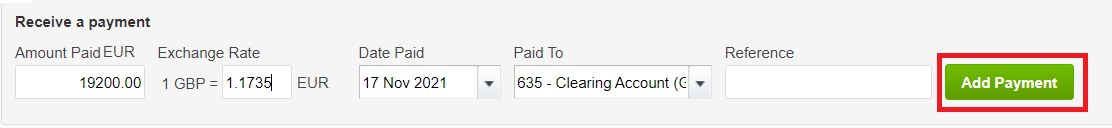

However, our USD bank account is still unreconciled.

We return to our reconciliation screen, but this time press the “Transfer” tab. From the dropdown menu, we choose our new clearing account. Xero will ask us to enter the Sterling amount transferred. In the “Amount GBP” box we need to enter £16,361.31.

So we are not reconciling this amount against the invoice but transferring money from the clearing account.

We’ve made two opposite transactions that offset each other: mark the invoice as paid to the clearing account, then transfer that amount to the USD account. The closing balance is now zero, all is clean and tidy.

What are foreign currency gains and losses?

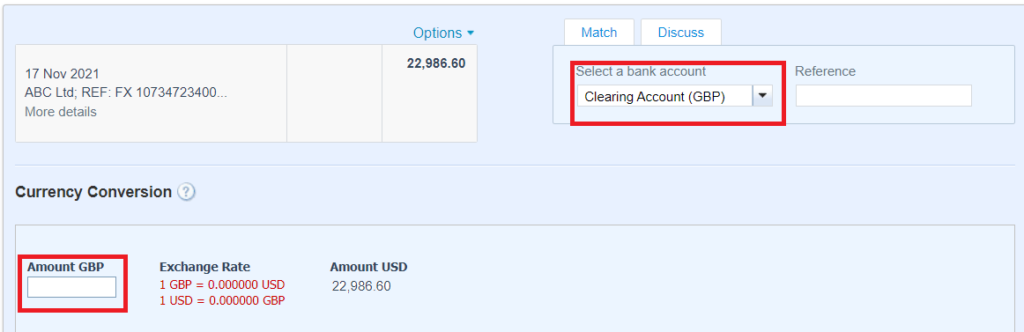

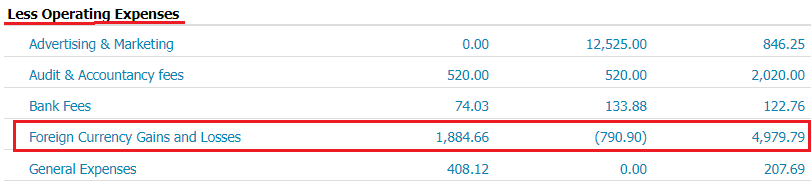

If you raise invoices /receive bills/have bank accounts in foreign currency you will see an additional line in your income statement:

What does this mean? It reflects the impact of currency exchange fluctuations on your bottom line.

Let’s say your bank account’s currency is British pound. On 30th September you raised an invoice for $1000 to your customer in the USA. At that point in time, the exchange rate was 1 GBP = 1.3 USD.

If you prepare a P&L statement in Xero in GBP the system will automatically convert your revenue using that exchange rate ($1000 = £769.23). This figure you will see on your income statement.

Suppose that the invoice was paid on 30th November – 2 months later than you raised the invoice. However, since the date of invoice, the exchange rate has considerably changed and $1 was equal to £1.19. This means that your $1000 was worth £840.33.

Even though the revenue is still recorded as £769.23 (as of the date of raising the invoice) the exchange rate fluctuation was taken into account and an additional £71.1 (£840.33-£769.23) is added to your income. You will see this in brackets (as a minus figure) under operating expenses sections on your P&L (as in this case you’ve got gains, not losses). So, this line on the income report shows the foreign currency adjustment that was made.

If the value of the base currency (in our example it is GBP) increases, we will have foreign currency gains. However, if the value of the home currency declines after the conversion, we will incur foreign exchange losses.

Unrealized vs Realised Gains and Losses. What is the difference?

Probably, you’ve already come across expressions such as “realized” or “unrealized” gains and losses. What is the difference? We will briefly review this question.

A gain or a loss is “realized” when the customer pays the invoice. In other words, the transaction has been completed or closed. We can confidently state how much we lost or gained on top of the historic invoice value. This is an accomplished fact.

A gain or loss is “unrealized” if the invoice has not been paid by the end of the accounting period. For example, we have $1000 ($ is not a base currency) recorded under our aged receivables. At the end of the accounting period when you prepare your financial reports these foreign currency sales invoices are still unpaid. Nevertheless, these awaiting payments should be re-evaluated based on the current exchange rate. Think of it like a potential profit or expense which has not occurred yet but should be reflected for reporting accuracy.

We will not see two separate lines on our reports for realized and unrealised gains and losses. They are being added up into a single line on the P&L – “Foreign Currency Gains and Losses”.

Accounting for Foreign Currency Transactions. How does it work?

Let’s summarize the above practical example in the following table:

Invoice Amount | Exchange rate at the invoice date | Exchange Rate at Payment Date | Realized gains or losses |

$1,000.00 | 1 GBP = 1.3 USD, £769.31 | 1 GBP = 1.19 USD, £840.33 | £840.33 – £769.31 = £71.02 – gain |

To calculate foreign currency gains or losses we need to subtract the invoice value on the date of issuing it from the amount collected. Positive figures mean that we received more than we would have collected on the invoice date. So it is gain.

These journal entries are required to reflect this operation accordingly. The first entry occurred on the day the invoice was raised:

Account | Debit | Credit |

Sales | £769.31 | |

Accounts Receivables | £769.31 |

Once we received the payment in respect of this invoice the following entry is posted:

Account | Debit | Credit |

Cash | £840.33 | |

Accounts Receivable | £769.31 | |

Foreign Currency Gains | £71.02 |

We received more because the exchange rate changed and the dollar became more expensive compared to the pound.

Let’s take a look at the journal entry in case of losses. Suppose that on the date of the payment 1 GBP = 1.4 USD. As a result, we received only £714.28

| Account | Debit | Credit |

| Cash | £714.28 | |

| Foreign Currency Losses | £55.03 | |

| Accounts Receivable | £769.31 |

We reviewed a simple example. In practice, the “Foreign Currency Gains and Losses” balance may be made up of numerous transactions. Not only sales invoices, but purchase bills and bank balances should be re-evaluated also at the end of the analyzed period. To see all details you can go to the Foreign Currency Gains and Losses Report in Xero.

We hope that the above article was helpful to understand how to reconcile foreign currency transactions in Xero and how this part of bookkeeping works. Any further questions you might have, please leave it in the comments!