Summary: Issuing a proforma invoice can help instead of a typical sales invoice can help your cash flow and VAT due. Read what it is and how to do it. At What a Figure! Accounting we will take you through it step-by-step.

What is a Proforma Invoice?

A pro forma invoice is a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. The invoice will typically describe the purchased items and other important information, such as the shipping weight and transport charges. (Investopedia)

You might rightly ask: ok, so what is the difference between an invoice and a proforma invoice?

The key difference is that a pro forma invoice is a ‘preliminary bill’ meaning it is not an actual bill. It is closer to a quote, but it is a request for payment.

Why would companies issue one?

Companies issue proforma invoices, where the client has to usually pay a big amount and they are often on longer payment terms (eg. 90 days). Therefore if the company issued an invoice, they would be due to pay the VAT on it, prior to receiving payment from the customer.

However, as proforma invoices are not actual invoices, they don’t count as a VAT invoice and they are not included on the VAT return.

How to use them?

1.) Issue a proforma invoice to your clients and wait for the payment

2.) Once you have received the payment, send a sales invoice to your client (it’s often just a copy of the proforma invoice, but with the ‘Invoice’ as the heading).

How to create a proforma invoice?

If you are using a small business accounting software, you might not have the option to issue one – as proforma invoices are usually used by bigger companies. However, don’t worry, there is a hack you can do to make it work!

We will show it on Xero accounting software, but if you are using a different one, there is a high chance, it works in a fairly similar way.

Set up the proforma heading

In most accounting software, you can determine what heading should be on the pdf when you download it, if the invoice is in Draft, Awaiting Approval, Approved, etc.

Approved ones are usually set to ‘Invoice’ and draft ones are Draft Invoice.

As most companies don’t download or send draft invoices, they are just for internal use, so we suggest to rename these to ‘Proforma’.

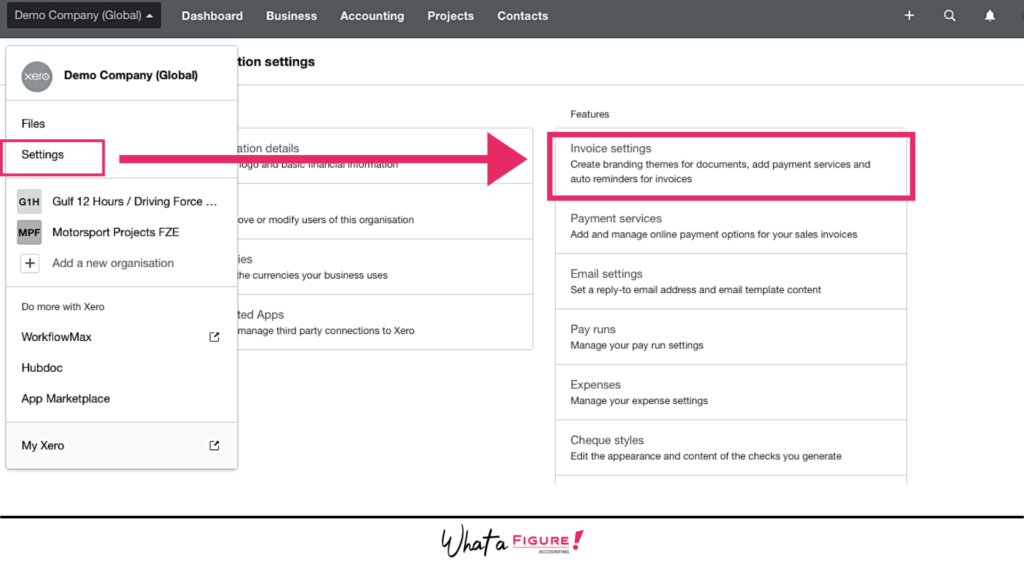

For this, in Xero, go to Settings > Invoice Settings as below:

Now choose the branding (if you have more invoice templates set up).

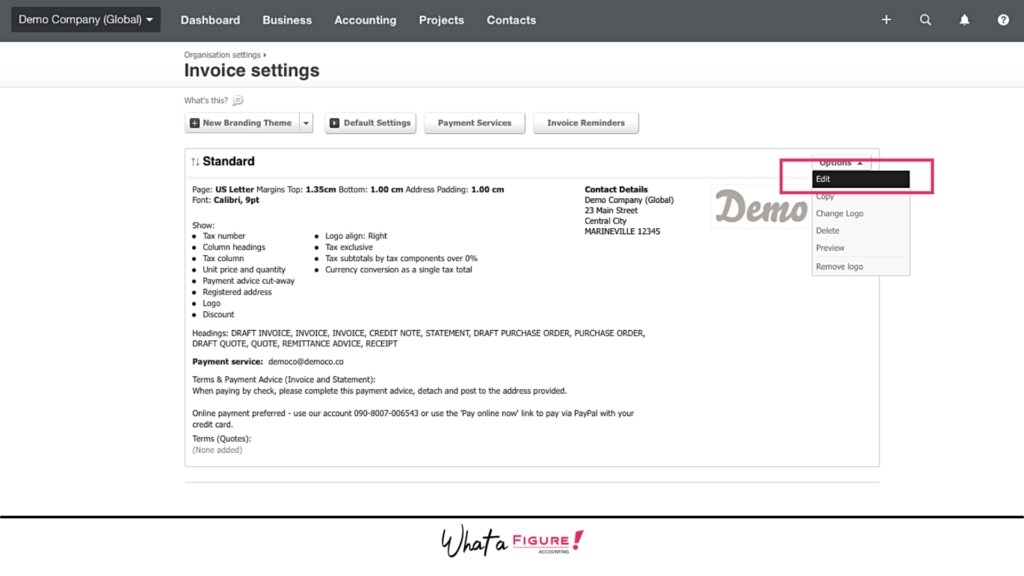

Go to Options > Edit

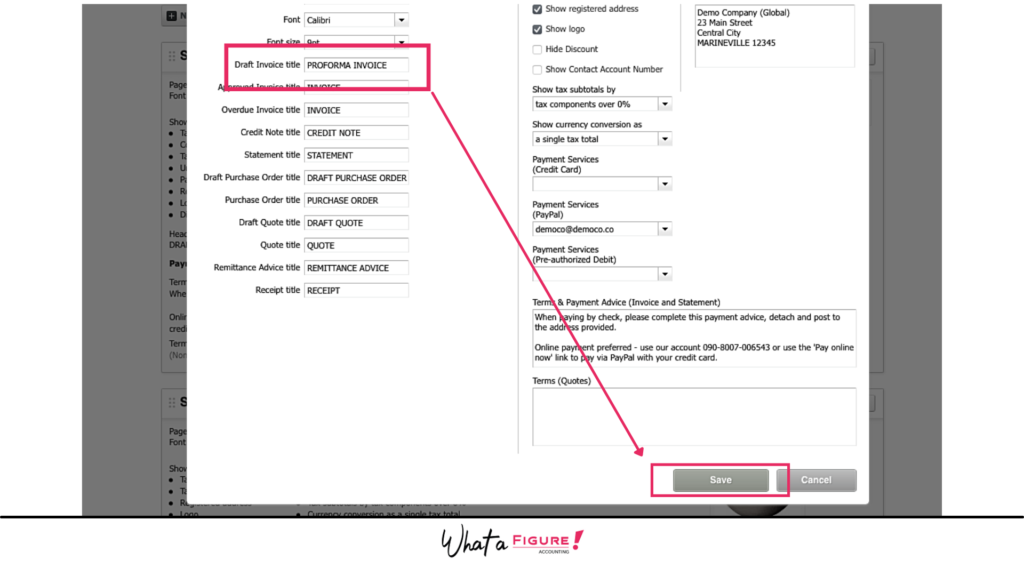

Now change the Draft invoice to show as Proforma (as on the image below):

Make sure to save it!

On the accounting software the menu heading will still show as ‘draft’, but if you download them or email them to your clients, they will have a Proforma heading on. Download one to see it works. Just make sure not to approve them. If you do, they will turn into an invoice and be included in your VAT return.

Once the client paid, you can then approve them and send them the actual invoice.

Effects of proforma (not real) invoices

Keeping your invoices in draft can have a few affect on your accounting and also on your cash flow forecasting, so let’s look at these:

Proforma invoices as they are in draft, won’t show on your Profit & Loss. Only approved invoices will show there. So your month end report, might be slightly off, until you are waiting for the payment.

Some accounting software might allow you to include draft invoices in your P&L, but be aware, that if you have other draft invoices on your system, they will show too. They can be both draft sales invoices or purchase bills! So don’t forget to check both!

If you are using a cash flow forecast tool, that syncs with your accounting software, then you might not see these proforma invoices as potential money coming in. Therefore, in this case, make sure to add them manually to your cash flow, so it is accurate. Again, some cash flow software might allow you to import draft invoices – just check what you have on your system first.

If you decided to import draft invoices, we highly recommend to have strict processes in place on what invoices you save as draft or awaiting approval instead. The last thing you want is having draft invoices wrongly showing up in your cash flow as money coming in – when they are not. It can put your business at risk.

We hope this article helped you consider the ins and outs of proforma invoices. If you have any questions, please let us know in the comments below.

Read next: Credit Note: What it is and how it can reduce your taxes?