How cost of goods sold is calculated (+relation to inventory)

If you’re new to Cost of Goods Sold (also called Cost of Sales) and inventory accounting or have been avoiding it because of all the jargon, at What a Figure! Accounting we will help you understand it. We will discuss all you need to know about COGS/stock accounting to make your e-commerce business develop and grow!

This article will help you to understand:

- the essence of COGS and inventory

- the different methods of calculating it

- useful inventory management practices.

Inventory vs COGS: understand the difference

Everything you have on the shelves in your warehouse (that are not sold yet) are your inventory.

Inventory is an asset – that you can use to make money out of.

Inventory is accounted for in case of physical goods, however, less strictly speaking digital goods (ebooks and courses) are also inventory. Digital goods the company sells to make money.

In this article we will focus only on physical goods.

The value of the inventory is shown on the balance sheet. We could also describe it as goods available for sale.

Every time an inventory is sold, the cost associated with it needs to be removed from the Balance Sheet and added to the Profit & Loss statement as an expense. It will show under Cost of Goods Sold (or Cost of Sales – the terms are interchangeable ).

In other words, COGS is the value of the inventory that was sold over the analyzed period of time. As it was sold, it is not an inventory any more. (We can’t sell it again).

Cost of sales includes the original purchase price plus any additional costs incurred in getting the product ready to sell (e.g. transportation, labor, and materials).

The cost of sales is one element of the calculation of gross profit, which is the difference between the revenue from selling a product and its associated cost of goods sold.

Managing inventory and cost of goods sold directly in your accounting software can be quite tedious for several reasons. Therefore most e-commerce sellers account for them externally in other software.

The only drawback of this, is that you will have to manually account for the inventory sold at the end of every months.

Let’s review how it could be done.

How Cost of Goods Sold is calculated?

There are 2 approaches for how cost of goods sold is calculated:

1) Account for all the inventory purchases as COGS

This means that all inventory/stock you buy from the supplier during the month you assign to the COGS account in the P&L. Keep in mind that this figure also includes shipping, Amazon fees, etc. For clarity, it is better to create separate accounts for these in the P&L.

Often at the end of the analyzed period you have remaining products on hand that hasn’t been sold. Therefore, as the COGS figure is not correct on the P&L, it needs to be adjusted.

At the end of the month, you must post an adjustment journal to move the remaining stock from the COGS to the stock (inventory) account on the Balance Sheet.

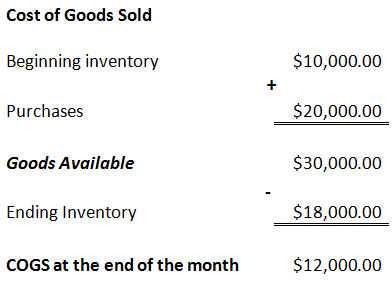

The common formula for COGS calculation could be represented as the following equation:

Cost of Sales = Beginning Inventory + Purchases – Ending Inventory

There are two possible scenarios

1.1. Calculate based on how much stock you should have

Assume that the opening stock in the warehouse was $10k (what you had on the 1st day of the month), while at the end of the month your actual stock was worth $18k.

You know that during the month you’ve purchased goods for $20k (currently you can see it as COGS on the P&L) plus $1k of other related costs like fees, shipping that is also accounted for as COGS.

Before any adjustments, you have the following figures on your P&L

Cost of Goods Sold | $20’000 |

Other COGS | $1’000 |

Total COGS | $21’000 |

During the month there were no adjustments to the Balance Sheet. It showed your opening inventory:

Inventories | $10’000 |

As you know that your closing inventory should be $18k you need to make an adjustment for the following:

As COGS needs to show $12k instead of $20k (without $1k of other COGS related costs), you need to make an adjustment for $8k. Move $8k from COGS to Inventories.

1.2. Calculated based on how much your actual COGS was

Using the same figures:

Beginning Stock: $10k

Purchases: $20k + $1k

COGS at the end of the month: $12k

We can then calculate the closing stock: $10k + $20k – $12k = $18k

Adjustment: 12k – 20k = – 8k

This method is prone to a potential discrepancy if not only stock purchases are shown in COGS but related costs also.

If you include additional costs (e.g. shipping fees) to your calculations you will get the wrong balance of COGS and Inventory in your financial statements.

Always make sure that actual purchase costs and related fees are separated if you use this method.

2) Account for all inventory purchases as stock

With this second approach you account all inventory purchases to the related asset account on the Balance Sheet (instead of the P&L). With this method, at the end of each month, you need to enter a manual journal to reduce the stock balance by the COGS.

COGS (related costs): $1k (accounted for separately on P&L)

Opening stock: $10k

Additional stock: $20k

Total stock at the end of the month on your Balance Sheet: $10k + $20k = $30k

Adjustment (based on actual COGS): – $12k

As a result of adjustment we will have the following figures:

Closing COGS = $12k + $1k = $13k

Closing stock = $30k – $12k = $18k

As you can see we got to the exact same result.

Important: As you can see, how cost of goods sold is calculated it doesn’t matter. However, NEVER CHANGE BETWEEN METHODS without the help of your accountant as it could really mess up your figures!

Cost of Sales and Inventory in E-commerce: Why Does it Matter?

As a rule of thumb, inventory balances and COGS should be correctly recorded in your accounting system. Otherwise, you might face great troubles. You won’t be able to estimate how many products are available for sale or what your profit is.

Let’s dive deeper into this.

If you’re an online seller, besides costs, you pay your suppliers for the products you sell. COGS could include:

- Inventory storage fees and costs

- Shipment: how much did it cost to receive the product to your warehouse(s)

- Listing fees

- Other miscellaneous expenses associated with receiving your goods

Every business is keen to reduce COGS: you should try to find a good supplier with the lowest prices. Also it’s worth reviewing your listings and remove unpopular products from time to time. By keeping track of your costs of goods sold, you can identify areas of opportunities for improvement and growth.

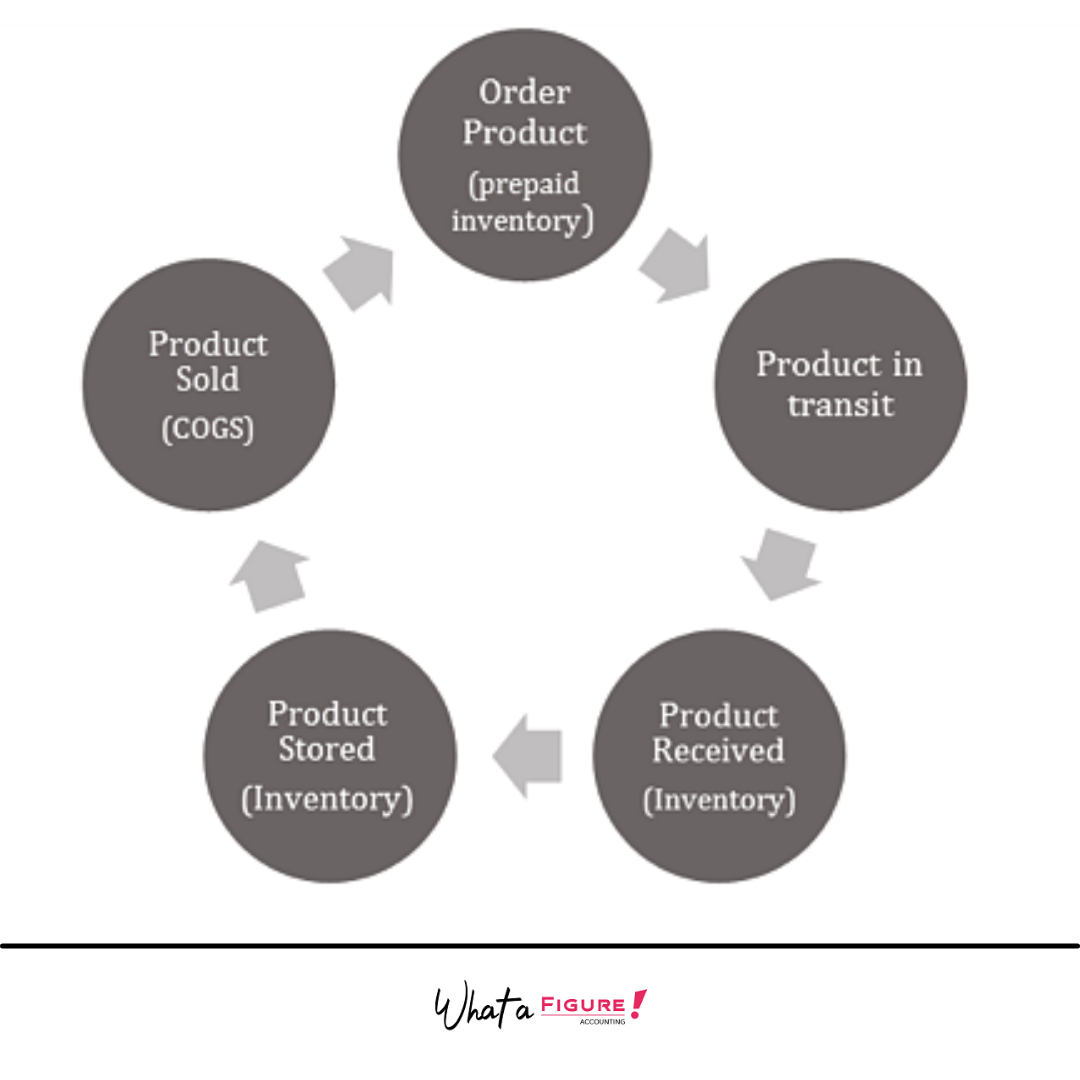

COGS and Inventory accounting always go side by side. Here is a diagram showing the inventory cycle:

As you can see it’s a closed loop. This cycle repeats over and over again. The most important question each e-commerce seller should have the answer to is how long it takes for goods to turn around. The faster it happens the better it is. It means that the business doesn’t overstock inventory and work efficiently. For more information on inventory turnover go here.

Challenges of inventory management in e-commerce (+ possible solutions)

1) Problem: Overstocking or overselling

Both scenarios are undesirable. Overstocking means that you have too many products that you can’t sell as fast as you wish. Consequently, you pay too much for storing inventory that you don’t actually need right now.

On the other hand, if you run out of stock and can’t fulfill customers’ orders, bad reviews could quickly damage your business.

Solution: First of all, make sure that you can determine an accurate cost of sales and inventory balance. You already know how to do it, but you can also rely on a professional bookkeeper.

Once you know your gross profit and what you have in the warehouse, you can review your strategy:

- Should you change your pricing strategy to boost your sales (speed up inventory turnover)?

- Should you diversify or change your sources of supply?

If you have an problem overselling you should investigate the product’s demand more closely. For this purpose, Google Trends tool could help you determine seasonality.

Your goal is to determine the lowest possible inventory amount you can have in order to meet demand and avoid delays in fulfillment.

2) Problem: Losing visibility of different sales channels

At some point, it becomes harder to keep track of all sales and orders (especially if you are using multiple sales channels). Without complete visibility on each step of your inventory cycle (interaction with the supplier/manufacturer, warehouses, customers ) you can’t make business decisions.

Solution: You should have an accounting software in place (like Xero or Quickbooks). The most beautiful thing about them is that you can connect your Amazon seller account or Shopify store with them (check A2X, Weava). Also, there are plenty of specialized inventory management software (eg. Inventory Planner, Zoho )

3) Problem: Like any other product-based business you will face the problem of choosing a suitable inventory valuation method. Depending on your choice, you may end up with a different net profit.

Solution: read below!

Inventory valuation methods: how it affects the business

FIFO (First In First Out) It assumes that the first goods purchased are the first ones applied to Cost of Goods Sold. The FIFO method is best for products that are losing their value over time. For instance, it refers to fashion and tech products. Products of this category become outdated quite quickly. Also, if you sell perishable products like (eg. fruits, candies and other food) or you have a long inventory turnover, you should use the FIFO method.

LIFO (Last In First Out) – It assumes that the last goods purchased are the first ones sold (and accounted for in Cost of Goods Sold). Please note that the USA is the only country that allows this method.

If the market is fluctuating and prices are changing constantly then this method is best for you. It gives an opportunity to match revenues with COGS more accurately (the most recent higher costs against current sales).

Therefore, businesses that sell products that raise in price every year benefit from using LIFO. Furthermore, it could save from inflation shocks.

Another important thing is that LIFO lowers your tax bill during inflation. If prices are going up (and you are using LIFO), you will account for higher COGS than you would with FIFO. Therefore your net profit (and hence corporation tax) will be lower.

Average Cost Valuation – based on the average cost of all items purchased during a period. Instead of looking at the first or the last price paid, you take the prices you paid throughout the entire year and calculate their average. It may not be accurate for specific product lines, but for a general overview of inventory price, it works great. Usually used when a business doesn’t have much variation in its inventory.

Choosing the right method depends on what type of product you sell, how diversified your inventory is, and whether prices fluctuate or not.

Important: Whichever method you choose, you need to keep it consistent and not change between them!

Most countries require companies to declare their inventory methods used in their year end accounts.

We hope that this article helped you to understand how cost of goods sold is calculated and how it is related to inventory. If you have any questions or suggestions let us know in the comments below.