Summary: In this article, we will review what a fixed asset register is. What type of items you should and shouldn’t account for in here and what are the advantages of using it. Lastly, once you have accounted for fixed assets, how to depreciate them in what time frame. For our illustrations, at What a Figure! Accounting, we use Xero the cloud accounting software.

What are current and fixed assets?

Companies usually have assets and liabilities. Assets help the entity to make more money (eg. properties), while liabilities are a constant burden, usually interest has to be paid on (eg. mortgage).

We differentiate between two types of assets: current assets and fixed assets.

Current assets

Current assets are assets that can be easily converted into cash and cash equivalents (typically within a year). These are used and available for the firm for day to day use. Eg. cash on hand, cash in the bank, outstanding sales invoices, stock (of goods), marketable securities.

Fixed assets

Fixed assets on the other hand are usually used for the lifetime of the company. These usually cannot be converted to cash so easily. (eg. building, equipment, software). These can be further classified as tangible (eg. land, building, machinery, equipment) or intangible fixed assets (eg. patents, trademarks or software).

What is a fixed asset register?

Most companies have a fixed asset register. This includes all the tangible and intangible fixed assets the company owns. It will tell the owner / investor or worst case a liquidator, what are the assets in the company. What could be turned into cash and how much they could get for them.

Fixed assets are usually used for several years (sometimes even 10+ years), and their value depreciates with wear and tear. The fixed asset register will show the actual value of these assets at any given point in time.

What is depreciation?

You know that shiny new Ferrari (fixed asset) you just bought in the salon? 😉 The one you paid full price for with zero mileage? Well, it just lost a huge percentage of its value (depreciated) by you driving out the door. Luckily, most fixed assets don’t lose their value this fast. Depreciation happens with wear and tear and therefore the value usually decreases gradually. It decreases to a point where you would need to replace it.

Different fixed assets have different lifespan and companies usually use the same lifespan for similar fixed assets. We mostly recommend the following:

-Computer equipment: 3 years

(These change so fast, they need upgrading usually after 3 years.)

-Office equipment (eg. office furniture): 5 years

-Trademarks and patents: 10 years – depending on how often you need to renew them.

Depreciation methods

The most common depreciation methods are the: straight-line and the declining balance method.

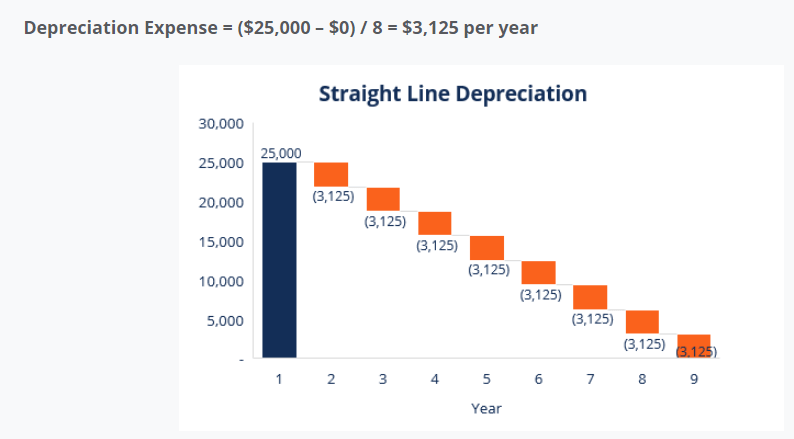

Straight-line method:

With this method, the fixed asset loses the same amount every single year.

See the examples below (from Corporate Finance Institute):

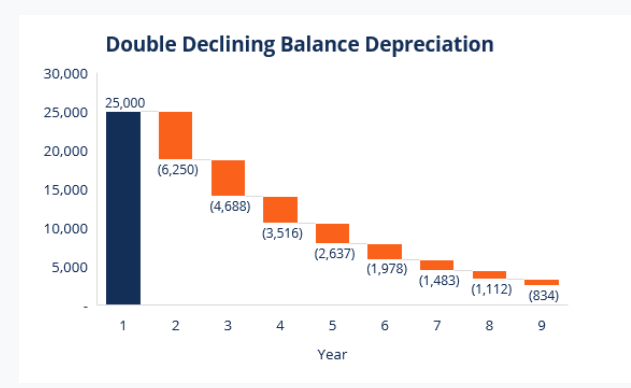

Declining balance method:

Declining balance method:

With this method, the fixed asset always loses a percentage of the remaining book value (not the original purchase price!). Therefore the value of the asset never depreciates to zero. This depreciation method takes into consideration that an asset is more productive in the earlier years than in the later ones (eg. in case of a brand new car).

Tax implications

Tax implications

One of the principles underlying the tax rules for deductions is that your income for the year should only be offset by those expenses that contributed to earning that income.

This means that the full cost of fixed assets are not tax-deductible in the year of the purchase. Instead, their depreciation expense (in every year) reduces the amount of earnings taxes are based on. This is crucial!

Therefore the depreciation method will have an impact on the taxes paid in any given year. If you use a straight-line method, your depreciation expense will be less in the first few years (compared to a declining balance method). Therefore in the first few years, you will pay more tax if you use the straight-line method, but you will pay less tax in the later years.

Whereas if you use the declining balance method, you will pay less tax in the beginning and more towards the end of the lifespan of the fixed asset. This is due to higher depreciation expense in the beginning and lower at the end.

Fixed assets in Xero

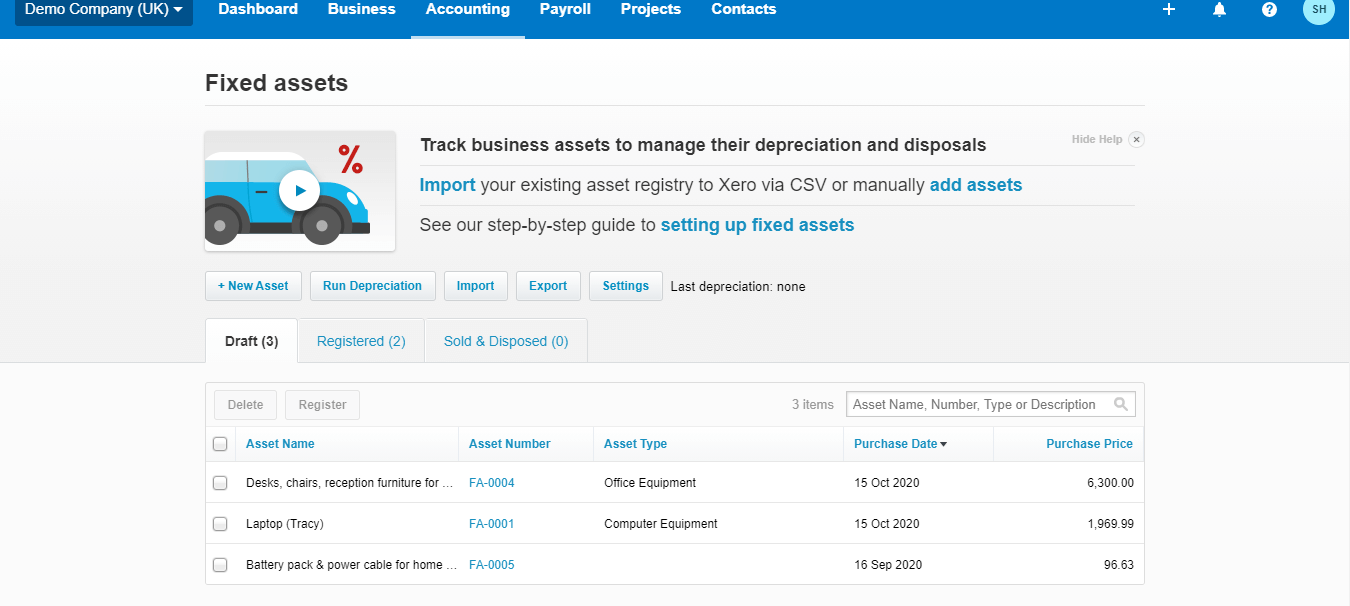

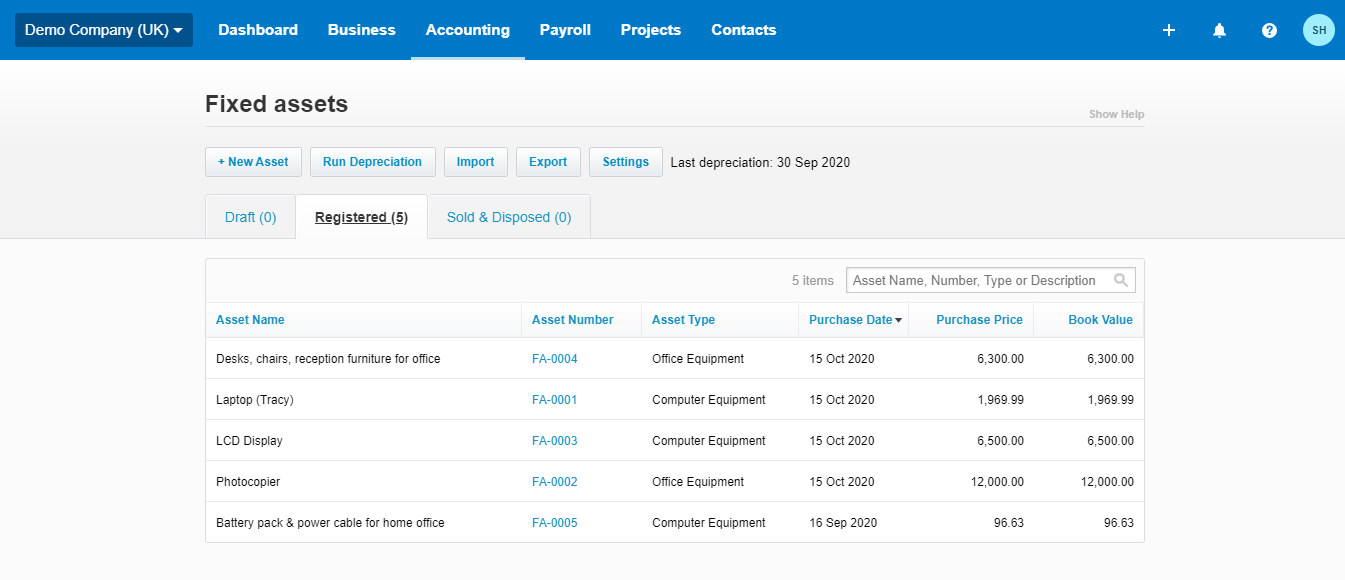

To access the Fixed Asset Register in Xero, go to Accounts > Fixed Assets

You will find all the fixed assets in here that you reconciled (in the bank reconciliation) to one of the fixed asset chart of accounts. (eg. computer equipment or office equipment).

They will all show as ‘draft’ until you register them (fill in all their details including lifespan) to be ready to depreciate.

Fixed asset registration

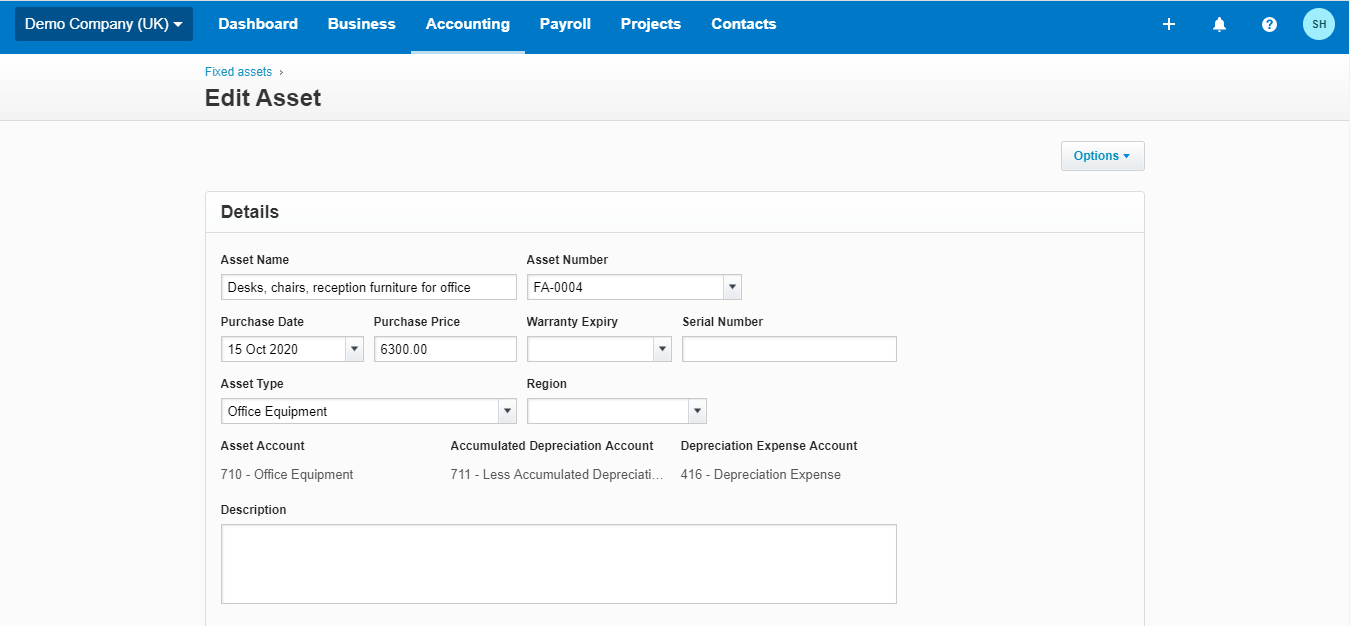

Click on any of the assets in the draft and fill in the below details to register it:

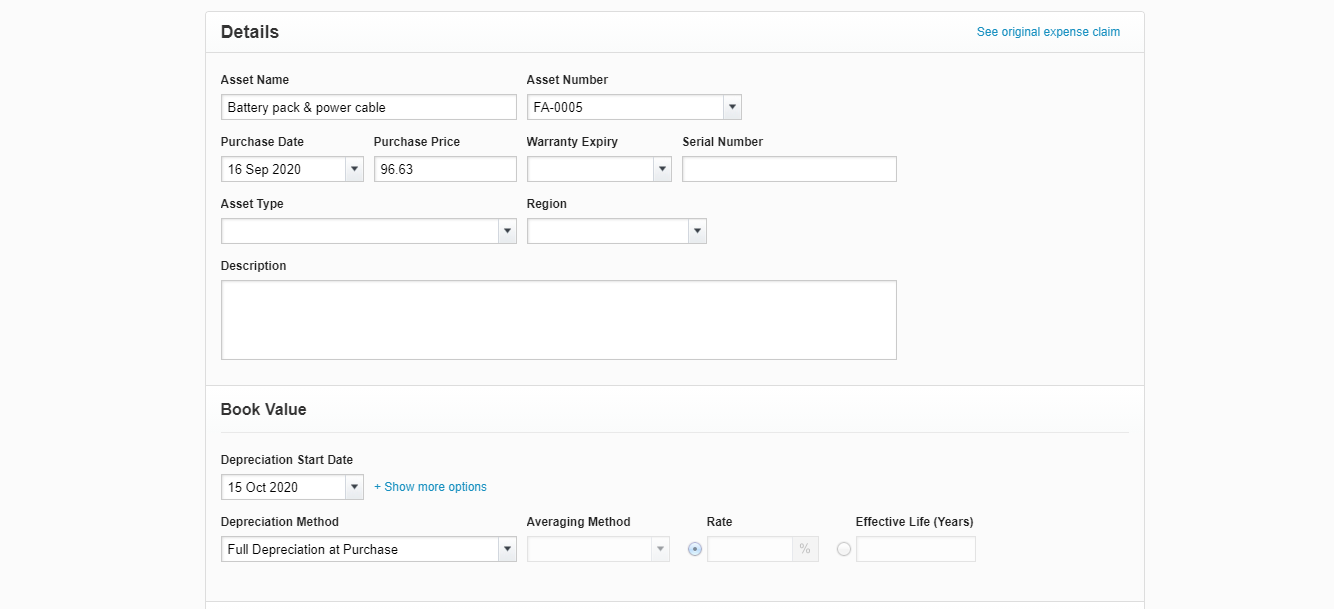

In the details above, you don’t really have to change / add anything, unless you want to. Warranty expiry or serial number are optional.

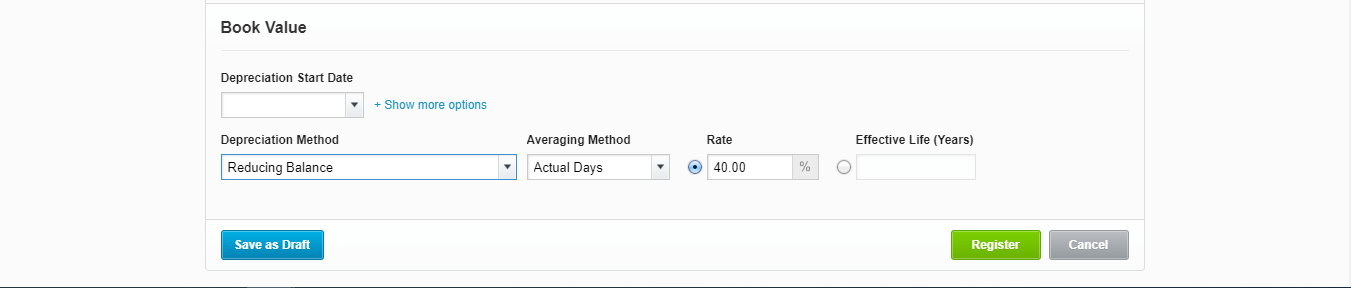

Book value – you do need to fill in the book value.

Depreciation Start Date: we advise to select the date you purchased the asset

Depreciation Method: we advise the Straight-line method

Averaging Method: we advise Full-month

(this is because it is on the Profit & Loss report you will want to compare your financial results with the previous month. It is easier to compare when the depreciation expense doesn’t fluctuate due to the days).

Rate / Effective Years: you can select one or the other.

5 years is equivalent to 20%. Or 25% is equivalent to 4 years. This is just for your information, as this won’t show.

Fixed asset policy

We recommend having an internal fixed asset policy. Meaning what is the minimum asset value that you register as a fixed asset. Most companies usually won’t register an asset below £500 / $500. This is because even if the lifespan is 3 years (36 months), the depreciation expense becomes so small, the admin of depreciating it costs more. For this reason, these assets are usually accounted for as an expense in the year of the purchase.

Xero has a solution if you still want to have these assets on your fixed asset register. You can depreciate them with a ‘Full Depreciation at Purchase’ method. This is useful for small items you might want to keep track of for any reason. In this case (see below) you won’t need to select the Averaging method or effective years.

Once you have finished registering all your fixed assets, go to the ‘Registered’ tab. This is your fixed asset register.

Run depreciation

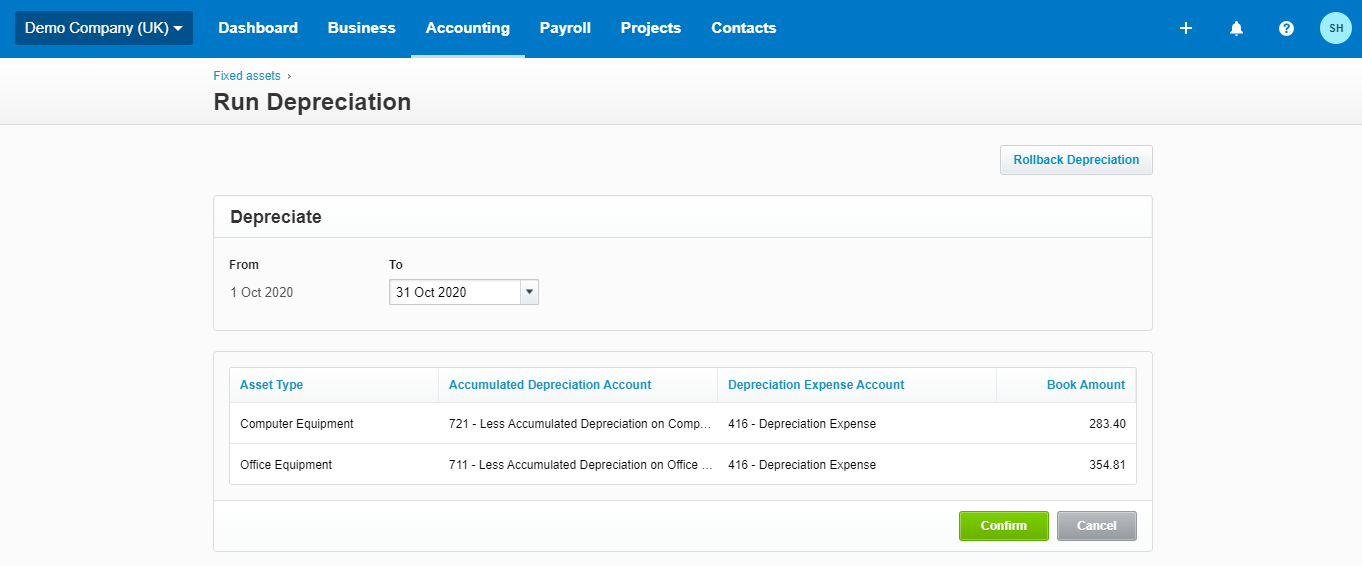

Press ‘Run Depreciation’ at the top to start calculating and posting your depreciation.

Xero will automatically calculate the depreciation expense for you. You just have to press confirm. Run the depreciation every month until you reach your current date.

If for any reason you accounted for a fixed asset that was purchased in the past and you have already run the depreciation for that period, click on ‘Rollback Depreciation’ after you click on ‘Run Depreciation’. You will have to select the rollback date and you will be able to recalculate your depreciation from that date onward.

We hope this article answered all your questions about fixed assets. However, if there is anything we haven’t covered or you would like some more clarification, let us know in the comments below.

Read next: How to Do a Cash Flow Forecast (free template!)